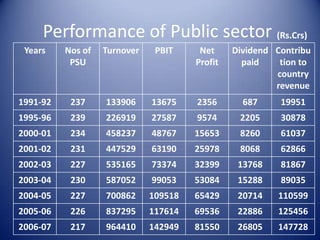

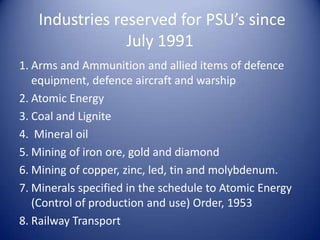

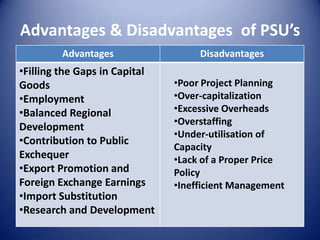

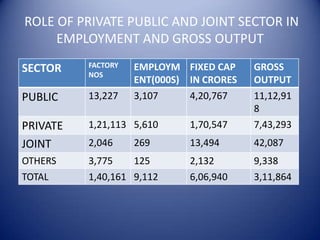

1) Public sector undertakings (PSUs) are government-owned corporations established to promote economic development, generate financial resources, and create employment opportunities.

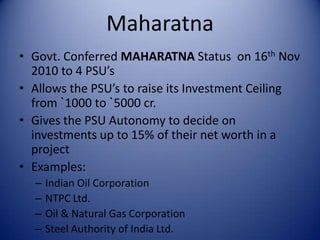

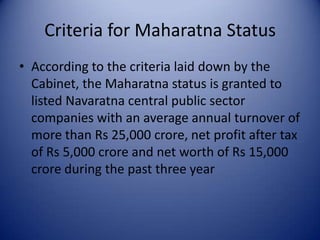

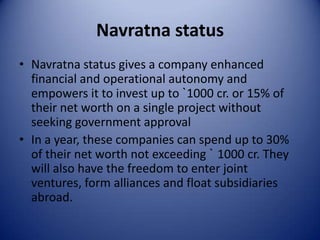

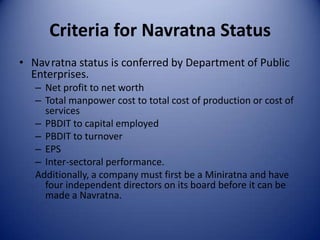

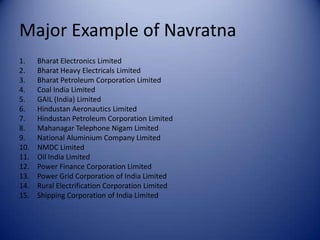

2) PSUs are divided into three categories based on autonomy - Maharatna have the most autonomy, followed by Navratna, and then Miniratna.

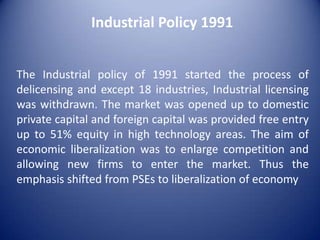

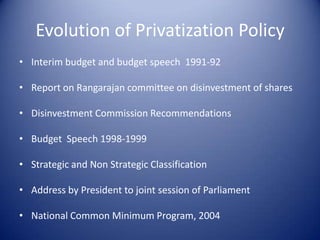

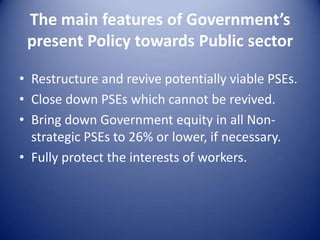

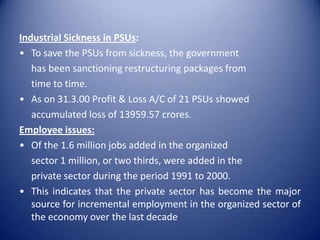

3) While PSUs helped achieve important social and economic goals, they have also faced issues like poor planning, overstaffing, and inefficiency. This has led the government to pursue policies like disinvestment and privatization to improve performance.