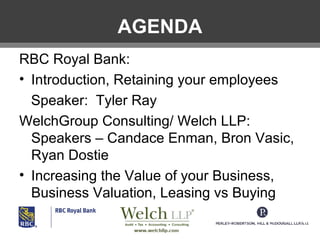

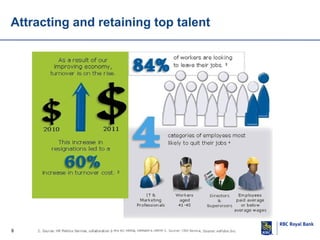

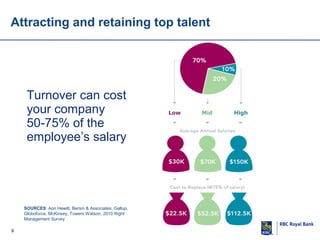

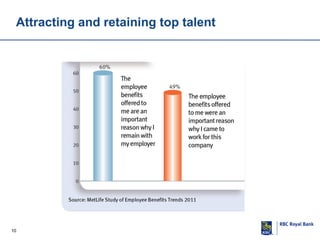

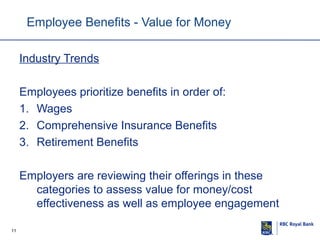

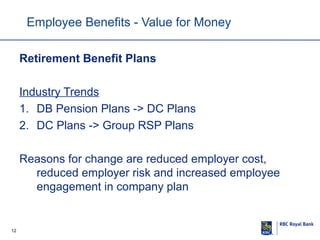

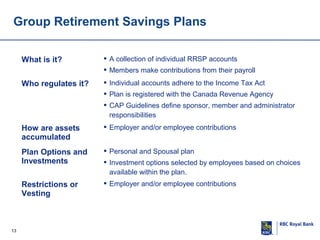

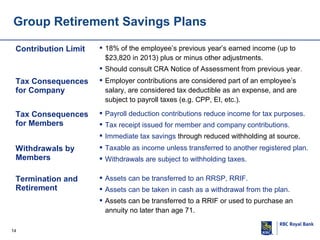

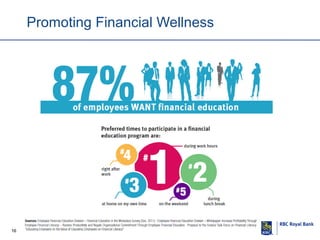

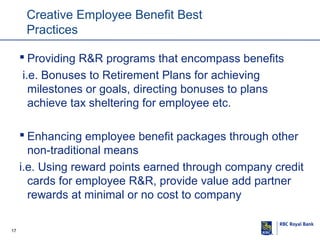

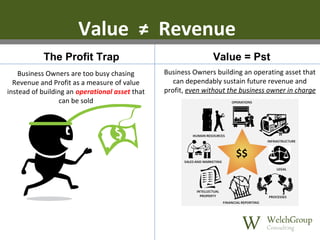

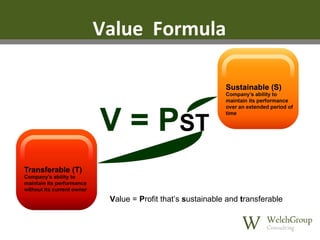

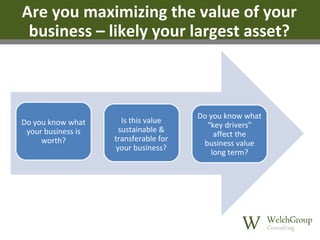

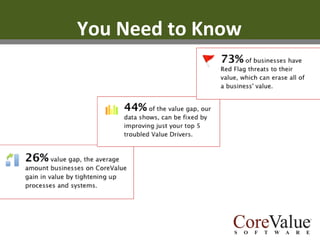

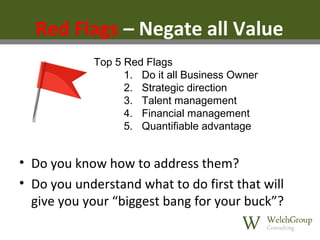

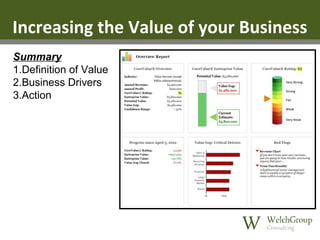

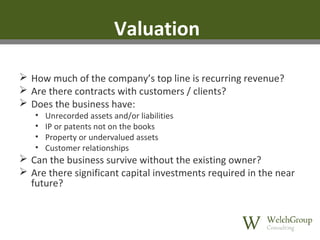

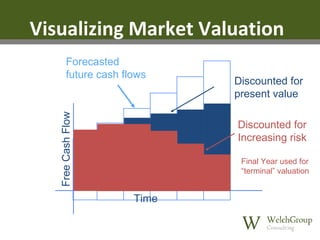

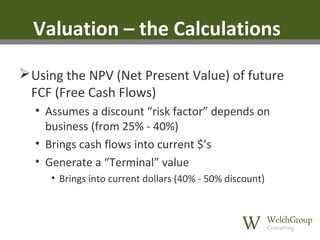

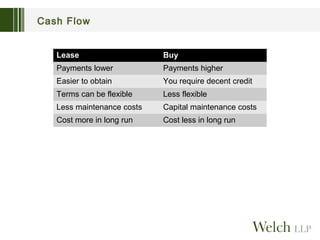

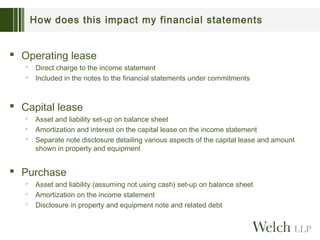

The document outlines a seminar focused on business growth strategies, including employee retention, business valuation methods, and leasing versus purchasing assets. Key speakers discuss techniques for maximizing business value and the importance of attracting and retaining top talent through effective employee benefits. It emphasizes the need for business owners to understand their company's worth and implement strategies for long-term sustainability and success.