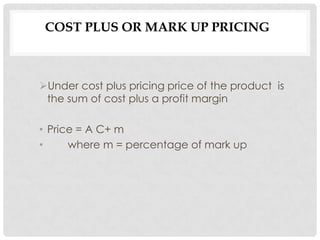

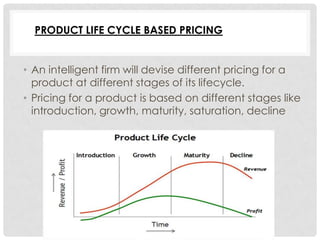

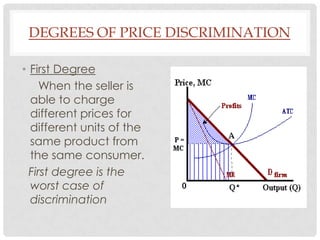

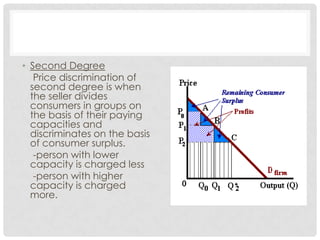

The document discusses various pricing strategies and determinants of price. It covers cost-based pricing approaches like cost-plus pricing and marginal cost pricing. It also discusses competition-based pricing strategies like penetration pricing. Other topics include product life cycle pricing, price discrimination, export pricing, and peak load pricing. The key factors that influence pricing decisions are the degree of competition, objectives of the firm, costs of production, demand in the market, and supply of the product.