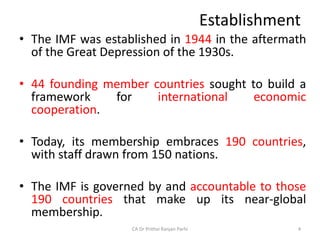

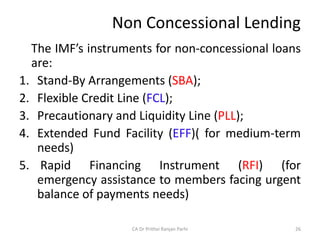

The document provides an overview of the International Monetary Fund (IMF). It discusses the IMF's establishment in 1944, mission to promote international monetary cooperation and financial stability, organizational structure, financing through member quotas, and lending activities. The IMF monitors members' economic policies and risks, provides policy advice and capacity development, and issues Special Drawing Rights (SDRs) to supplement official foreign exchange reserves. The IMF obtains its financial resources from member quotas as well as multilateral and bilateral borrowing agreements.