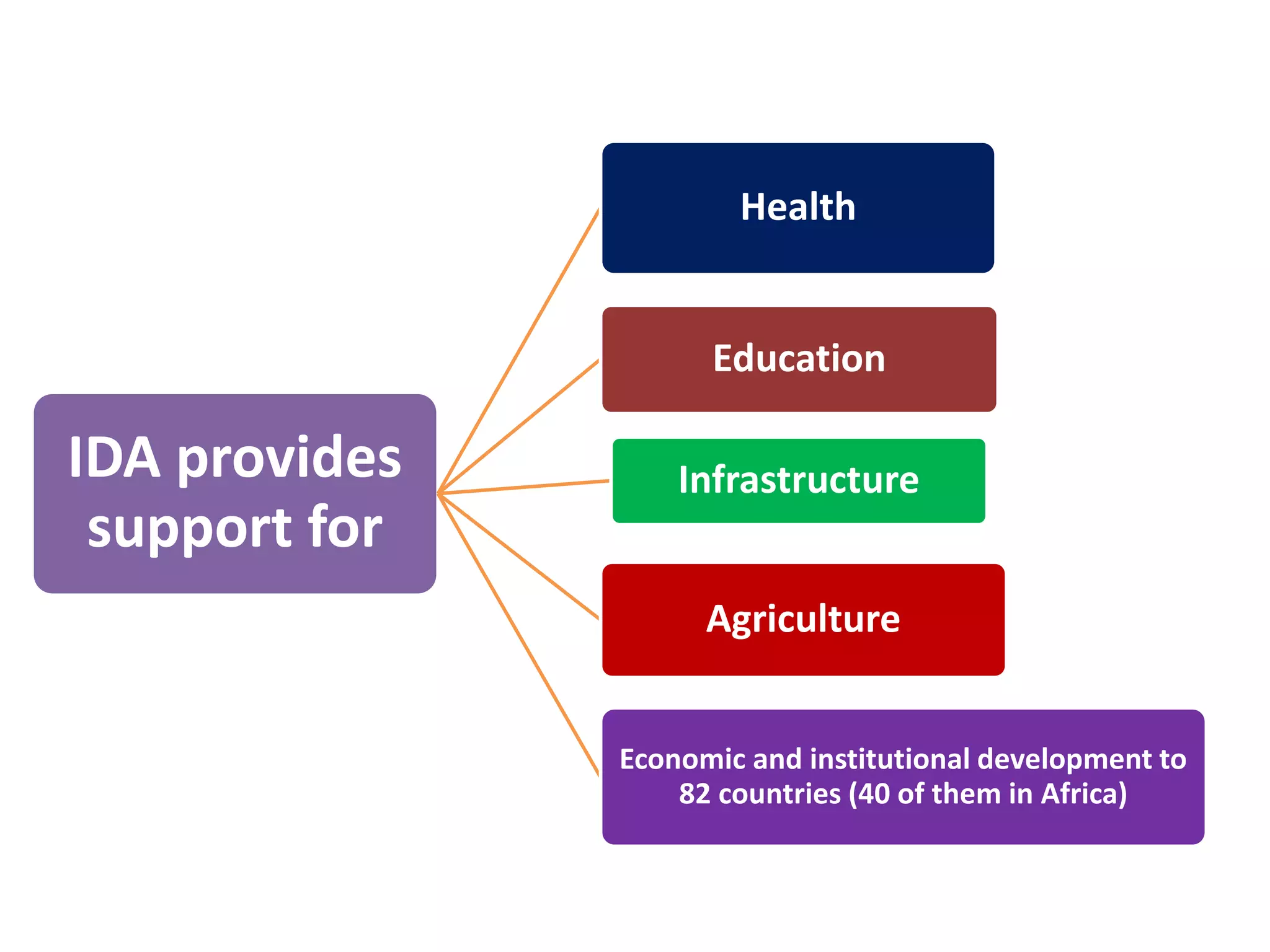

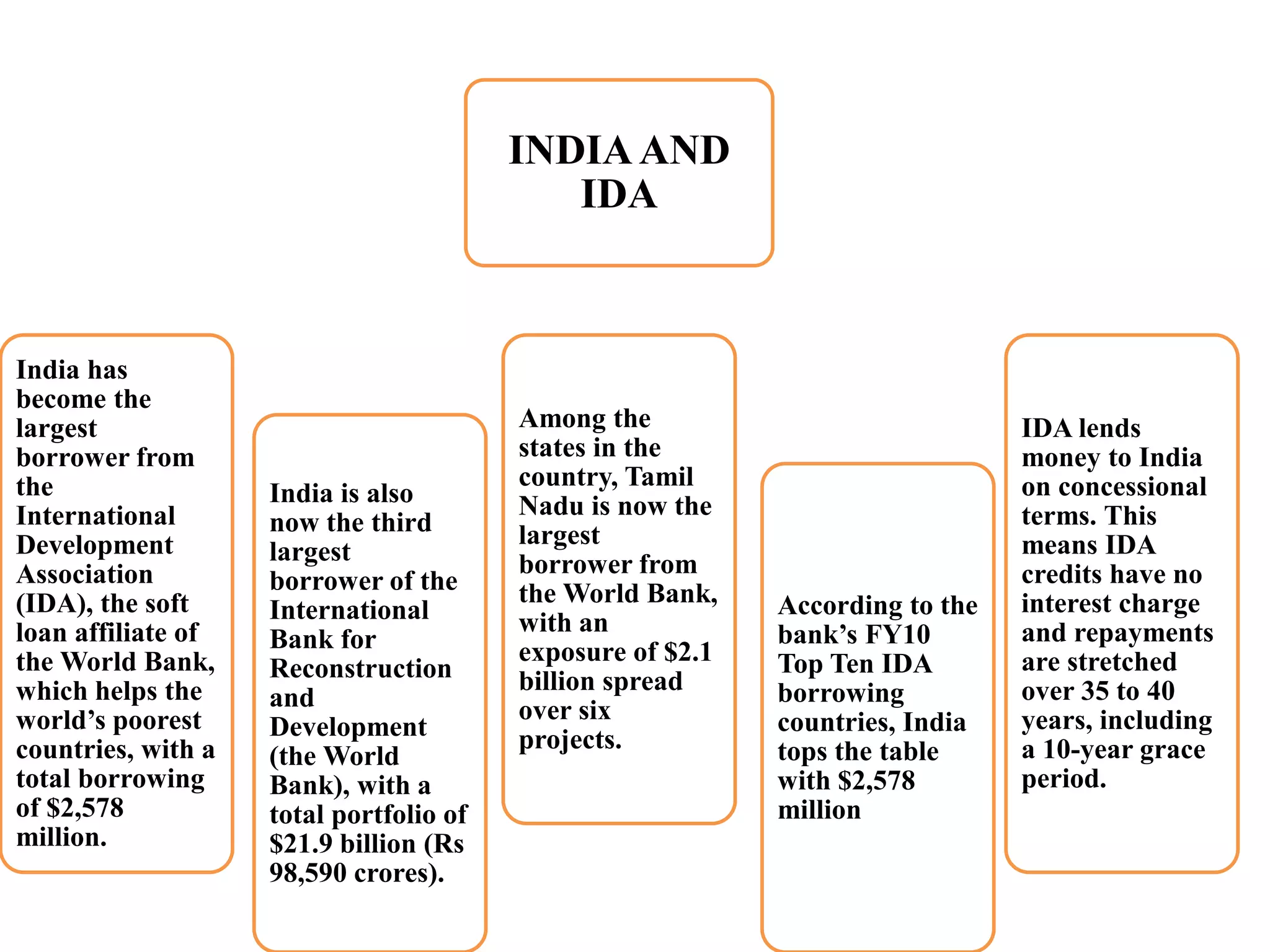

The International Development Association (IDA) was established in 1960 and is headquartered in Washington D.C. with 173 member countries. IDA provides concessional loans and grants to the world's poorest developing countries. IDA supports projects in areas like health, education, infrastructure, and agriculture in 82 countries, 40 of which are in Africa. IDA's goals are to reduce poverty and disparities within and across countries by providing long-term, low-interest loans to promote economic development and improve living standards. India is currently IDA's largest borrower, having received $2.578 billion in total from IDA.