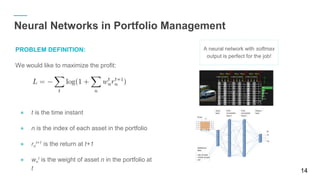

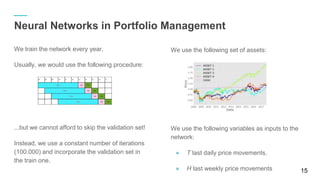

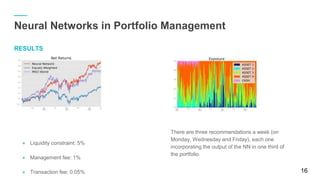

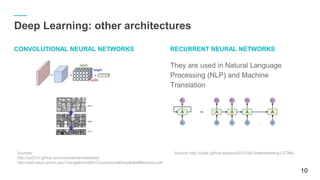

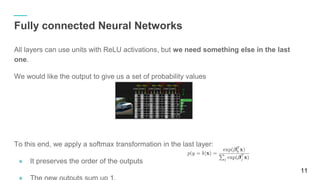

The document discusses using Python and TensorFlow for deep learning applications in stock exchange trading and asset management. It covers foundational concepts in machine learning, including neural networks, training models, and performance evaluation, along with practical examples. Additionally, it explores the use of neural networks in portfolio management to maximize profits while incorporating various constraints.

![● Example: evaluate f= x2

+ y2

. First define the graph.

import tensorflow as tf

x = tf.Variable( 3)

y = tf.Variable( 4)

f = x*x + y*y

● It’s separated from its execution:

>>> sess = tf.Session()

>>> sess.run(x.initializer)

>>> sess.run(y.initializer)

>>> result = sess.run() # Result equals 25

● Or more compactly:

init = tf.global_variables_initializer()

with tf.Session() as sess:

init.run()

result = f.eval

12

Deep Learning with TensorFlow

● Example:Graph for Logistic Regression on the MNIST database.

# Data input

x = tf.placeholder(tf.float32, [ None, 784])

y = tf.placeholder(tf.float32, [ None, 10])

# Set model weights

W = tf.Variable(tf.zeros([ 784, 10]))

b = tf.Variable(tf.zeros([ 10]))

# Construct model

pred = tf.nn.softmax(tf.matmul(x, W) + b) # Softmax

# Minimize error using cross entropy

cost = tf.reduce_mean( -tf.reduce_sum(y *tf.log(pred), axis=1))

# Gradient Descent

optimizer = tf.train.GradientDescentOptimizer(learning_rate)

.minimize(cost)

● Running and optimising:

with tf.Session() as sess:

sess.run(init)

for i in range(total_batch):

batch_xs, batch_ys = mnist.train.next_batch(batch_size)

_, c = sess.run([optimizer, cost], feed_dict ={x: batch_xs,

y: batch_ys})

# Compute average loss

avg_cost += c / total_batch

TensorFlow is a open source software library for numerical computation.](https://image.slidesharecdn.com/presentacionpycones2017-170925101327/85/Python-Tensorflow-how-to-earn-money-in-the-Stock-Exchange-with-Deep-Learning-PyconEs2017-talk-12-320.jpg)