This presentation provides an overview of Magnesita Refratários S.A. to investors covering the following key points:

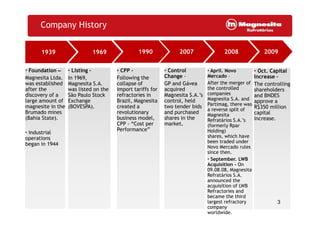

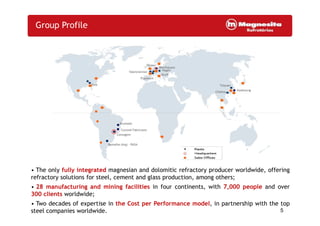

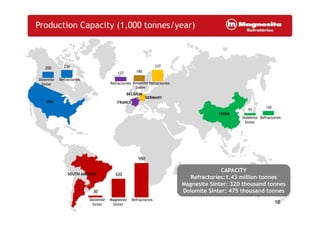

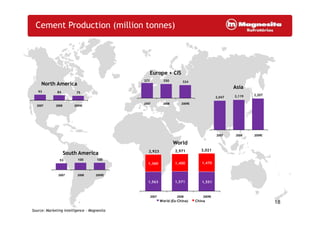

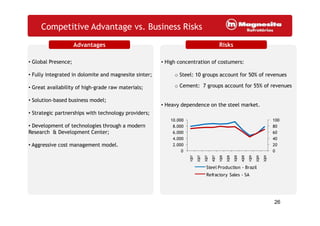

- Company history dating back to 1939 with operations in 28 countries across four continents.

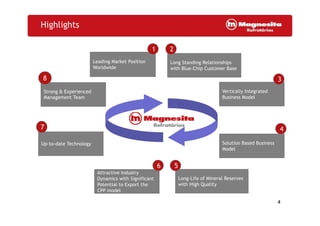

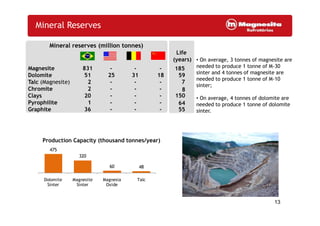

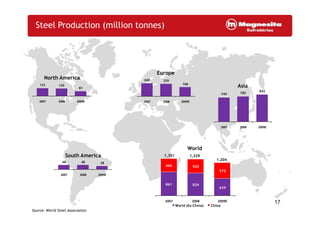

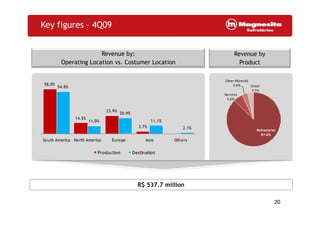

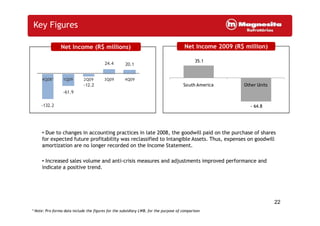

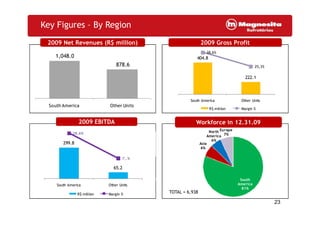

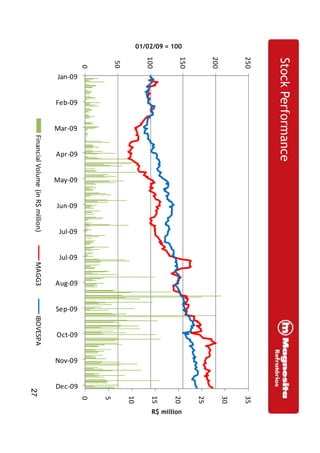

- Highlights of 2009 results including leading market position, vertically integrated business model, experienced management, and long-term mineral reserves.

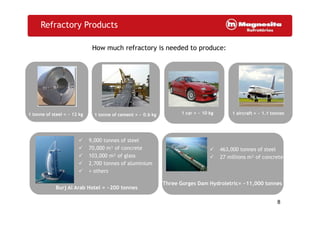

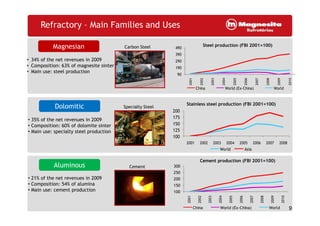

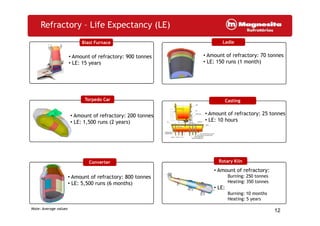

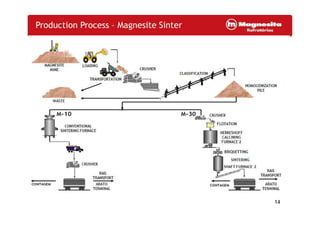

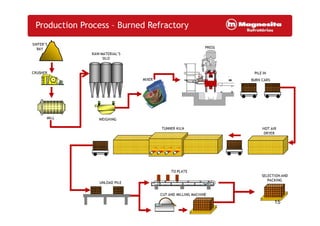

- Refractory product segments including magnesian and dolomitic products used mainly in steel production.

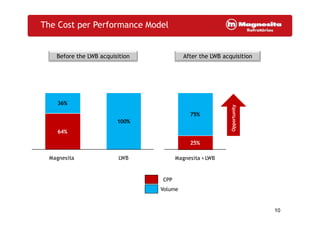

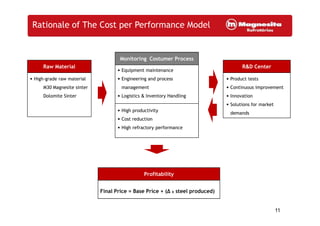

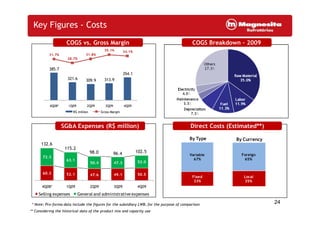

- "Cost per Performance" business model implemented following an acquisition to improve productivity and profitability.

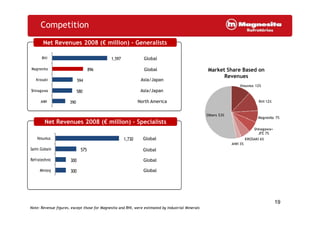

- Regional production capacity and reserves as well as market share compared to main competitors.

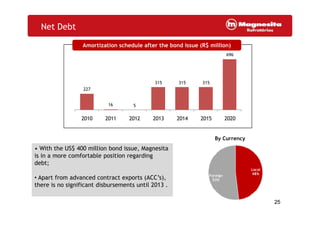

- Key financial figures for 2009 showing recovery from prior year including