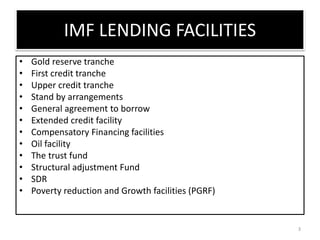

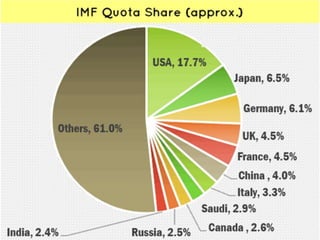

The document provides an overview of the various lending facilities offered by the International Monetary Fund (IMF). It discusses 12 main facilities including the Gold Reserve Tranche, First Credit Tranche, Upper Credit Tranche, Stand-By Arrangements, General Agreement to Borrow, Extended Credit Facility, Compensatory Financing Facilities, Oil Facility, The Trust Fund, Structural Adjustment Fund, SDR, and Poverty Reduction and Growth Facilities. Each facility is briefly described in terms of its purpose, terms of lending such as interest rates and repayment periods, and eligibility criteria.