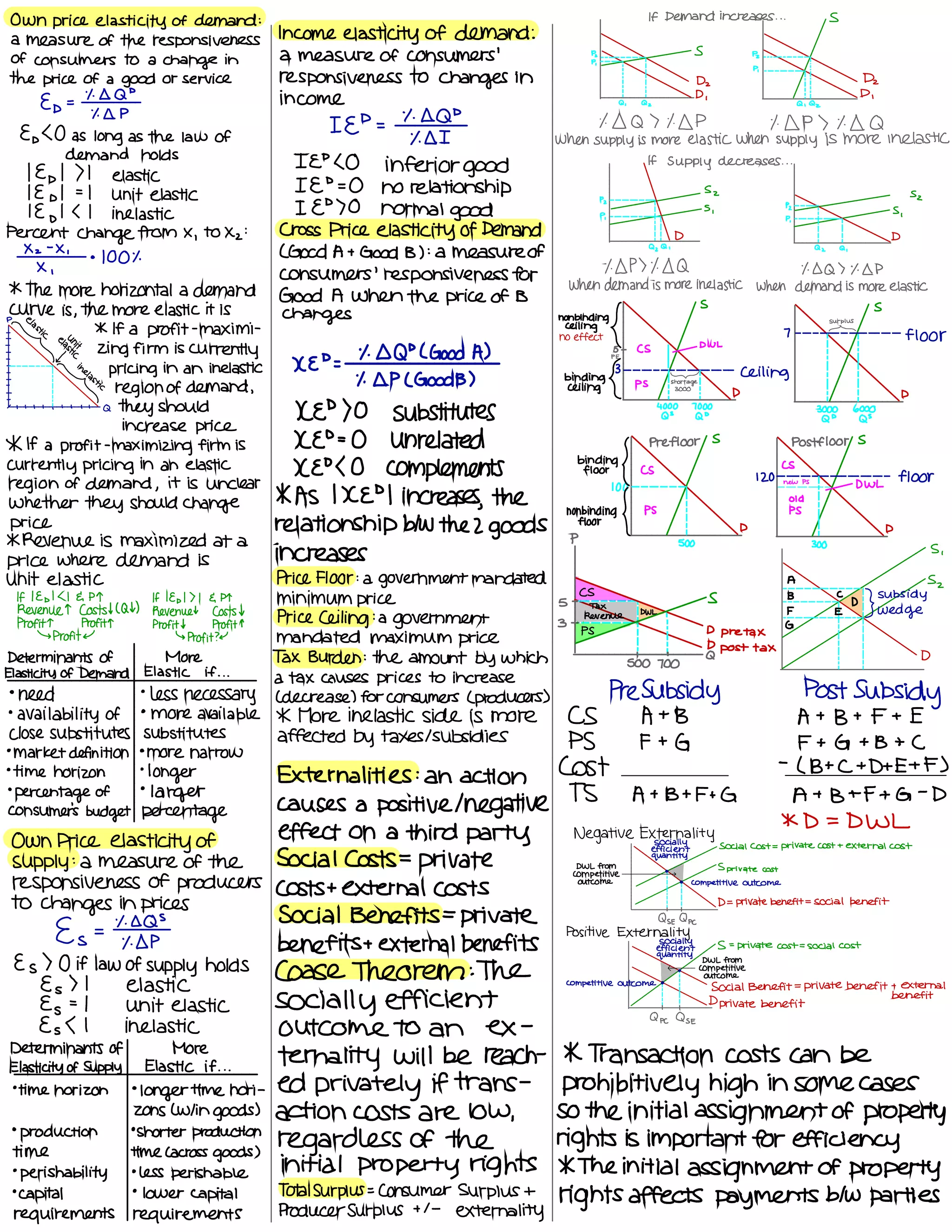

Own price elasticity of demand measures how responsive consumers are to changes in the price of a good. Income elasticity of demand measures responsiveness to changes in consumer income. Supply elasticity measures producer responsiveness to price changes. More inelastic sides of demand and supply curves are more affected by taxes and subsidies. Externalities occur when an action imposes positive or negative effects on a third party not involved in the primary transaction.