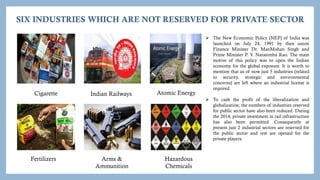

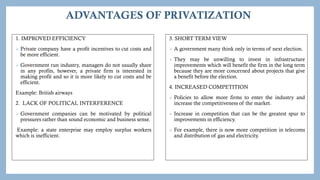

Privatization involves transferring ownership of public assets or services to private entities. The document discusses various aspects of privatization in India including the reasons for it, methods used, and examples of privatization in key industries such as coal, telecom, airports, energy and minerals. Privatization aims to improve efficiency but there are also risks such as less focus on necessary products or services and unemployment. Overall, the document provides a comprehensive overview of India's experience with privatization across multiple sectors.