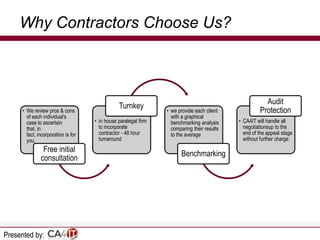

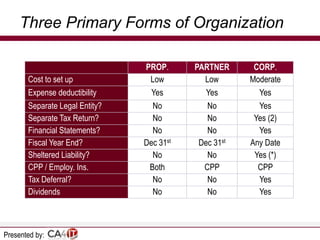

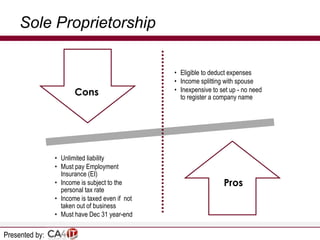

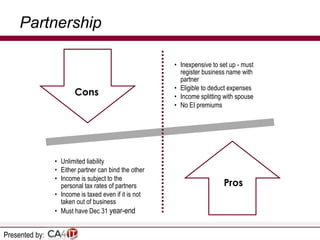

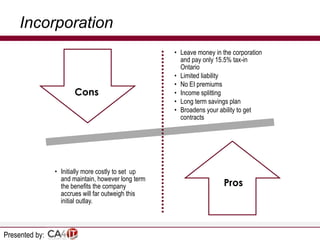

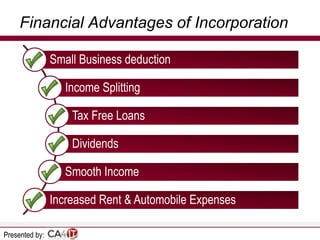

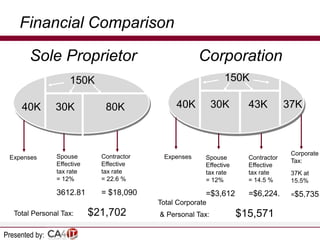

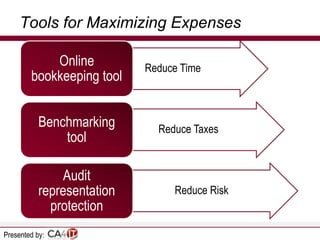

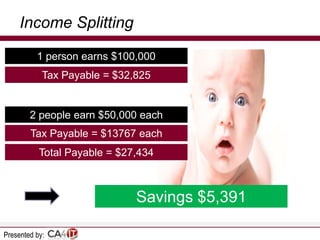

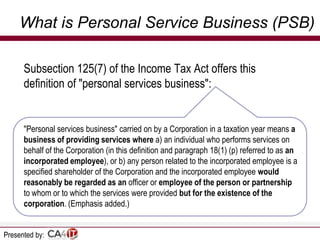

This document provides an overview of the advantages of incorporating a business from a contractor education seminar. It discusses the primary forms of business organization including sole proprietorships, partnerships, and corporations. The financial advantages of incorporation include tax deferral, income splitting, and accessing lower corporate tax rates. Non-financial advantages include liability protection and increasing marketability. The document provides tips for maximizing tax deductions and benefits of incorporation through strategic planning and expense allocation. It also covers considerations for personal service businesses and next steps clients can take.