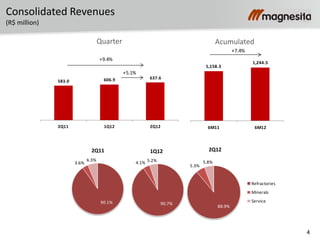

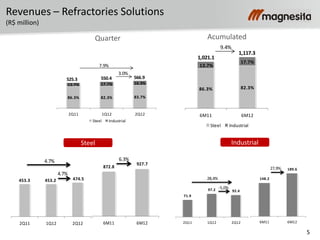

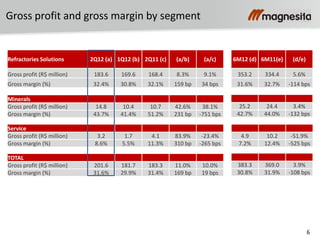

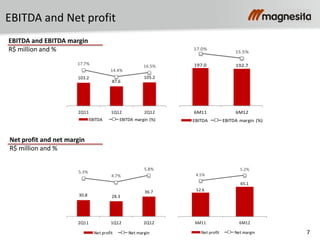

Magnesita reported strong financial results in the second quarter of 2012 compared to both the previous quarter and the same quarter of the previous year. Revenues increased 5.1% quarter-over-quarter and 9.4% year-over-year. Gross margins improved across all business segments due to exchange rate effects and performance gains. EBITDA grew 20.1% quarter-over-quarter and was slightly higher than the previous year despite a one-time reversal of expenses in 2011. Net profit increased 29.7% from the prior quarter and 19.4% from the previous year.