Embed presentation

Downloaded 20 times

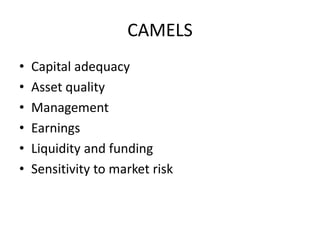

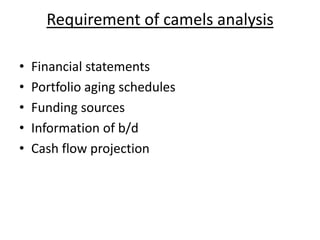

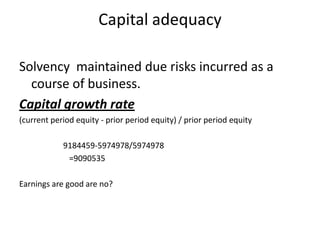

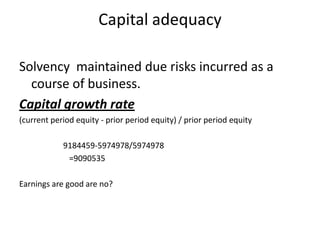

CAMELS is a tool used by US bank regulators to measure the financial condition of institutions. It assesses Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk based on financial statements, portfolio aging, funding sources, business information, and cash flow projections. For example, capital adequacy ensures solvency by maintaining sufficient capital for risks in business, which can be measured by the capital growth rate of (current equity - prior equity) / prior equity.