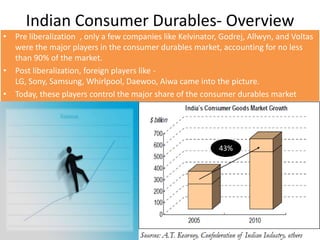

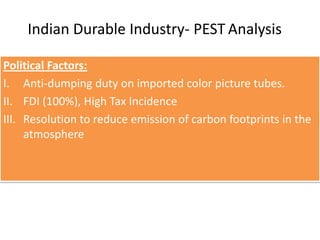

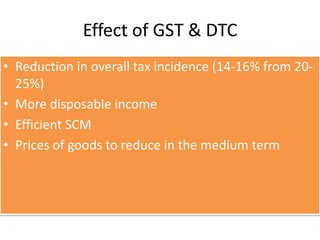

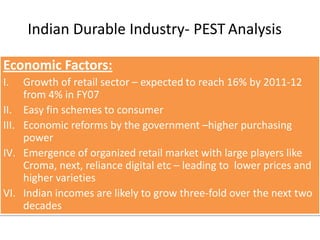

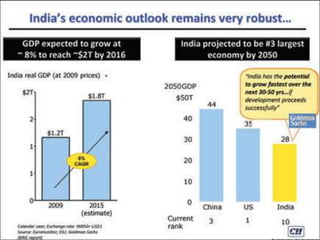

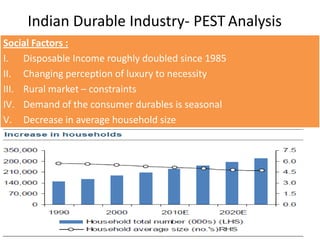

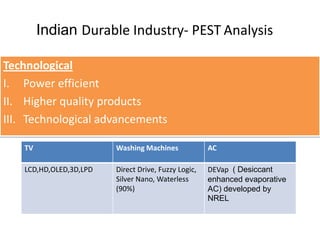

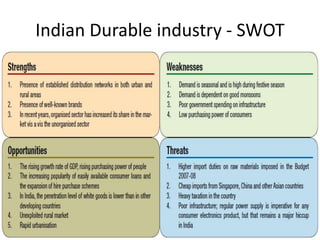

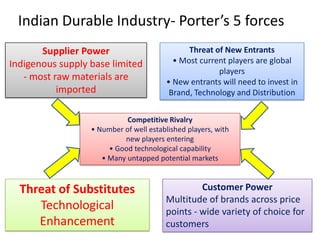

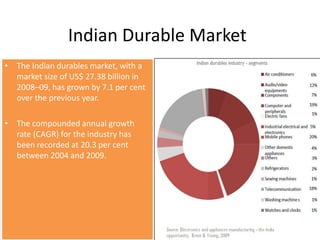

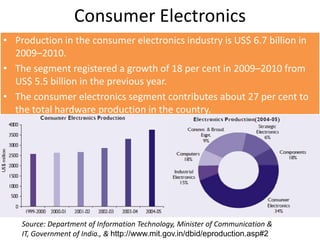

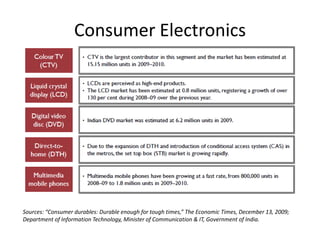

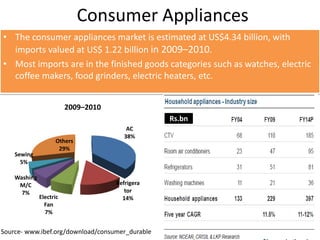

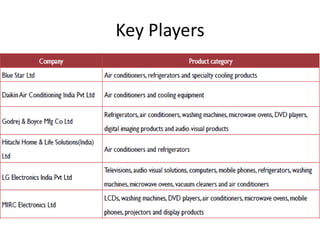

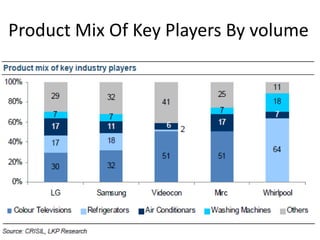

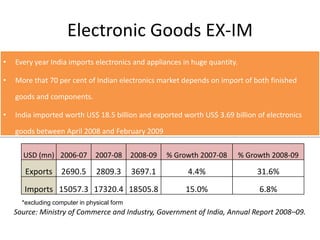

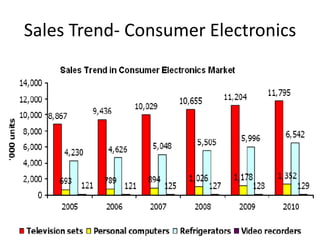

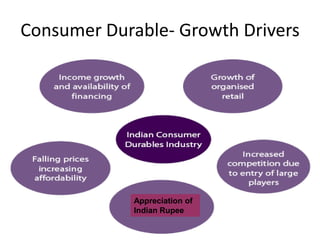

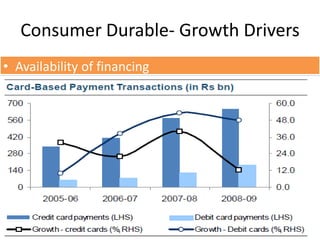

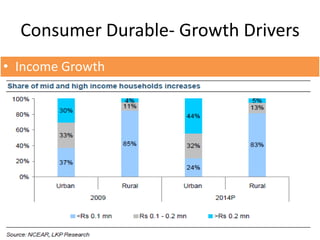

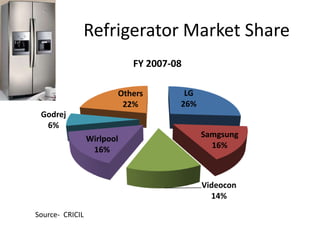

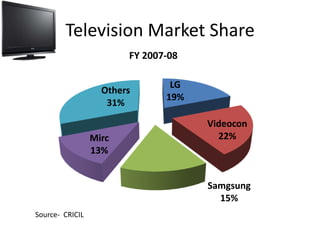

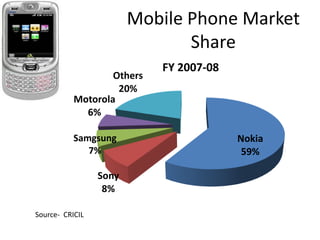

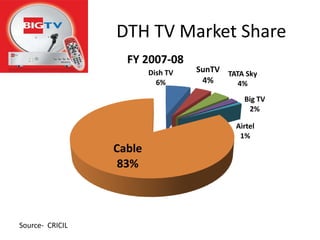

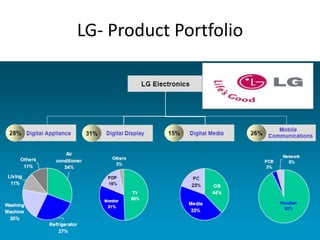

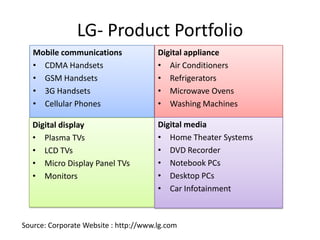

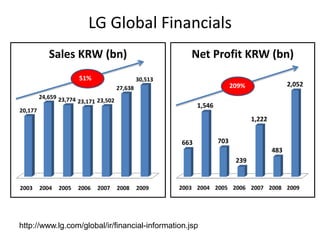

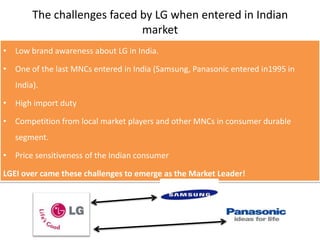

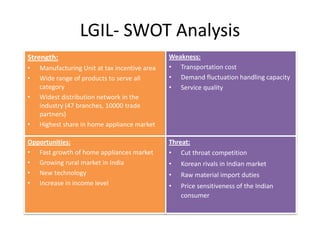

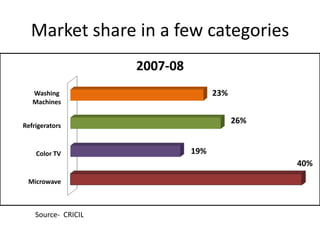

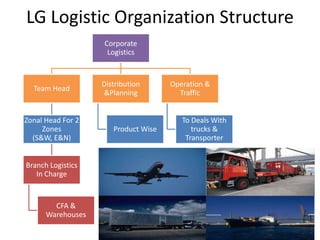

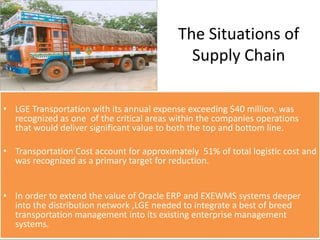

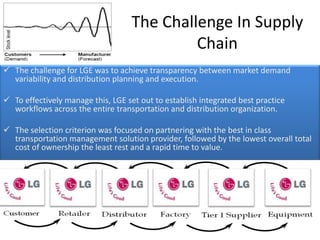

This document provides an overview of the consumer durable industry in India. It discusses key characteristics of the industry such as rapid innovation and cost pressure. It then focuses on the Indian market, describing how it has grown significantly since liberalization. Major players like LG and Samsung now control a large share of the market. The document analyzes the industry using PEST and Porter's Five Forces frameworks. It provides statistics on market sizes and growth rates of various consumer durable segments. Finally, it discusses the leading players like LG and presents details about LG's operations, product portfolio, and financial performance.