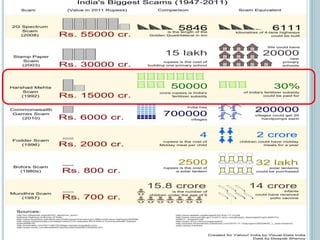

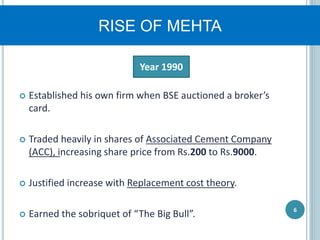

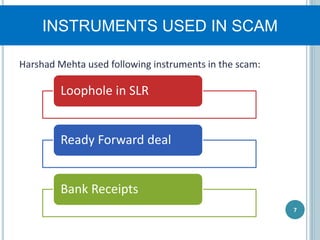

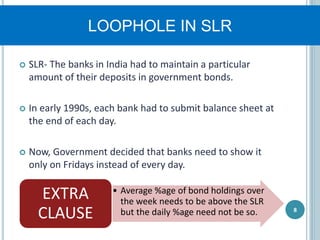

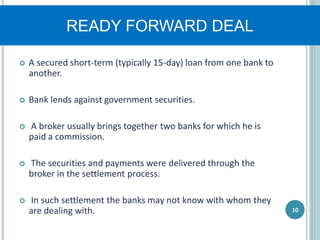

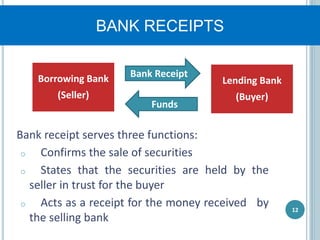

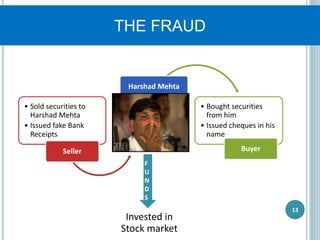

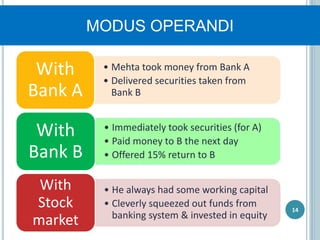

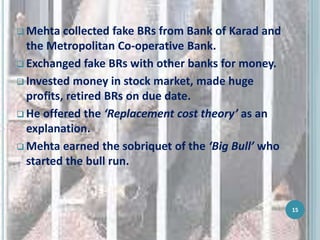

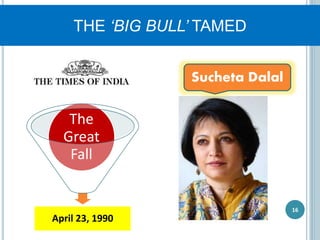

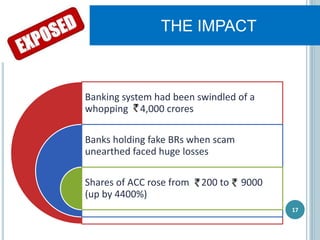

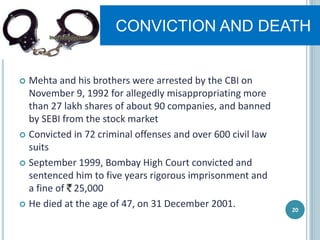

Harshad Mehta orchestrated a massive stock market fraud in India in the early 1990s by exploiting loopholes in the country's banking system. He issued fake bank receipts and used the funds to speculate in the stock market, driving share prices dramatically higher. When the scam was uncovered in 1992, it caused billions in losses and a crash in the stock market. Mehta was later convicted on criminal charges and died in 2001 while still facing civil lawsuits. The fraud led to regulatory reforms and stricter laws around disclosures and market oversight.