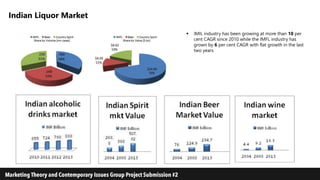

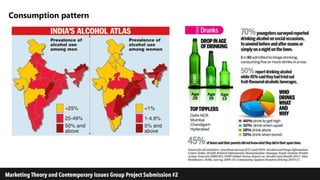

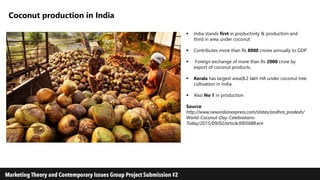

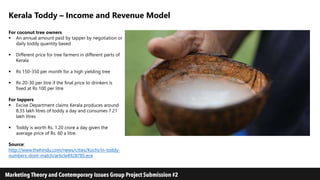

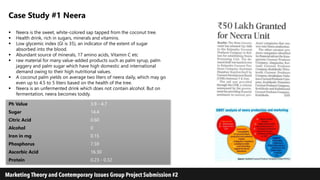

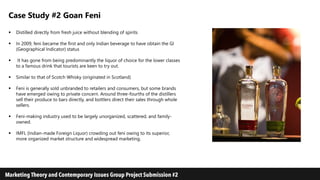

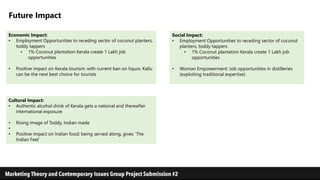

India has a large and growing liquor market, valued at $35 billion annually. The market includes Indian Made Foreign Liquor (IMFL) such as whiskey, rum, and brandy as well as beer and country liquor. IMFL and beer have seen high growth rates of over 10% and 15% respectively, while country liquor growth is slower. Kerala has a tradition of consuming toddy, or palm wine extracted from coconut trees, and has the highest per capita consumption of alcohol in India. However, the toddy industry is declining due to fewer tappers and changing consumer preferences. Revitalizing toddy production and marketing it as the traditional Neera beverage or developing premium brands could help boost the industry.