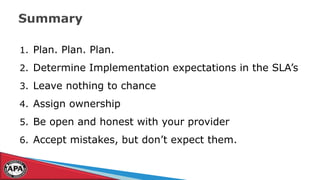

The document discusses the implementation of a global payroll aggregator model, covering aspects like governance, structural options, and the essential components of global payroll administration. It outlines the processes required for managing payroll across multiple countries, highlighting the importance of compliance, effective vendor management, and technology integration. The document also emphasizes the need for a structured approach to building a business case, rolling out payroll services, and ensuring smooth onboarding of new vendors.