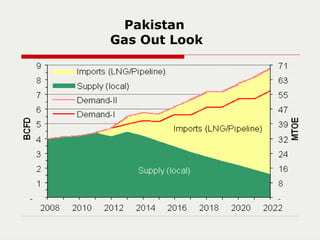

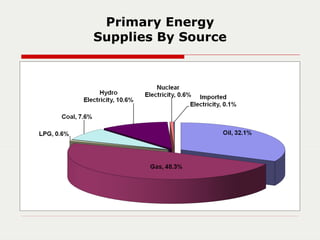

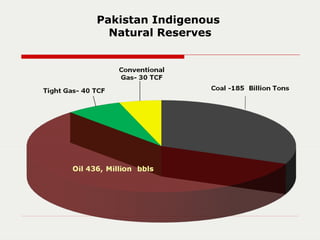

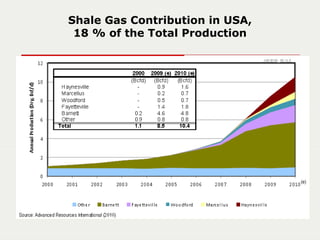

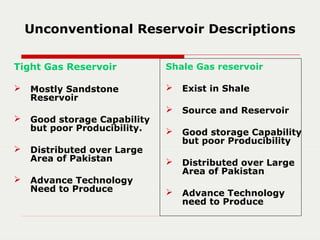

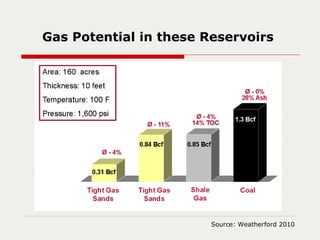

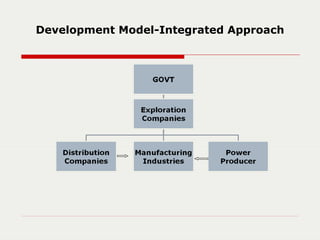

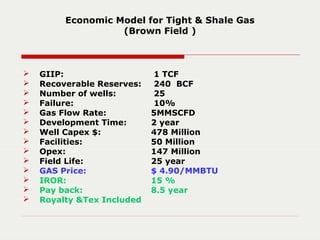

The document discusses Pakistan's unconventional energy resources like tight gas reservoirs, shale gas, and coal bed methane. It notes that these resources could help meet Pakistan's growing energy needs. Unconventional reservoirs are estimated to hold over 200 trillion cubic feet of natural gas. The development of these reservoirs provides challenges but is economically viable given current gas prices. An integrated approach involving exploration companies, service providers, industries, and the government is needed to successfully develop Pakistan's unconventional energy resources.