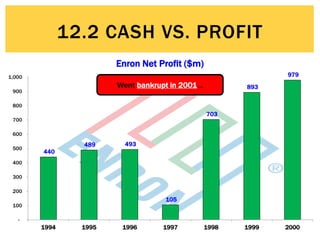

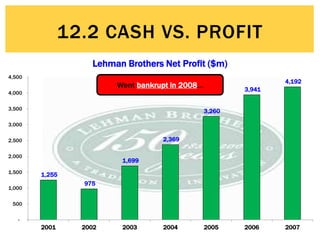

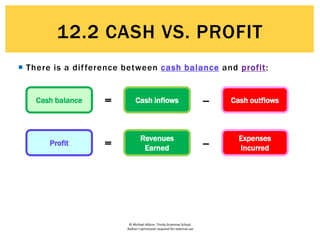

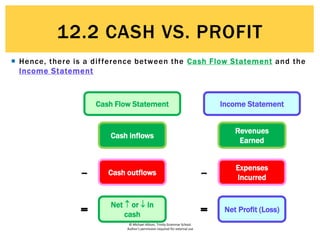

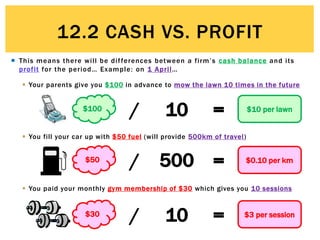

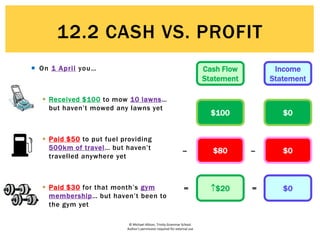

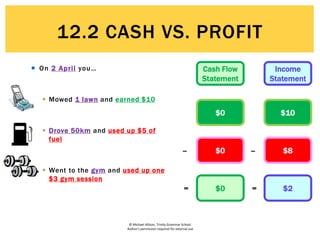

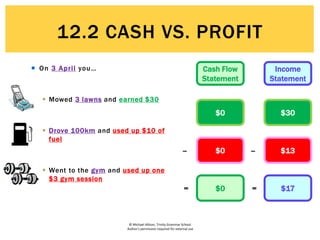

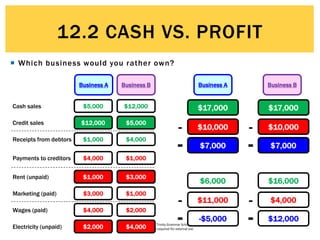

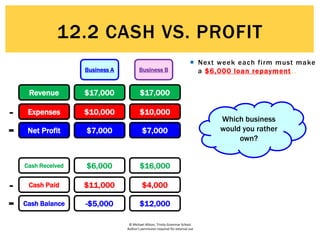

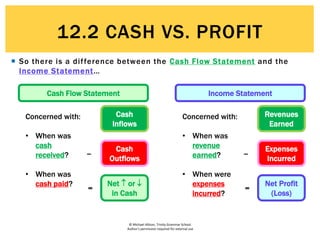

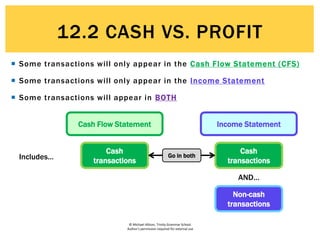

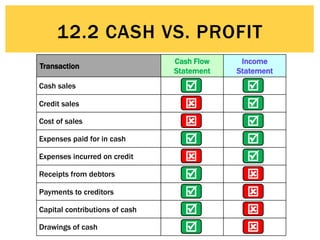

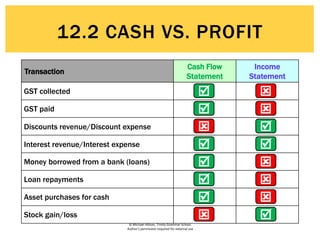

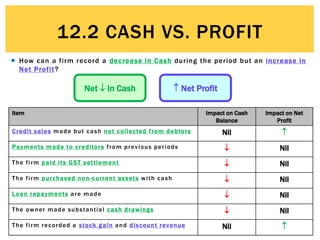

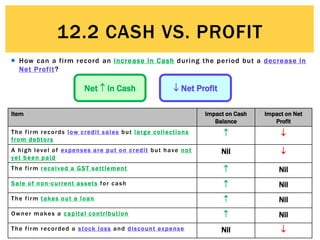

The document discusses the differences between cash flow statements and income statements. Cash flow statements record when cash is received and spent, while income statements record when revenue is earned and expenses are incurred. There can be differences between a company's cash balance and net profit because some transactions only impact one statement. For example, a company can report an increase in net profit but a decrease in cash if it made credit sales or incurred expenses that were not paid in cash.