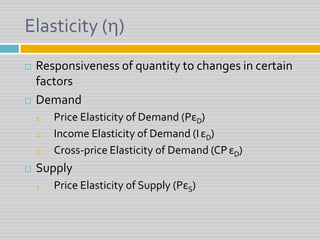

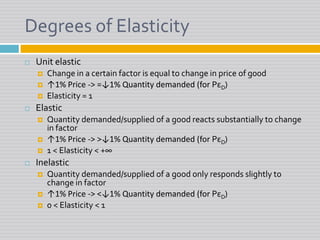

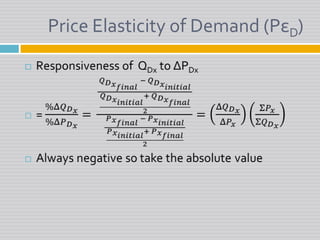

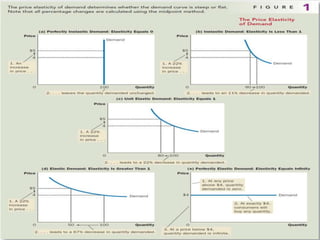

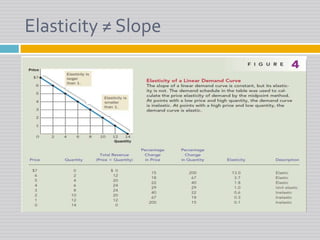

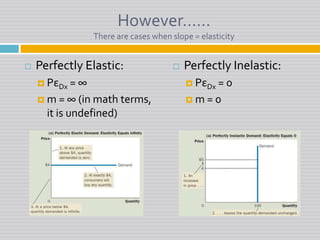

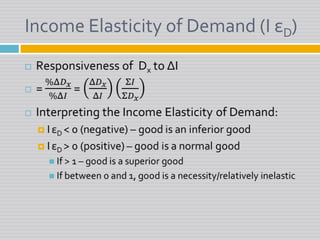

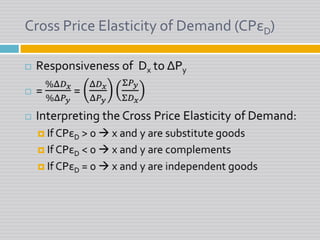

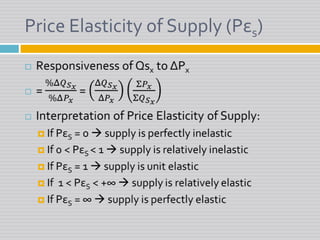

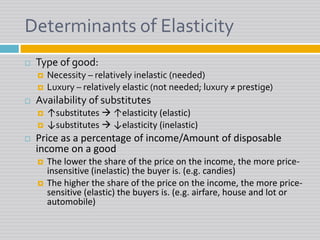

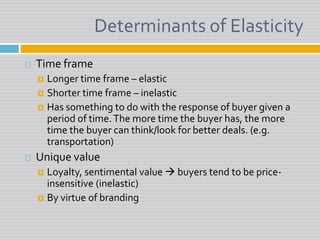

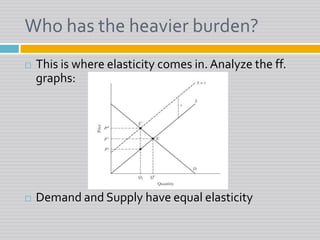

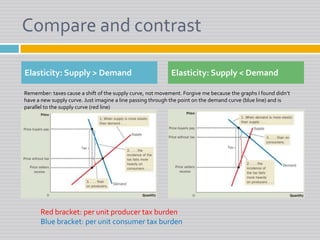

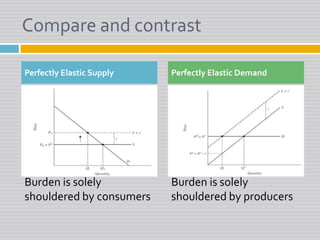

This document provides a summary of key concepts relating to elasticity, including definitions of price elasticity of demand, income elasticity of demand, cross-price elasticity of demand, and price elasticity of supply. It discusses factors that determine elasticity such as type of good, availability of substitutes, and time frame. The document also explains tax incidence and how the burden of a tax is related to the elasticity of supply and demand, with the group with the more inelastic curve shouldering more of the tax burden.