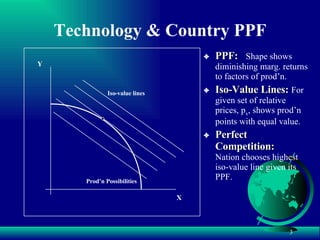

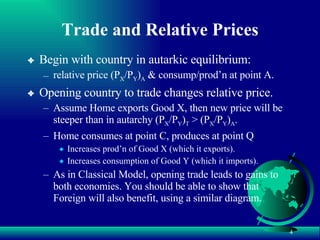

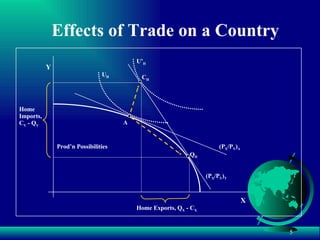

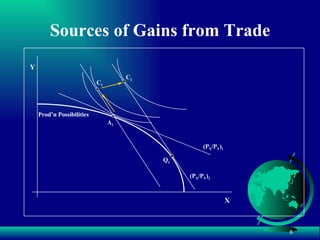

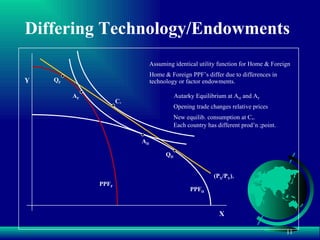

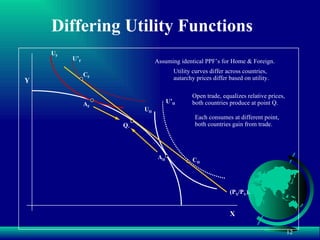

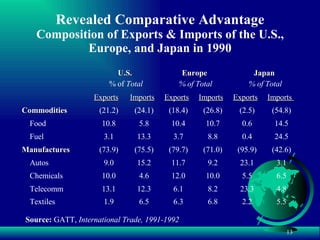

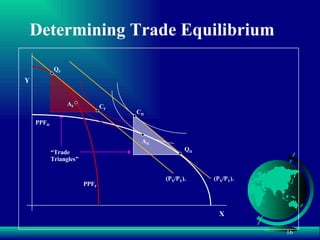

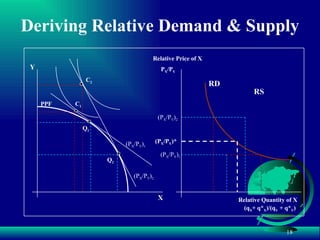

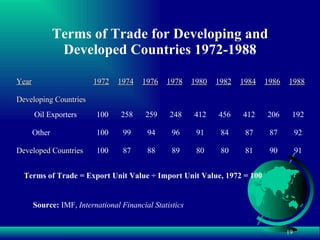

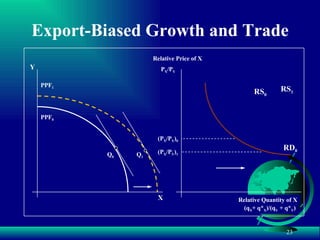

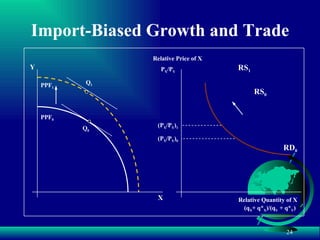

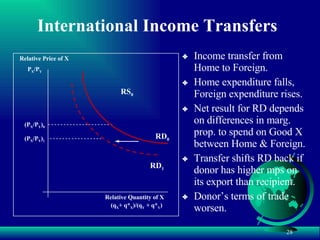

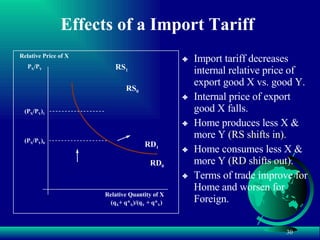

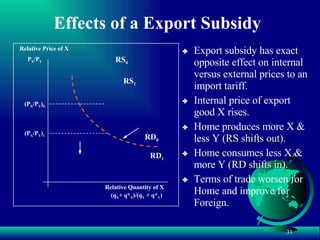

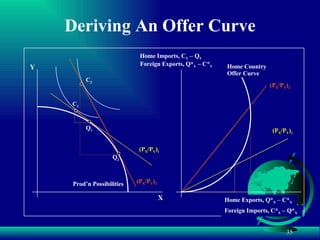

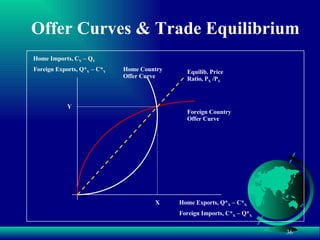

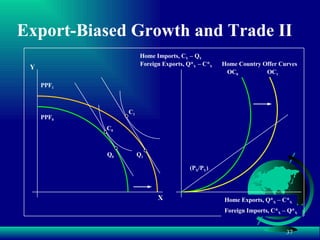

The document discusses the standard trade model and gains from trade. It introduces a 2x2x2 model with two countries producing two goods using two factors of production. Opening trade leads to gains for both countries as production and consumption move to new equilibrium points that exploit each country's comparative advantage. The terms of trade adjust to balance trade between the countries. Economic growth can impact a country's terms of trade depending on whether it is export- or import-biased. Government policies like tariffs, subsidies, and transfers also affect equilibrium terms of trade.