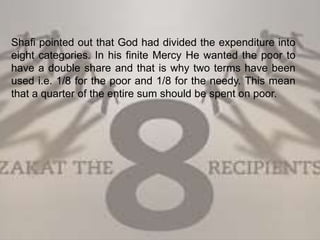

The document discusses the economic aspects of early Islamic society, focusing on the institution of zakah as a mandatory almsgiving and the means of livelihood for Prophet Muhammad (pbuh) after the migration to Madinah. It also elaborates on the distribution classifications of zakah for various categories of the needy, including the poor, debtors, and travelers, while touching on the historical evolution of the Islamic lunar calendar. The document highlights the challenges and adaptations made in taxation and calendar systems to suit the agricultural needs of the Muslim community.