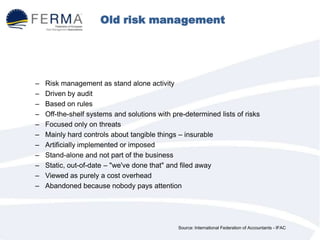

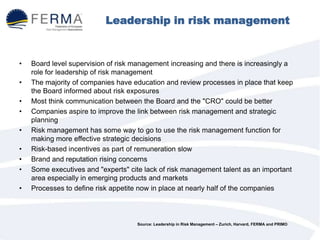

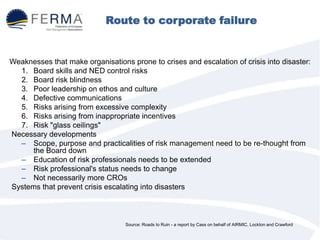

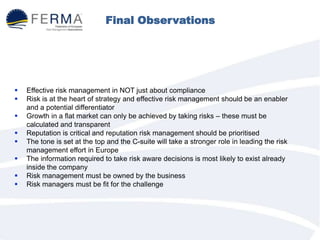

Living and working in a riskier world discusses the evolution of risk management from a standalone activity focused only on threats to a strategic business discipline that supports organizational objectives. It argues risk management must shift from rules-based compliance to principles-based resilience by considering opportunities in addition to threats, taking a holistic view of risks, and integrating risk management into the business rather than treating it as a separate cost. As the world becomes more complex and interconnected, reputation and non-insurable risks are rising concerns, requiring risk professionals to broaden their skills and focus on culture, behavior, and building resilience across organizations.