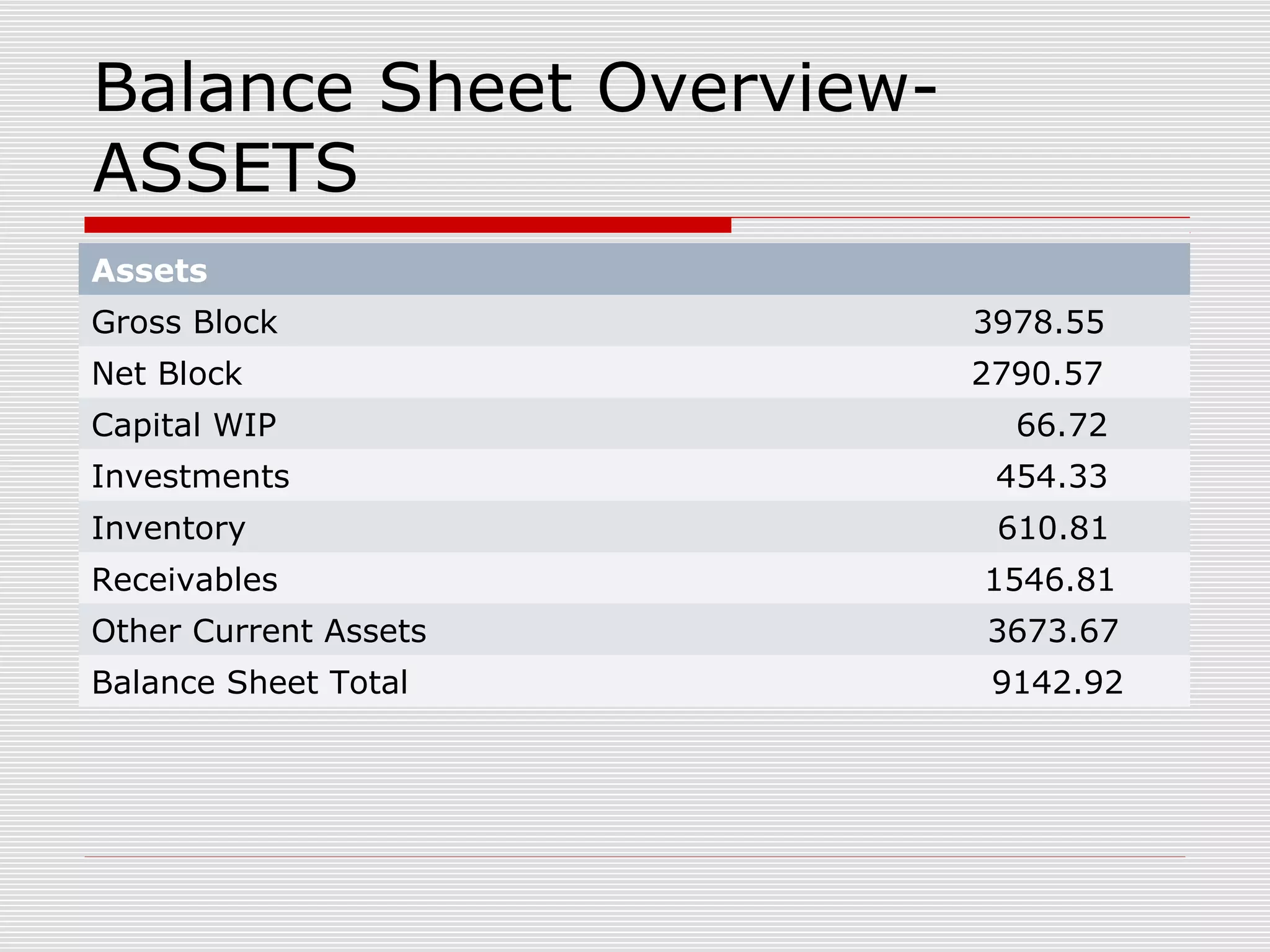

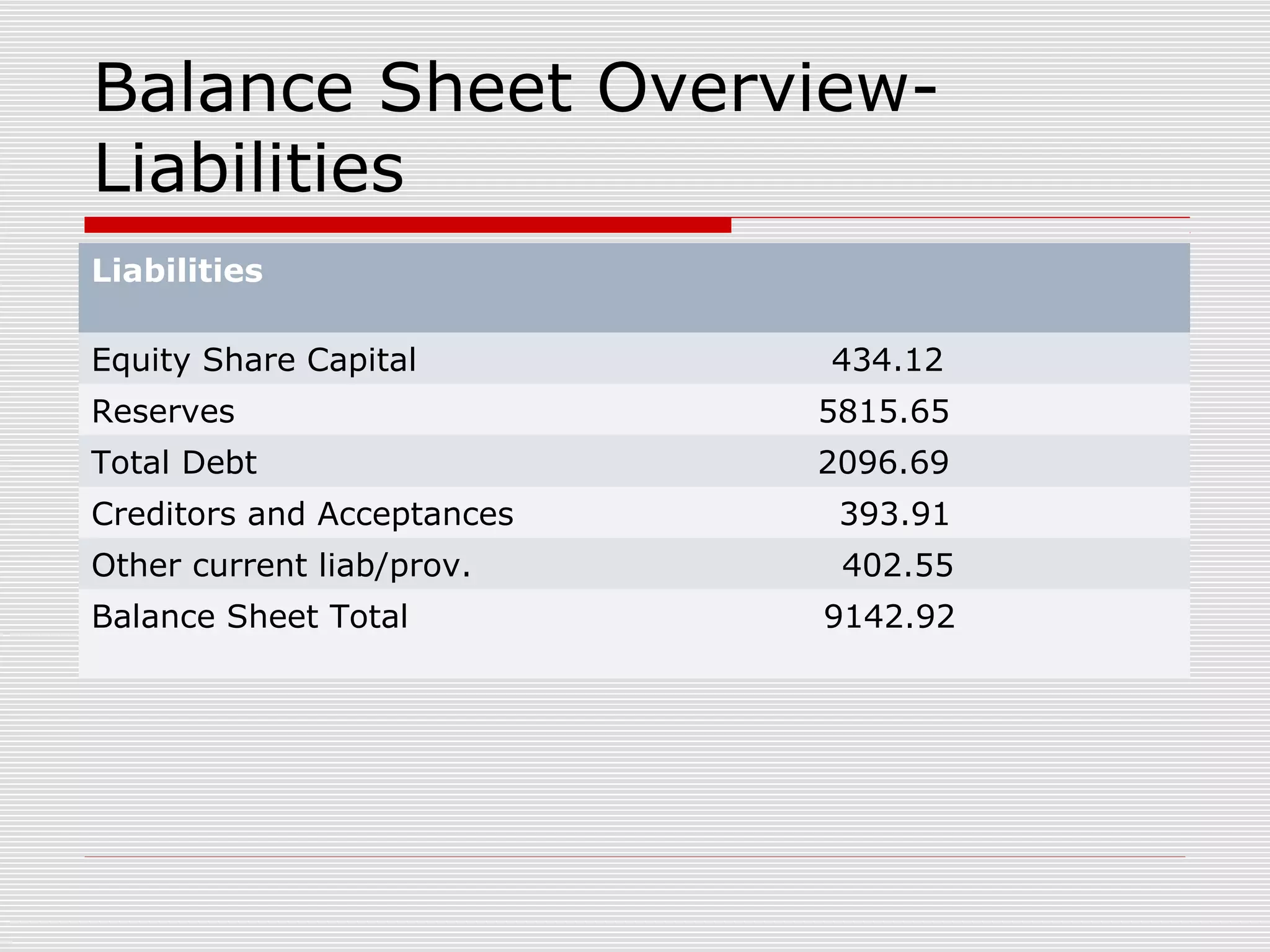

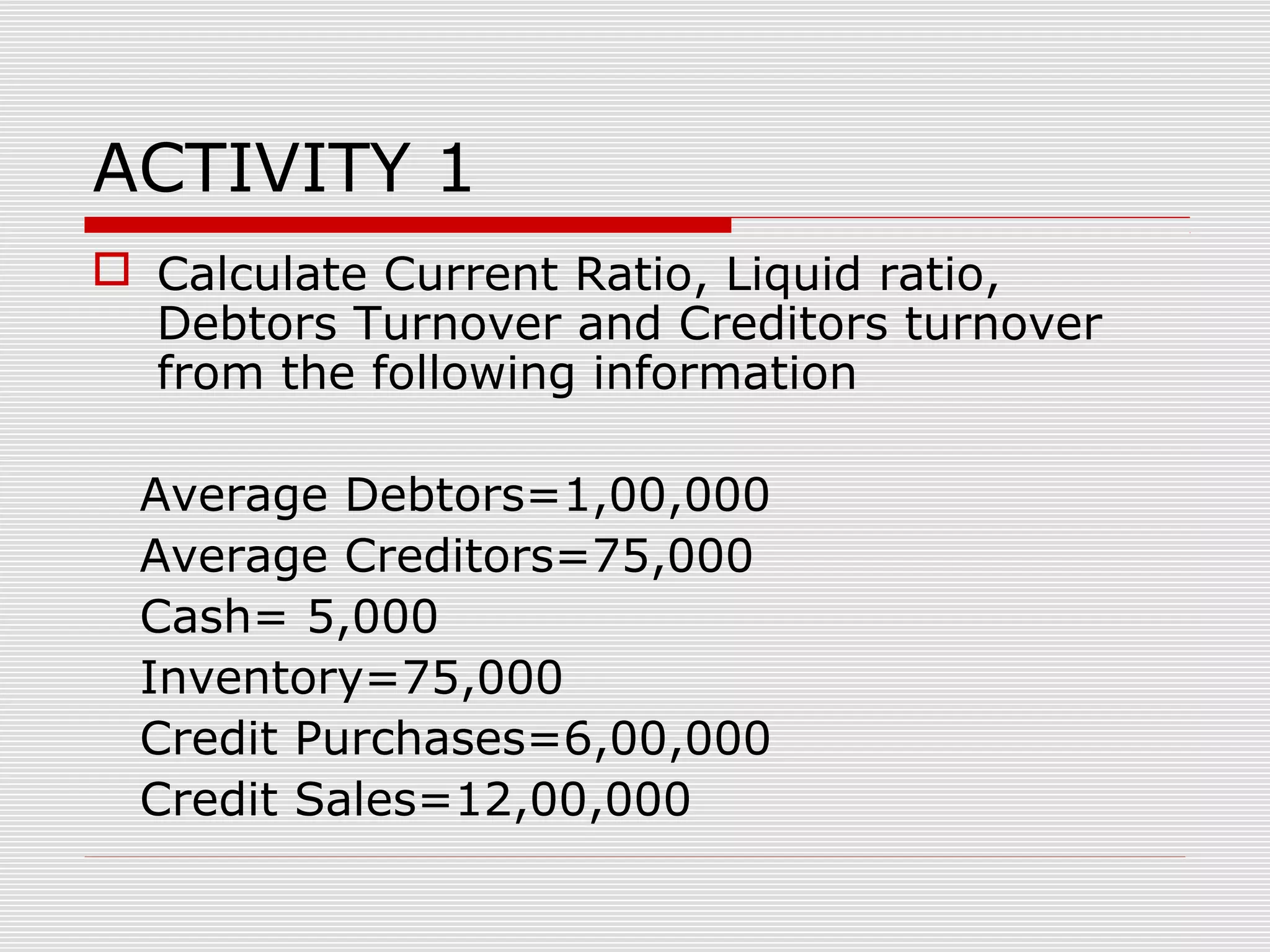

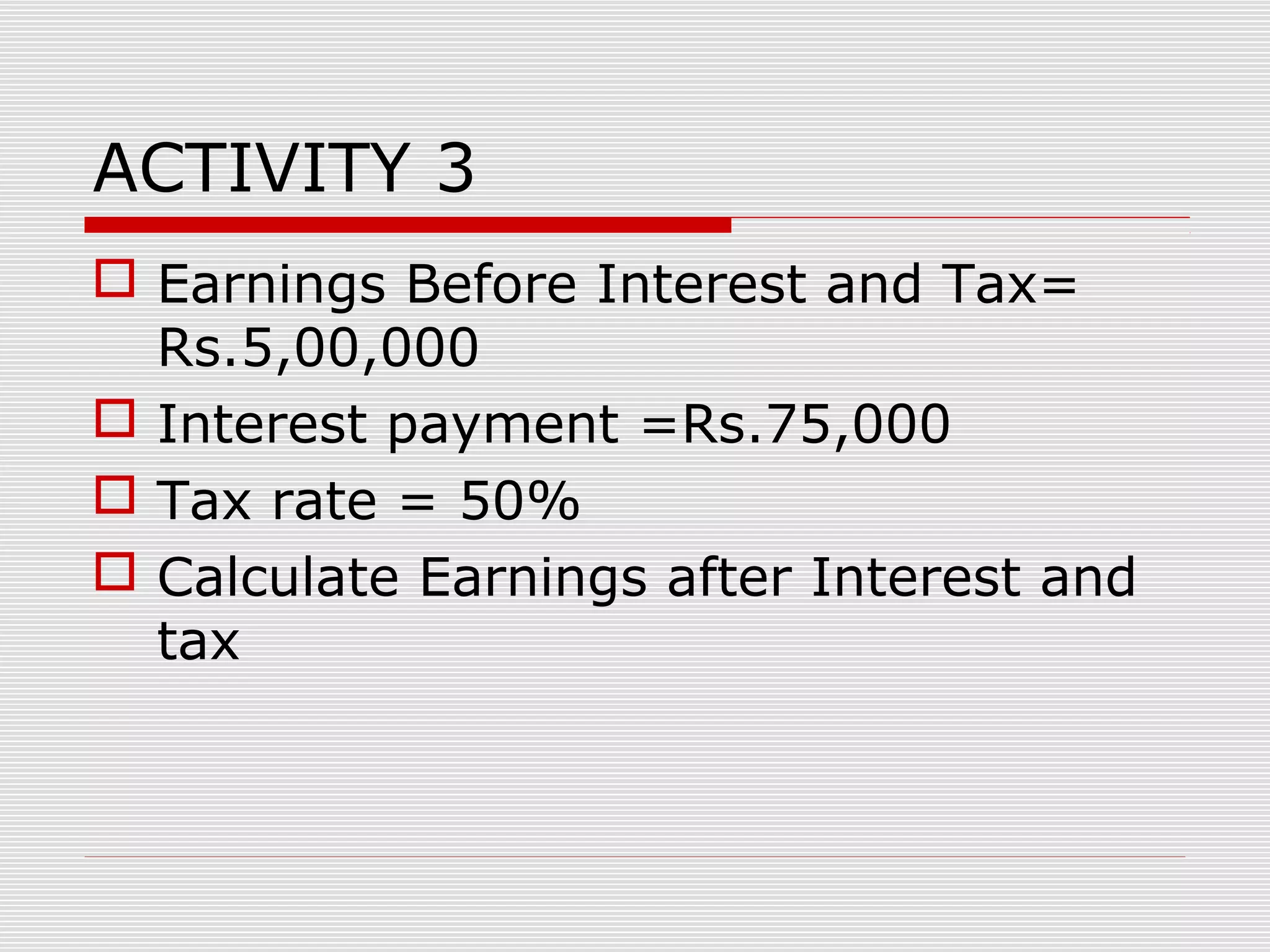

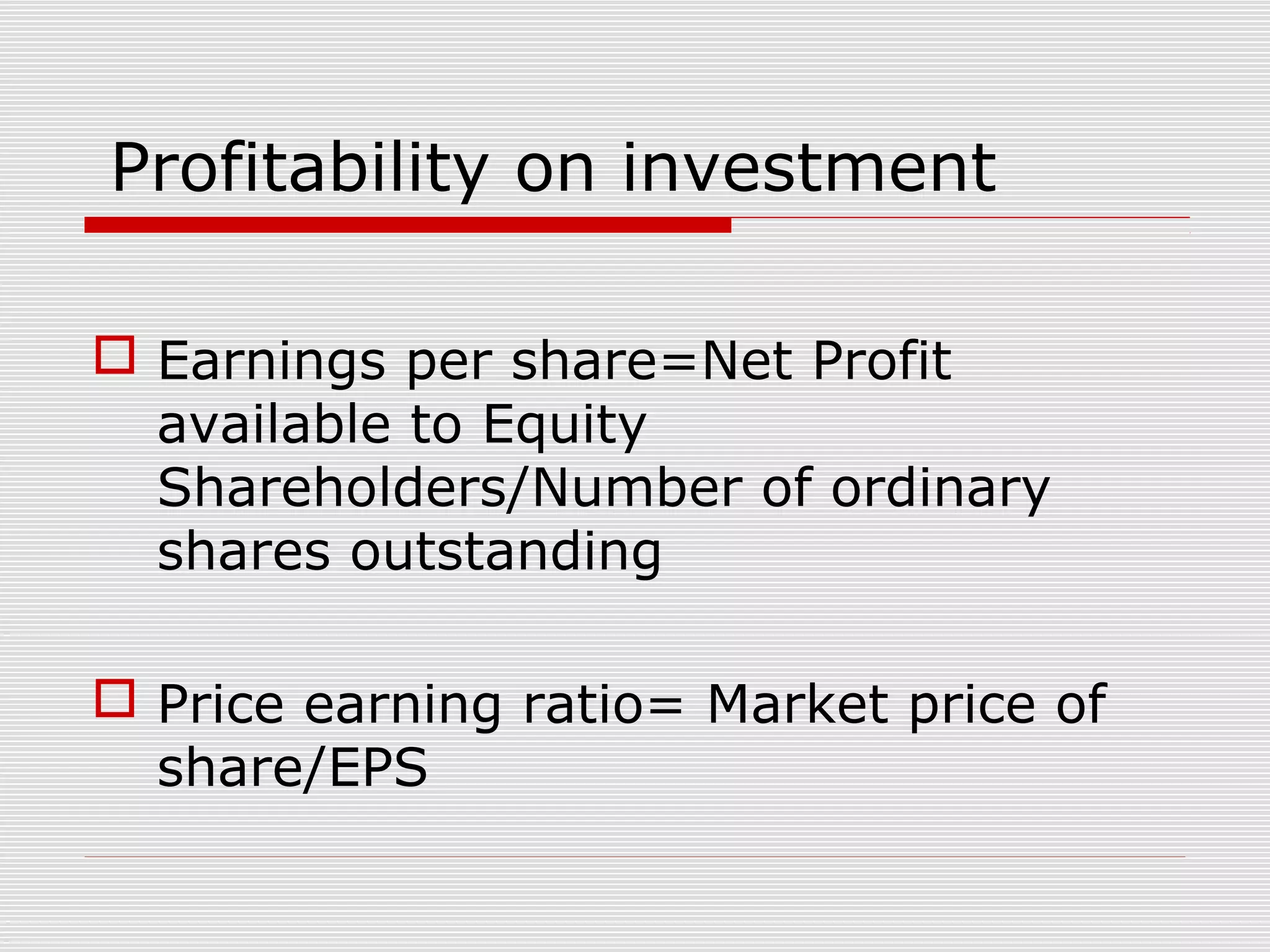

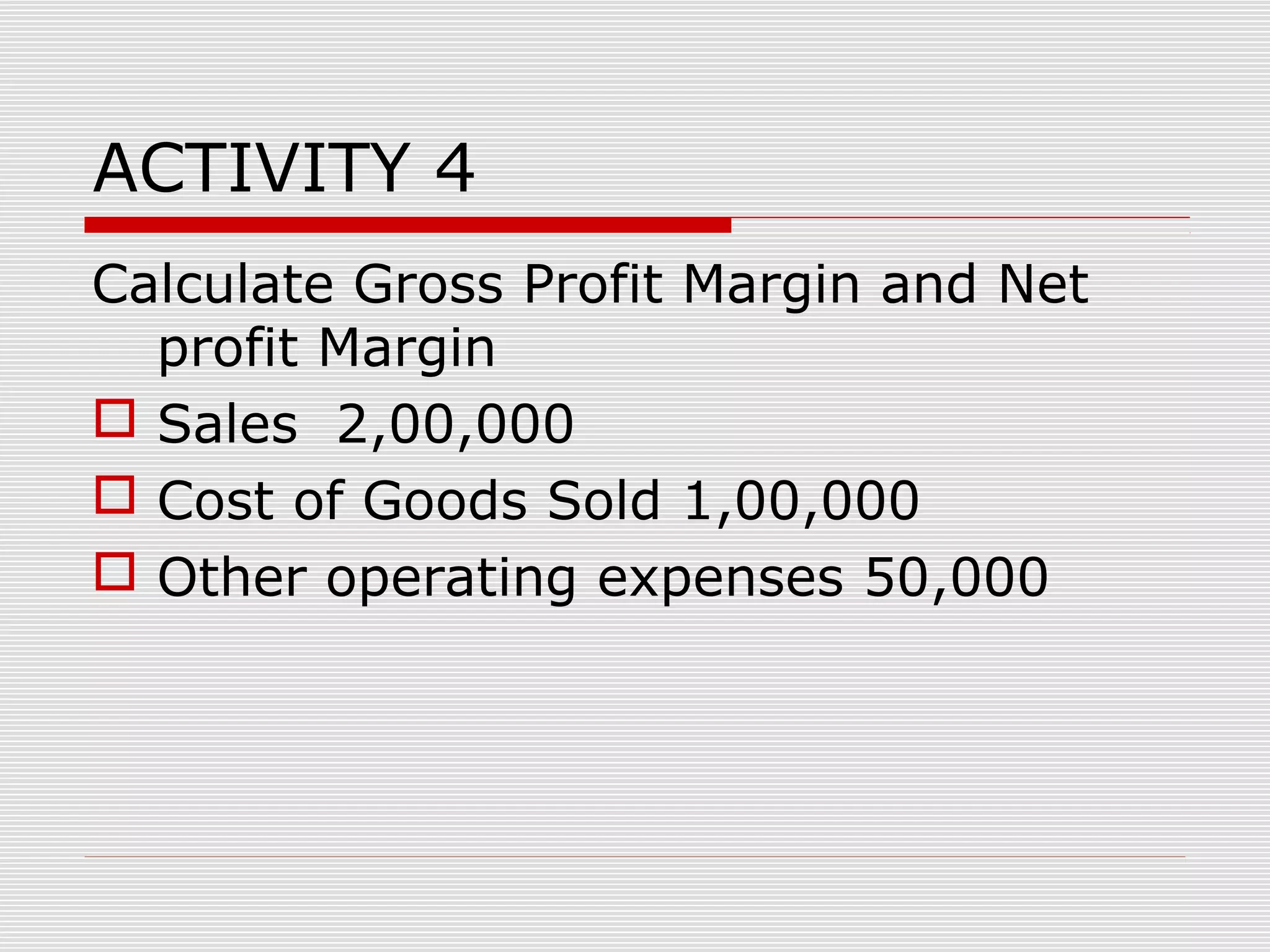

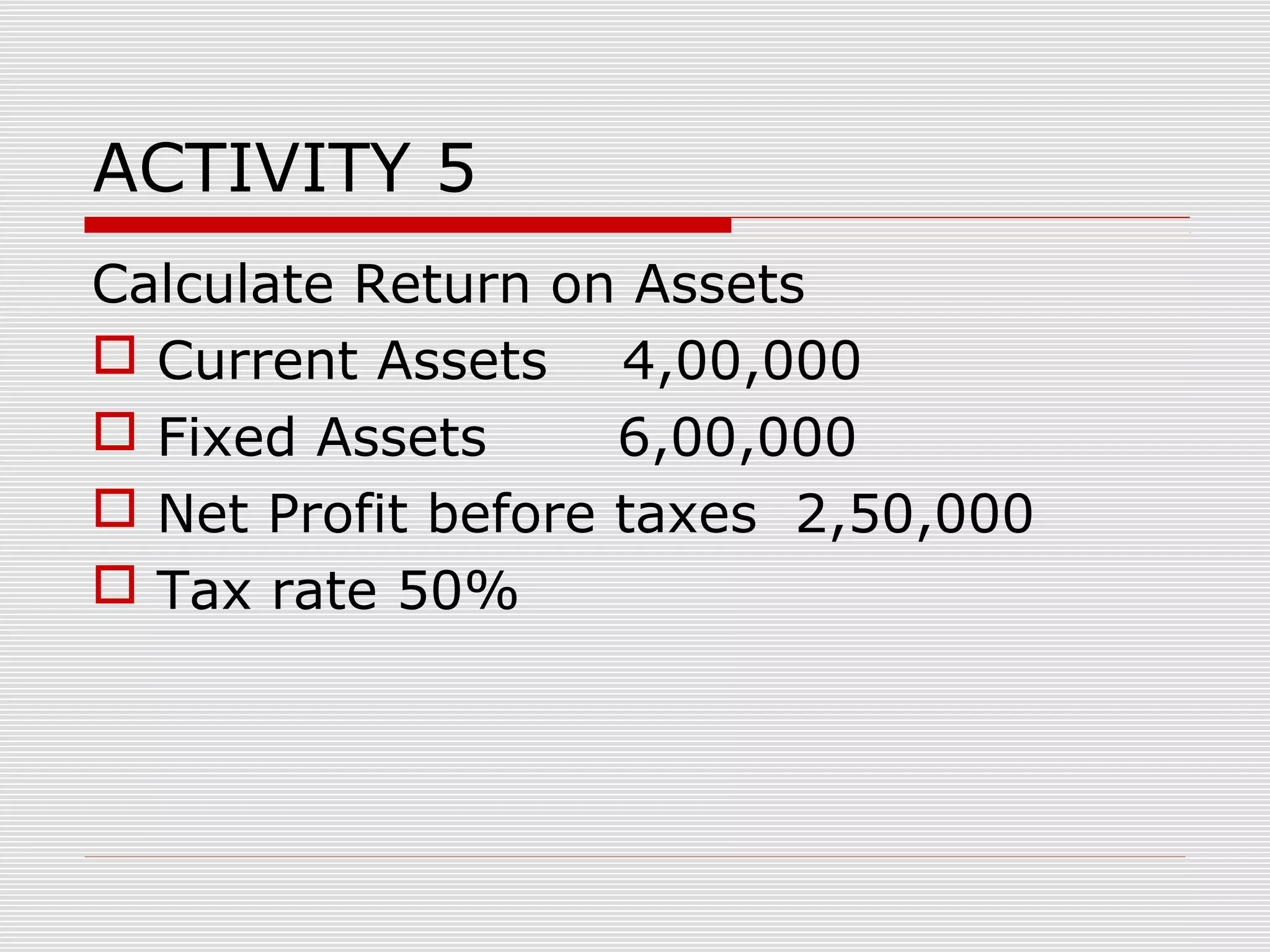

This document discusses financial statement analysis and ratio analysis. It provides an overview of the rationale, process, tools and components of financial analysis. Some key ratios discussed include liquidity ratios, capital structure ratios, profitability ratios, activity ratios and ratios on investments. Examples are given of how to calculate common ratios like current ratio, debt-to-equity ratio, gross profit margin, return on assets and inventory turnover. The document stresses the importance of ratio analysis for decision making and compares firms, while noting some limitations to keep in mind.