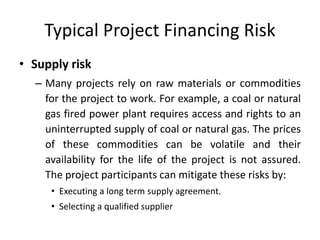

Risk response planning is the process of developing options to reduce threats to a project's objectives based on the results of risk analysis. It assigns risks to owners, applies resources through the risk management plan. Risk response strategies include avoiding risks by changing plans, transferring risks through insurance or contracts, mitigating risks by reducing likelihood or impact, and accepting some risks. Opportunities may be exploited to ensure they occur, shared with partners, or have their likelihood or impact enhanced. Contingency plans prepare for risks that do materialize.