This document summarizes Eni's preliminary fourth quarter and full year 2011 results. Key highlights include:

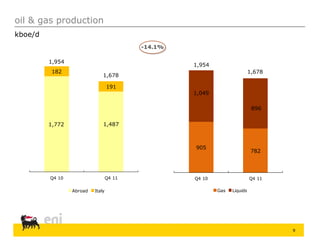

- Oil and gas production of 1.95 million barrels of oil equivalent per day for Q4 2011, down 14% from the previous year.

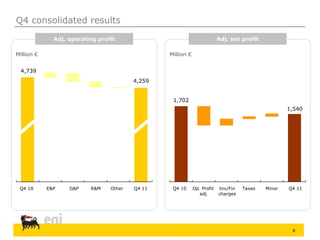

- Adjusted net profit of €1.47 billion for Q4 2011, down 8.5% from the previous year.

- Exploration successes in countries such as Angola, Ghana, Mozambique, and Norway that added 1.1 billion barrels of oil equivalent of new resources.

- Quick restart of Libyan production after the crisis, with output almost back to pre-crisis levels.