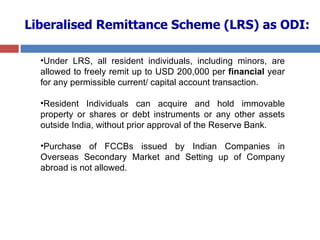

The document outlines the regulations and permissions regarding Overseas Direct Investment (ODI) for Indian residents, detailing how investments can be made in foreign entities, including joint ventures and wholly owned subsidiaries. It specifies general permissions allowing various forms of share acquisitions, the automatic investment routes allowed up to a certain percentage of net worth, and conditions for investing in specific sectors. Additionally, the circular includes provisions for different approval routes based on various investment scenarios and conditions, including limits and requirements for shares' valuation and transfer.