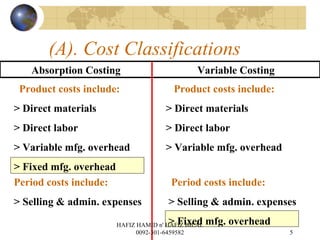

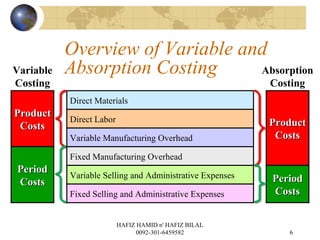

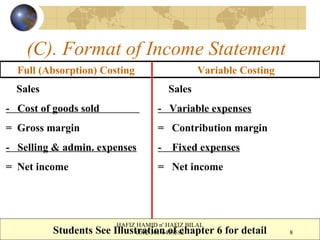

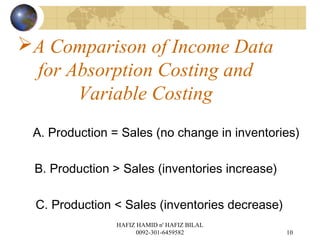

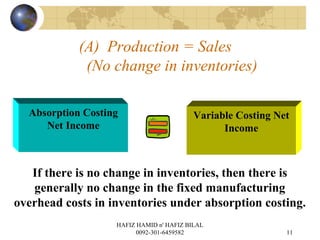

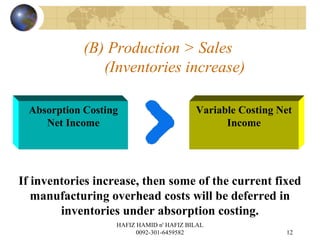

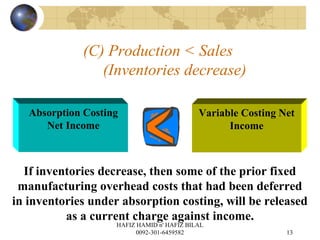

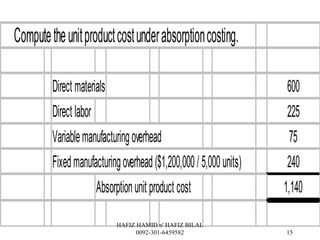

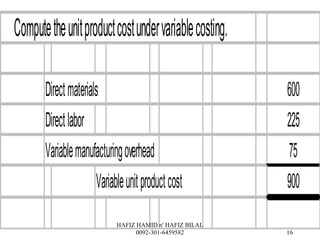

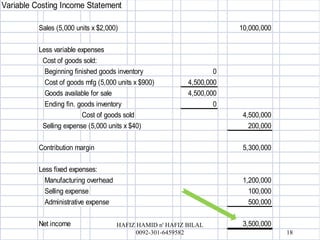

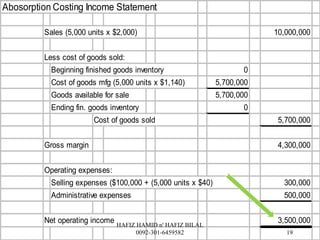

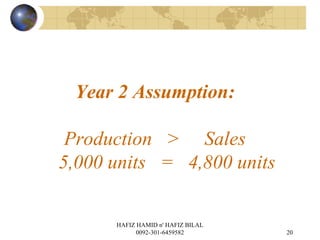

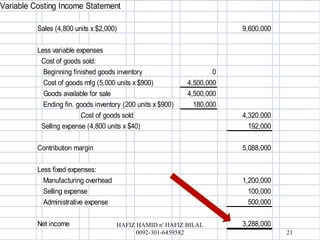

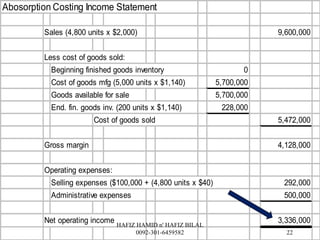

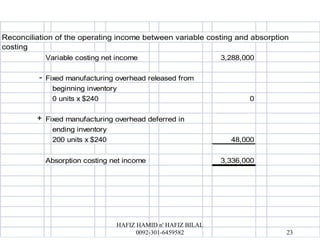

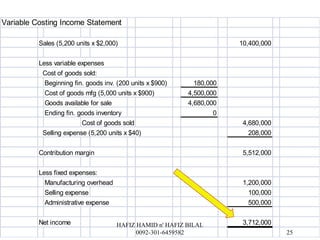

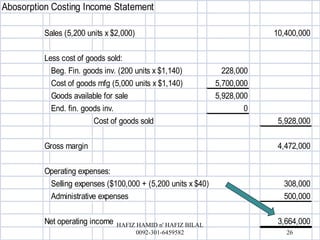

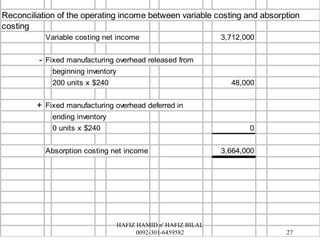

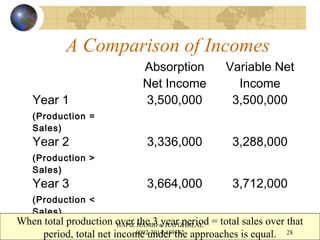

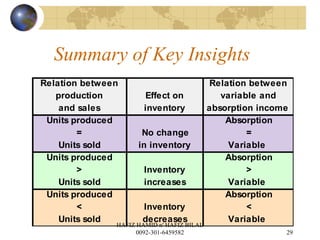

This chapter compares absorption costing and variable costing. Absorption costing treats fixed manufacturing overhead as a product cost, while variable costing treats it as a period cost. When production equals sales with no inventory changes, net income is the same under both methods. When production exceeds sales, absorption costing nets income is higher as fixed costs are deferred in inventory. When production is less than sales, absorption net income is lower as fixed costs in inventory are released. Over multiple periods with equal total production and sales, total net income is the same under both methods.