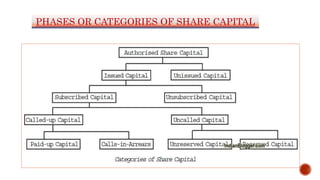

The document discusses the different categories of share capital for a company:

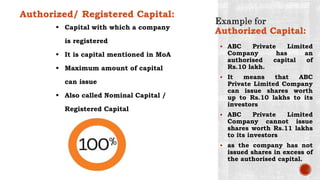

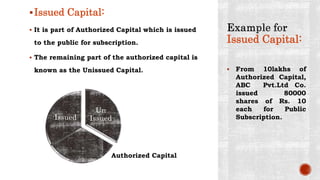

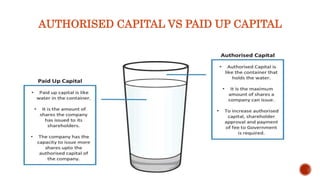

1) Authorized capital is the maximum capital that a company is permitted to issue according to its memorandum of association.

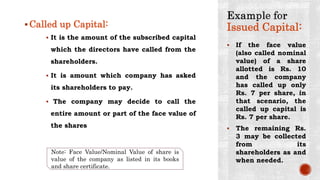

2) Issued capital is the part of authorized capital that has been issued for public subscription.

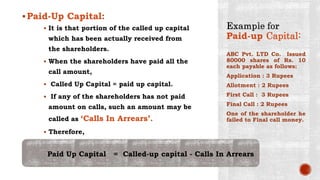

3) Paid-up capital is the portion of the issued capital that has been received from shareholders based on their obligations to pay. It represents the capital currently held by the company.