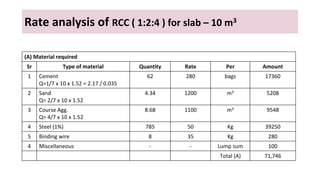

This document provides a rate analysis for 10 cubic meters of reinforced cement concrete (RCC) slab with a mix ratio of 1:2:4.

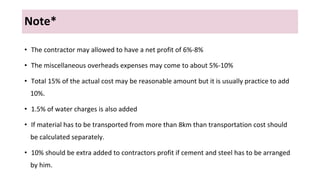

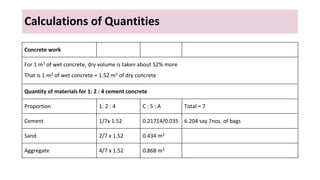

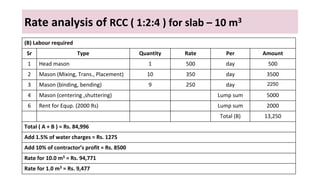

The rate analysis calculates costs for materials, labor, equipment rental, water charges, and contractor profit. Material costs include cement, sand, coarse aggregate, and steel reinforcement. Labor costs account for masons for mixing, transporting, placing, binding, and shuttering.

The total cost is Rs. 84,996, to which water charges of 1.5% and 10% contractor profit are added. The final rate calculated per cubic meter of RCC slab is Rs. 9,477.