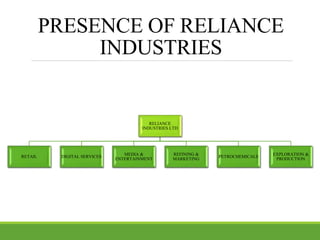

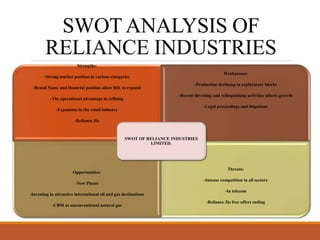

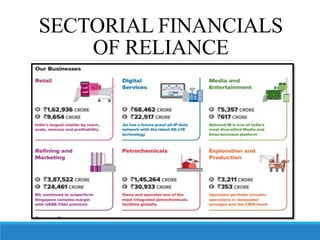

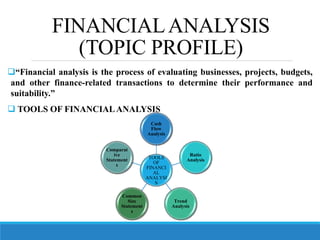

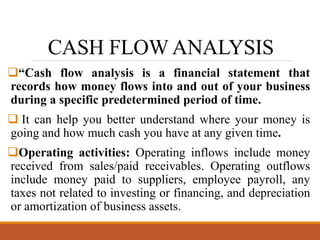

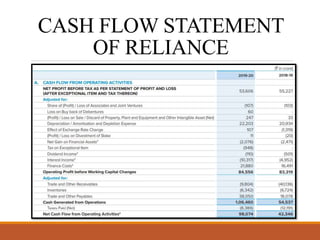

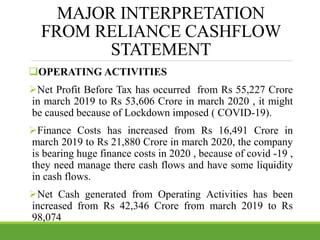

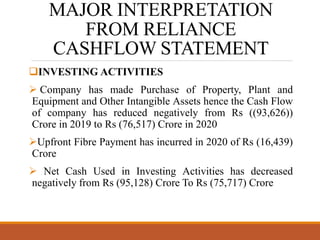

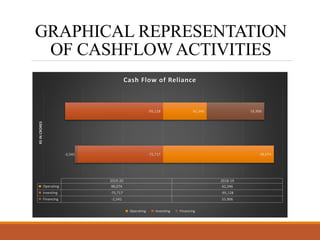

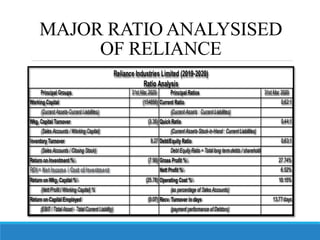

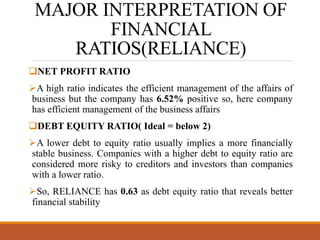

Reliance Industries Ltd is an Indian conglomerate company with diversified business activities. It has a presence in refining and petrochemicals, oil and gas exploration and production, retail, digital services, and media and entertainment. A financial analysis of Reliance reveals an increase in net cash from operating activities from 2019 to 2020 despite a decrease in net profit. The company's debt-equity ratio of 0.63 indicates good financial stability. Reliance has grown significantly over the years to become the largest company in India.