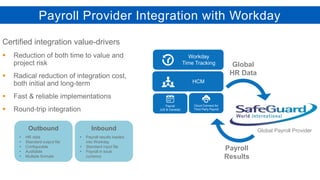

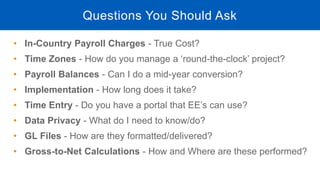

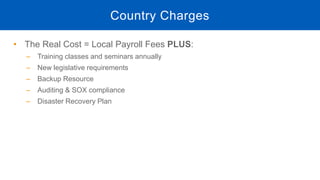

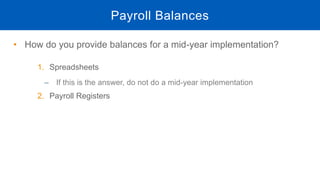

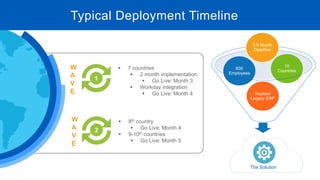

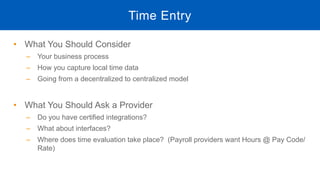

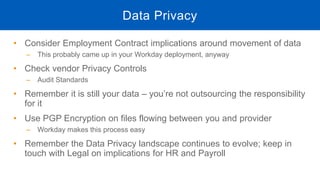

The document outlines key considerations and questions for selecting a global payroll provider, emphasizing the importance of integration with Workday and the management of various payroll aspects across countries. It highlights factors like implementation timelines, data privacy, cost management, and local compliance requirements. Additionally, it suggests best practices for data handling and the significance of certified integrations for efficient payroll operations.