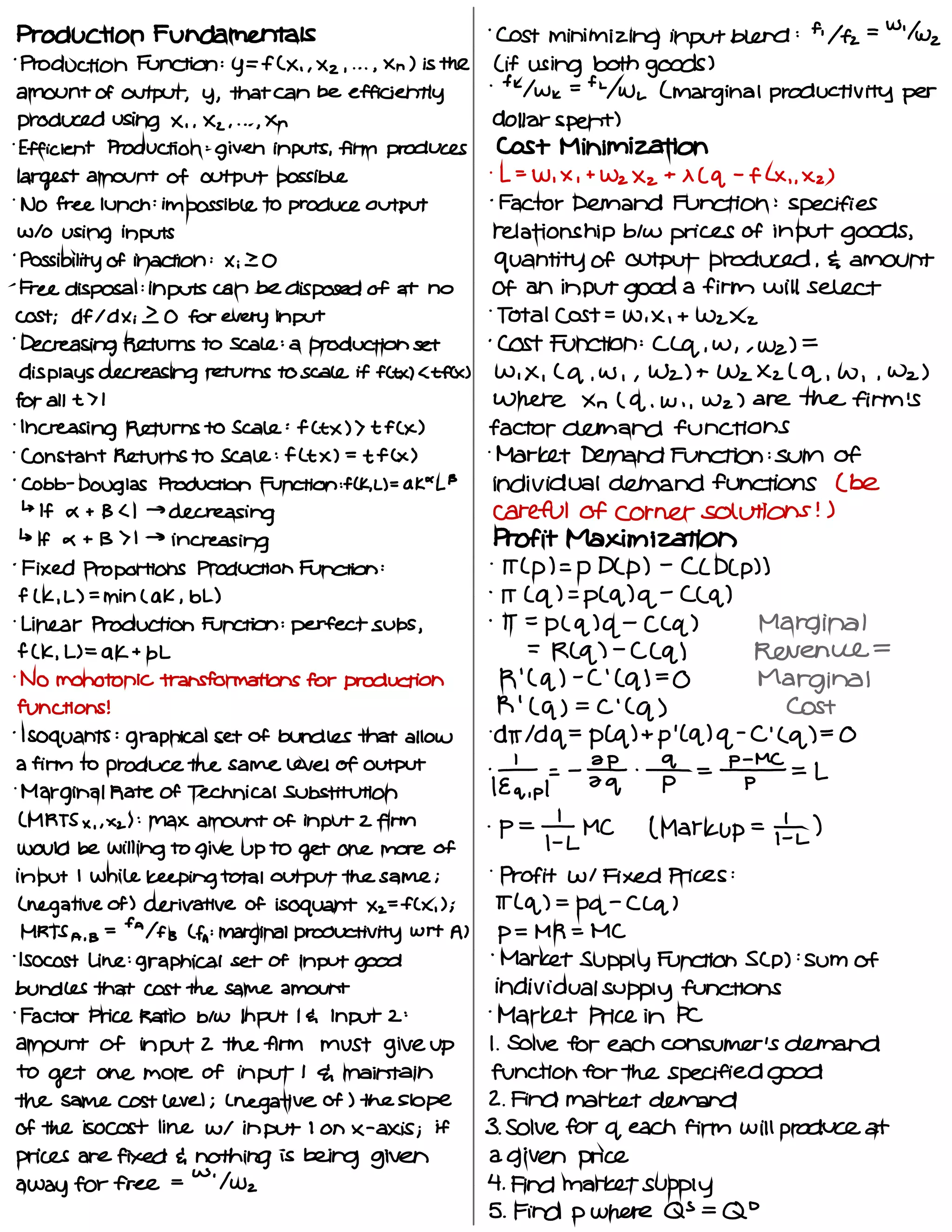

1. The optimal input blend is where the marginal productivity per dollar spent is equal for all inputs.

2. A production function specifies the maximum output possible from different combinations of inputs.

3. A cost minimizing firm will produce at the input levels where the marginal costs of each input are equal to its price.