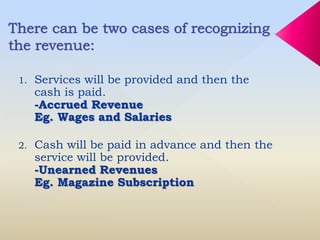

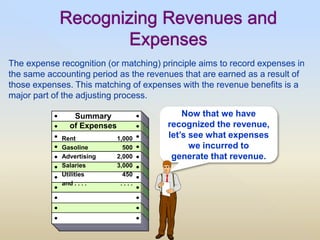

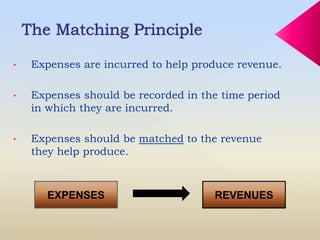

The document discusses key accounting principles related to revenue and expense recognition. It states that revenue should be recorded when a product or service is delivered to a customer, even if cash is received before or after delivery. Expenses should be recorded and matched in the same period as the revenues they help generate. This ensures expenses and revenues are accurately recorded and reported in the financial statements.