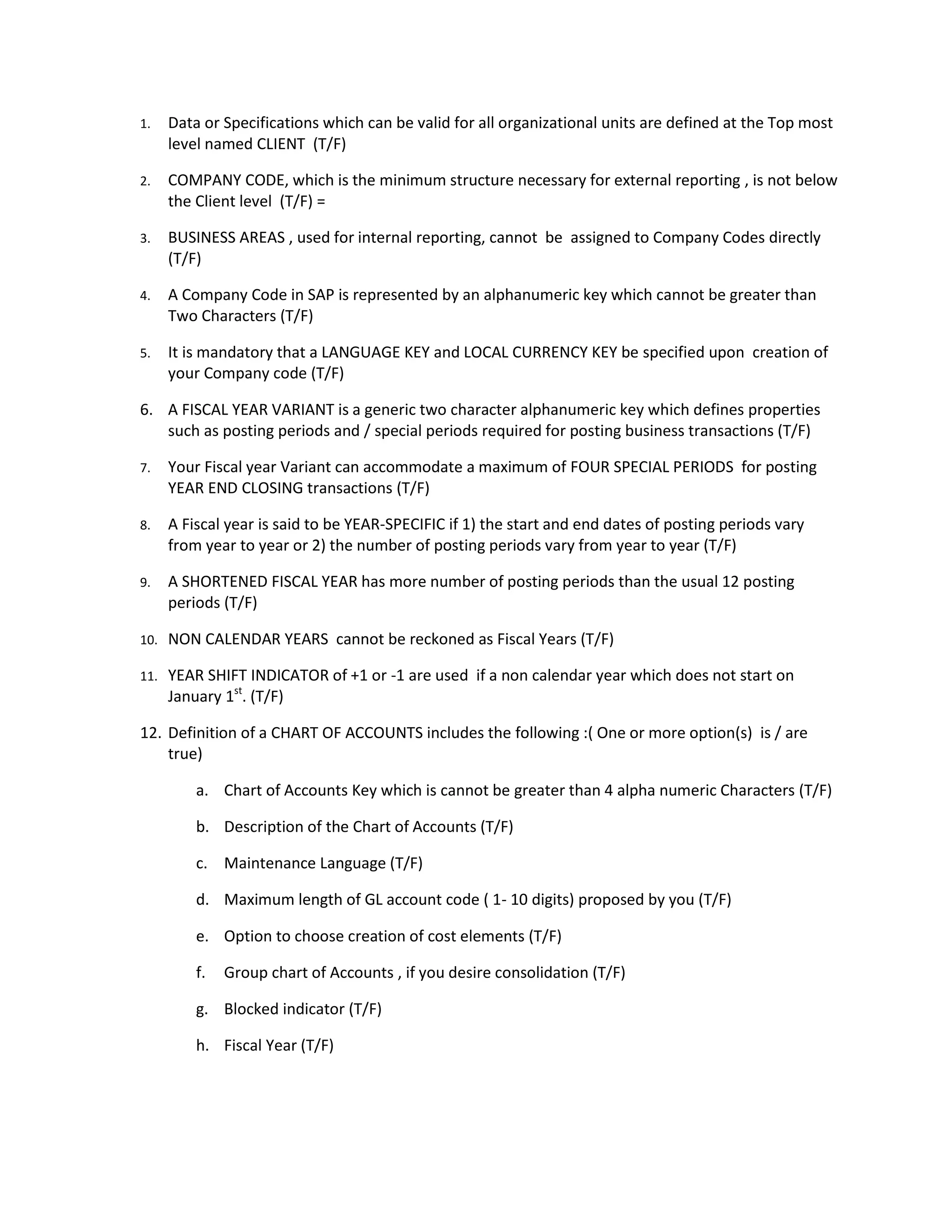

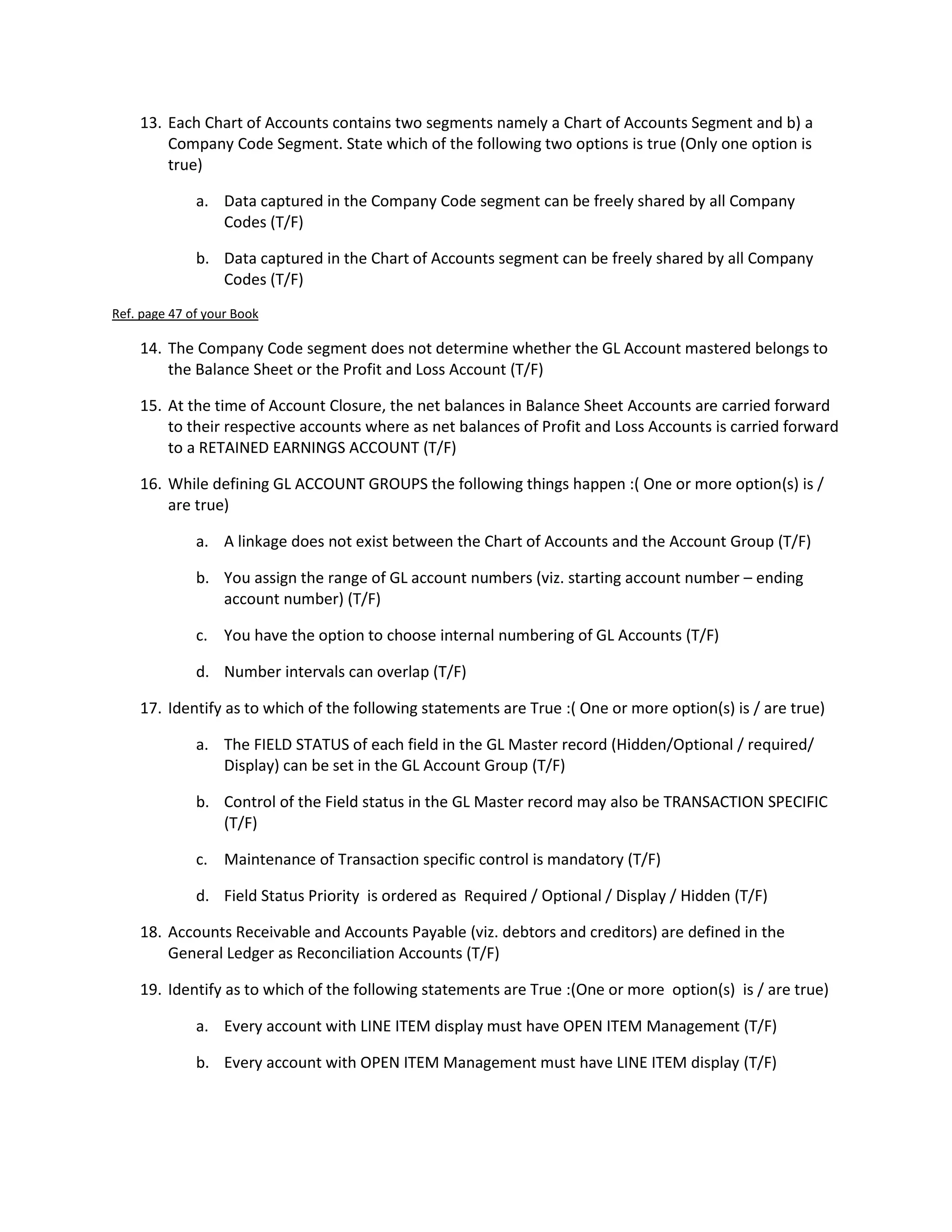

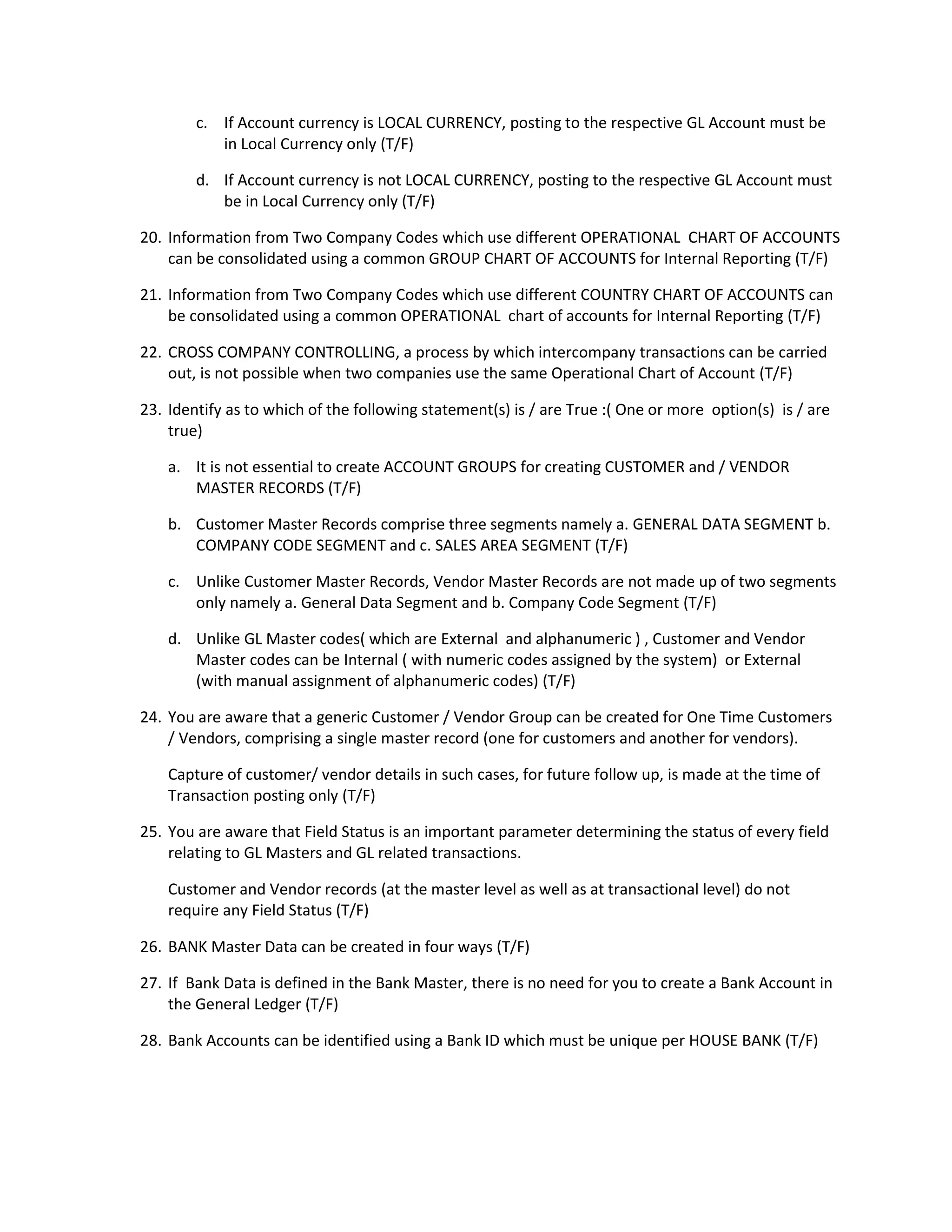

This document provides a 60 question mock test on SAP FI (Financial Accounting) concepts. The questions cover a range of topics including basic settings, master data, document control, posting control, clearing, cash journal, and special GL transactions. Correct answers are awarded points ranging from 1 to 0.125 based on the number of true/false options in the question. An overall percentage score can be calculated by multiplying the total points by 1.66.