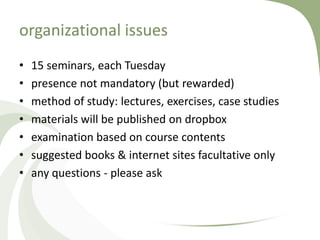

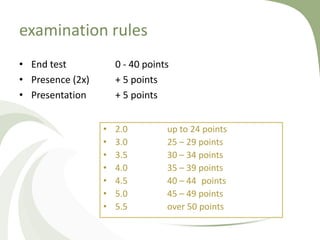

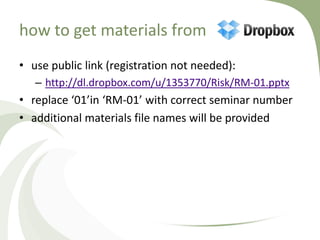

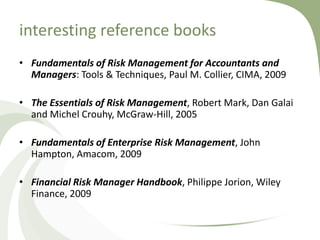

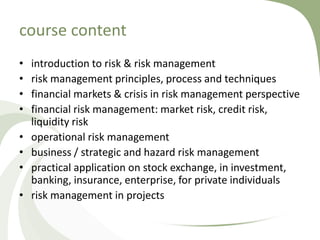

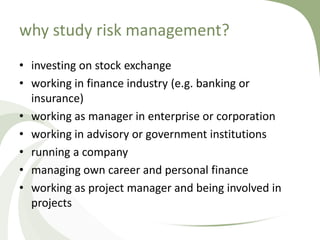

This document provides an overview and syllabus for a risk management course at the University of Economics in Kraków, Poland. The course will cover core concepts in risk management including the risk management process, financial risk, operational risk, and applications across different industries. It will involve 15 seminars taught through lectures, exercises and case studies. Students will be evaluated based on an end test, class participation, and a presentation. The document provides contact information for the instructor and references additional learning materials available online and in books.