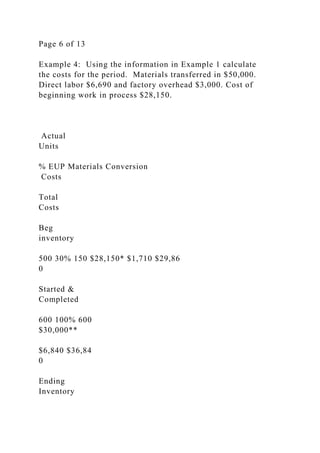

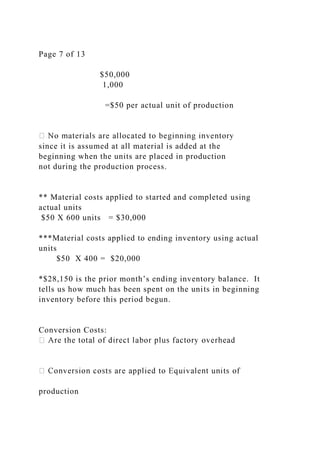

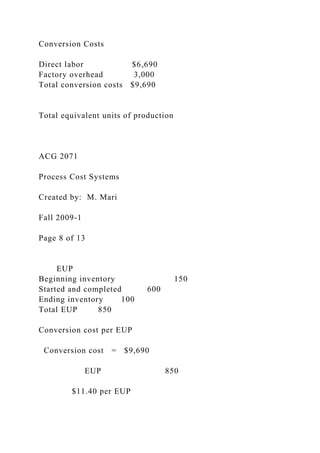

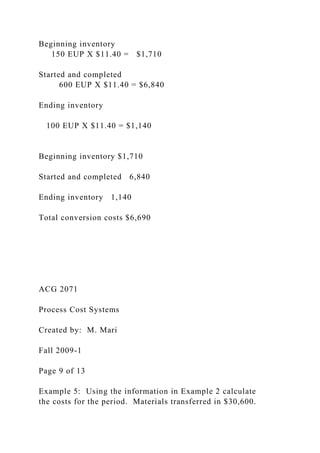

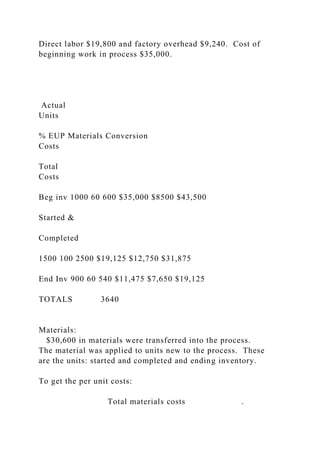

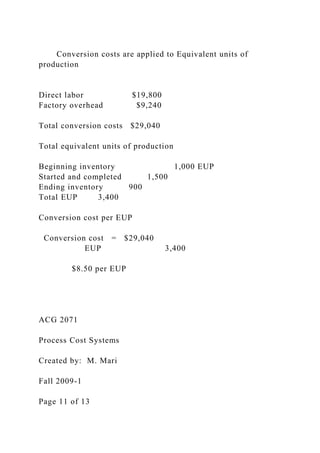

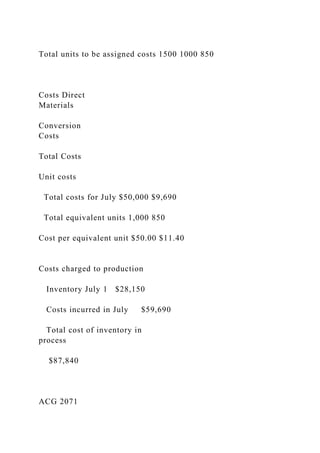

The document provides a detailed overview of process costing systems as applied to Spectre Chemicals, which produces a product called Zaloff across two departments for March and April 2011. It outlines the production processes, calculates equivalent units of production, and discusses cost allocation methods, including direct materials costs and conversion costs. Examples illustrate the computation of costs and highlight the importance of tracking beginning and ending inventory within the context of managerial accounting.