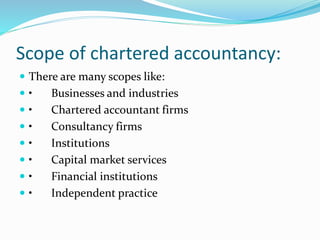

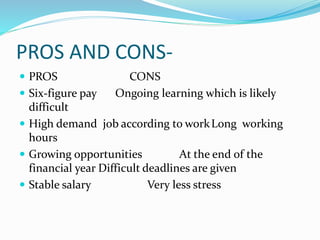

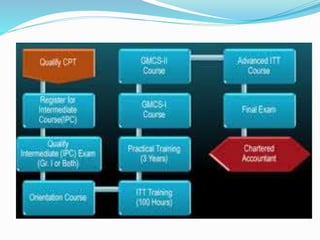

Chartered accountants were the first accountants to form a professional body in 1854 in Scotland. They work in both the government and private sectors, managing finances, taxation, and business strategy. Becoming a chartered accountant requires years of training and exams. While the career is challenging, it offers benefits like high and stable salaries, ongoing career opportunities, and strong demand across industries like businesses, financial institutions, and consultancy firms. The career provides scope for working independently or for organizations.