This document summarizes the financial performance of Nordnet for the first three quarters of 2012. Key points include:

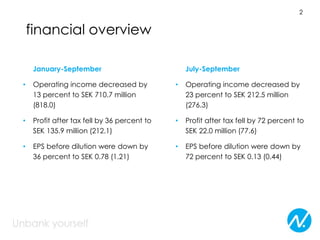

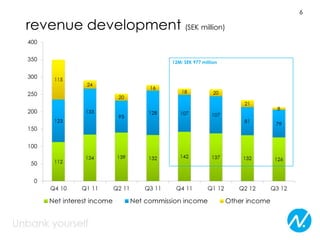

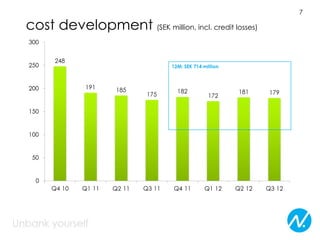

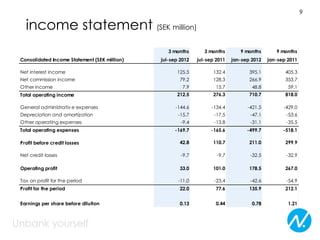

- Operating income and profit after tax decreased by 13% and 36% respectively for the first three quarters compared to the same period in 2011, due to lower trading activity.

- EPS fell by 36% for the first three quarters.

- Total operating income and profit for the third quarter alone decreased by 23% and 72% respectively compared to Q3 2011.

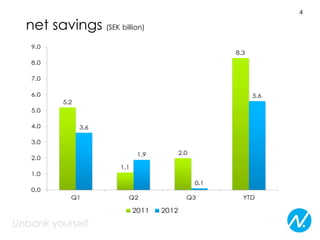

- Nordnet saw lower numbers of trades and net savings in the period.

- Håkan Nyberg became the new CEO in August 2012.

- The document outlines Nordnet's vision to become the leading bank for savings in the