This document provides an overview of privatization in Pakistan, including:

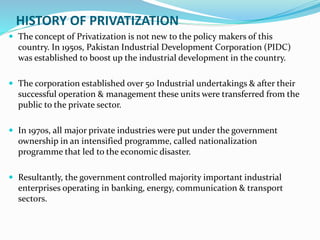

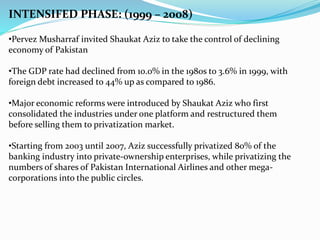

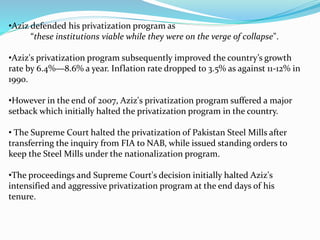

- The history of privatization beginning in the 1950s and picking up pace in the late 1980s and early 1990s.

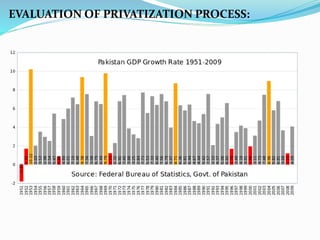

- The advantages of privatization including increased efficiency and profitability, reduced political interference, retirement of debt, and reduced fiscal burden.

- The disadvantages, which include potential increase in tax evasion, wealth concentration, unemployment, and exploitation by private sector owners.

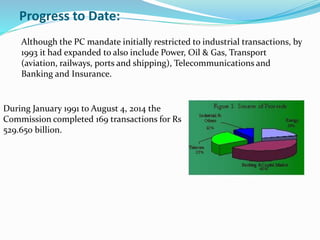

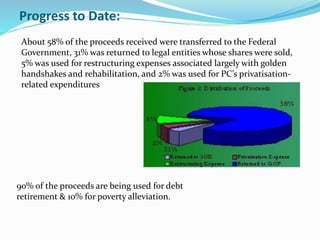

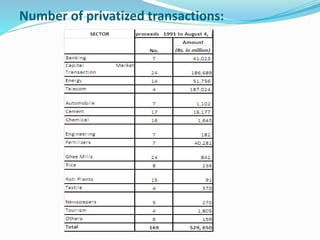

- Key privatization transactions and both successes (like MCB Bank) and failures (like K-Electric).

- The two main phases of privatization - the spontaneous phase from 1989-1993 and the second phase from 1993-1999