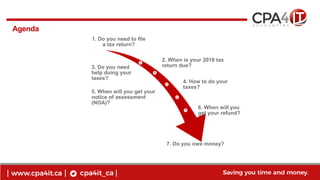

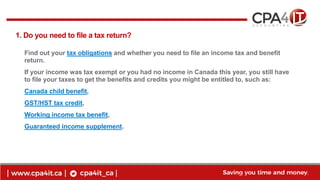

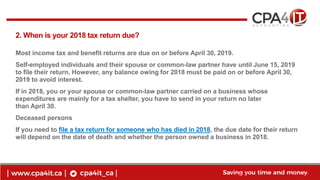

This document provides information about filing personal taxes in Canada. It addresses 7 common questions people have about doing their taxes: 1) whether you need to file a return, 2) tax return deadlines, 3) getting help filing taxes, 4) methods for filing taxes, 5) when to expect a notice of assessment, 6) when to expect any refund, and 7) what to do if you owe money. The document encourages working with a professional for tax advice and filing taxes.