Rucha mam (1)

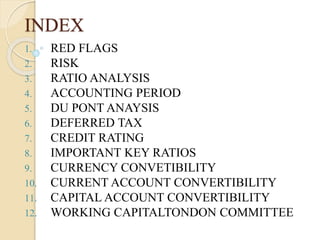

- 1. INDEX 1. RED FLAGS 2. RISK 3. RATIO ANALYSIS 4. ACCOUNTING PERIOD 5. DU PONT ANAYSIS 6. DEFERRED TAX 7. CREDIT RATING 8. IMPORTANT KEY RATIOS 9. CURRENCY CONVETIBILITY 10. CURRENT ACCOUNT CONVERTIBILITY 11. CAPITAL ACCOUNT CONVERTIBILITY 12. WORKING CAPITALTONDON COMMITTEE

- 2. RED FLAGS Red Flags analysis comprises credit, debt etc SEBI has introduced RED FLAGS Red Flags are identified into 4 category: 1. Business & Management 2. Corporate governance risk 3. Accounting risk 4. Financial risk

- 3. Business & management risk: • Promoters & key mngt. Their personal track records • Aggressive growth policy • Complicated business structure • High customer concentration Financial Risk: •Quality of CF generation/earning ratio •Difference in w.c •Large amt of cash lying idle. •Sales generation on capital employed •Change in cash sales •Intangible asset as part of total asset. Corporate governance Risk: •Concentration of promoters holding •Quality of board & their independence •T/O of senior mngt. •Mngt. Compensation package

- 4. Risk Methodology for Mfg co. Credit analysis of an entity begins with a review of the Economy/Industry in which the entity operates along with an assessment of the business risk factors specific to the entity. 1. Economy & Industry Risk: The economic/industry environment is assessed to determine the degree of operating risk faced by the entity in a given business. (key ingredients of industry risk.) Investment plans of the major players in the industry, demand-supply factors, price trends, changes in technology, international/domestic competitive factors in the industry, entry barriers, capital intensity, business cycles etc

- 5. 2. Business Risk Analysis: Few parameters involved in assessing business risk: • Diversification • Size • Seasonality & cyclicality • Cost structure • Market share 3. Financial Risk Analysis: Financial risk analysis involves evaluation of past and expected future financial performance with emphasis on assessment of adequacy of cash flows towards debt servicing. •Cash Flows •Financial Ratios •Financial flexibility •Validations of projects & sensitivity analysis 4. Management Evaluations.

- 6. Project Risk It is any factor that may potentially interfere with successful completion of the project. It is not an problem but recognition that a problem may occur. Types: 1. Expansion 2. Debottlenecking 3. Backward/Forward integration 4. Diversification

- 7. Leverage Buyouts In LBO the acquirer anticipates that loans can be quickly repaid through the disposal of non-core assets that the target holds. Risks involved: Carry out the sale of non core asset or value is lower then previous anticipation. Considering the country’s regulatory, social & law and other situations which can be unfavorable.

- 8. RISK Risk evaluation & Fundamentals of credit risk assessment Risk assessment broadly involves two steps: Identification of Risk Risk Mitigation

- 9. Industry Risk Tools to evaluate: Poter’s 5 forces. Herfindahl Hirschman Index. N-Firm concentration.

- 10. Ratio Analysis It is an Quantitative Tool use to interpret the Financial statement in terms of operating performance & Financial position of the firm. • Efficiency ratio • Profitability ratio Operating performance ratio • Liquidity ratio • Leveraged ratio Risk Analysis

- 11. VALUATION RATIO: •P/E ratio •Earning-growth ratio •Price to book ratio •Price to sales ratio •Enterprise value (EBITDA ) •Price to cash ratio Ratio from credit point of view: •Interest coverage ratio •Debt service coverage ratio •Current ratio •Quick ratio •Debt-Equity ratio •Overall gearing ratio

- 12. DU PONT ANALYSIS Profitability (N.P.) Operation Efficiency (TOTAL ASSET T/O) Leverage (financial leverage) It is an mathematical expression that can be used to analyze return on equity in details.

- 13. Last Fiscal year Trailing 12 months Leading 12 months Accounting Period… Deferred Tax… Time Difference Permanent Difference

- 14. Important Key Ratios -Banking point of view.. Net Interest Income Net Interest margin Capital Gearing Ratio Tier 1 CAR Credit/Deposit ratio ROTA RONW Gross Advance Net NPA Net NPA to Tangible net worth Cost to Income Ratio CASA Proportion Yield on Advances Cost of Deposit Core Spread Gross NPA For comparison: •Current Ratio •Debt-Equity Ratio •Asset T/O Ratio •Return on capital employed •Inventory T/O Ratio

- 15. Credit Rating C.R are independent opinion about relative credit risk. C.R are not investment advise or buy hold or sell recommendations. Rating Scale Long term Short Term Investment Grid Non-Investment Grid

- 16. Rating Risk Weight AAA 20% AA 30% A 50% BBB 100% BB,C,C 150% Unrated 100%

- 17. Sovereign Rating Assessment of sovereign creditworthiness i.e. sovereign’s capacity & willingness to honor its exiting & prospective debt obligation in timely manner. Rating is evaluated on the basis of score arrived on parameters below: Political External finance Macro- economic Fiscal sustainability

- 18. Currency Convertibility Freedom to convert domestic currency into international expected currency & v/v. Current account convertibility Freedom in respect of payment & transfer for current international transfer

- 19. Capital account convertibility Freedom of currency conversion in relation to capital transfer in term of inflows & outflows. CAC in India FULL CAC

- 20. WORKING CAPITAL 1. w.c cycle = (CA-CL)*365 / net revenue 2. Net w.c = (CA – excess cash) – CL Methods of w.c : 1. Operating cycle = debtors + stock - creditors 2. Cash conv. Cycle = cash + cash + cash inventory receivables payables

- 21. Drawing power Drawing Power is the amount of Working Capital funds the borrower is allowed to draw from the Working Capital limit allotted to him. Concept of drawing power is generally applicable on CC accounts. It is calculated by considering the total value of paid stock (Paid stock=Stock fewer Creditors) + book debts (not more than 90 days old) & deducting margin from the same

- 22. An committee appointed by RBI for advising to FIX MPBF for borrower. Developed in 1975 Recommended 3 methods. 1. Borrower’s to buy 25% of net w.c 2. Borrower’s to buy 25% of c.a 3. Borrower’s to buy 25% of core c.a

- 23. In 1993, committee recommended fixation of credit limits of small entities on the basis of projected turnover i.e. w.c limits up to 25% of projected turnover.