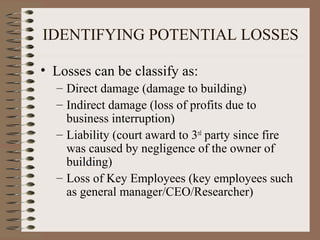

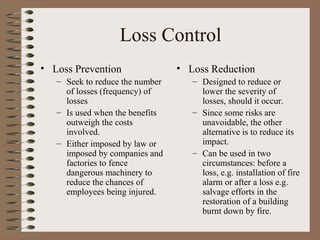

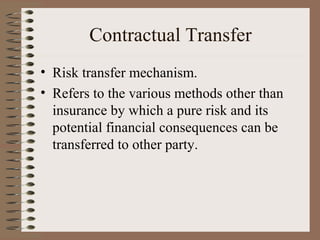

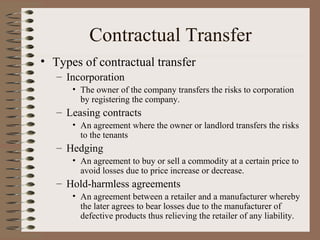

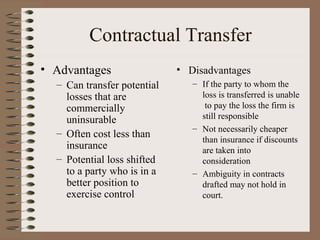

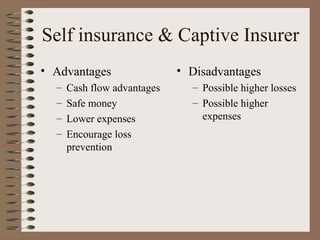

This document discusses risk management and insurance. It defines risk management as identifying, measuring, and controlling risks that threaten assets and earnings. The objectives of risk management are to help organizations progress toward goals efficiently. Risk management involves identifying potential losses, evaluating their likelihood and impact, examining risk management techniques, implementing a program, and monitoring it. Techniques include risk control methods like avoidance, prevention, and transfer, as well as risk financing methods like retention, self-insurance, and insurance. The overall process is to select and implement the most cost-effective risk management program.