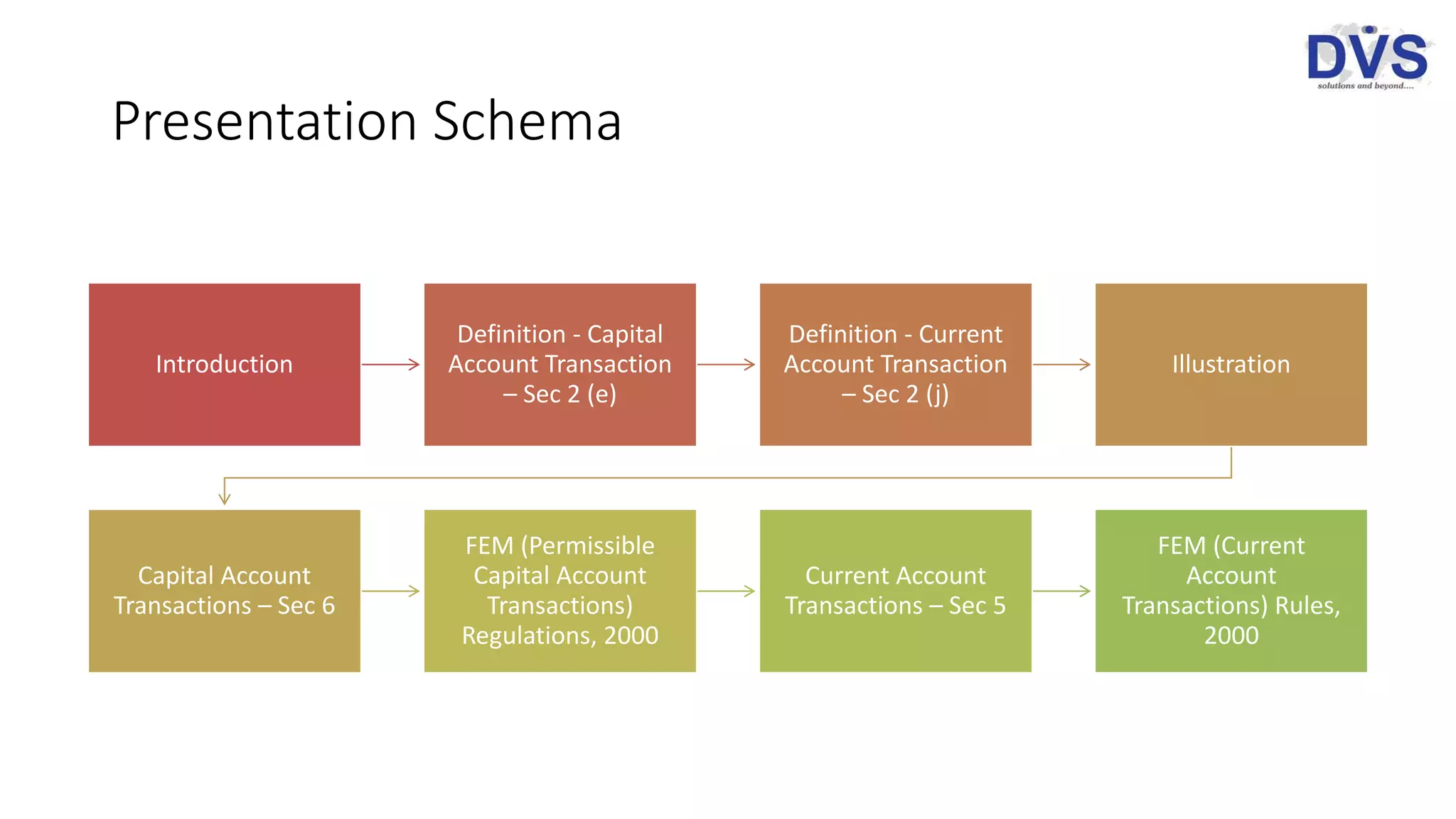

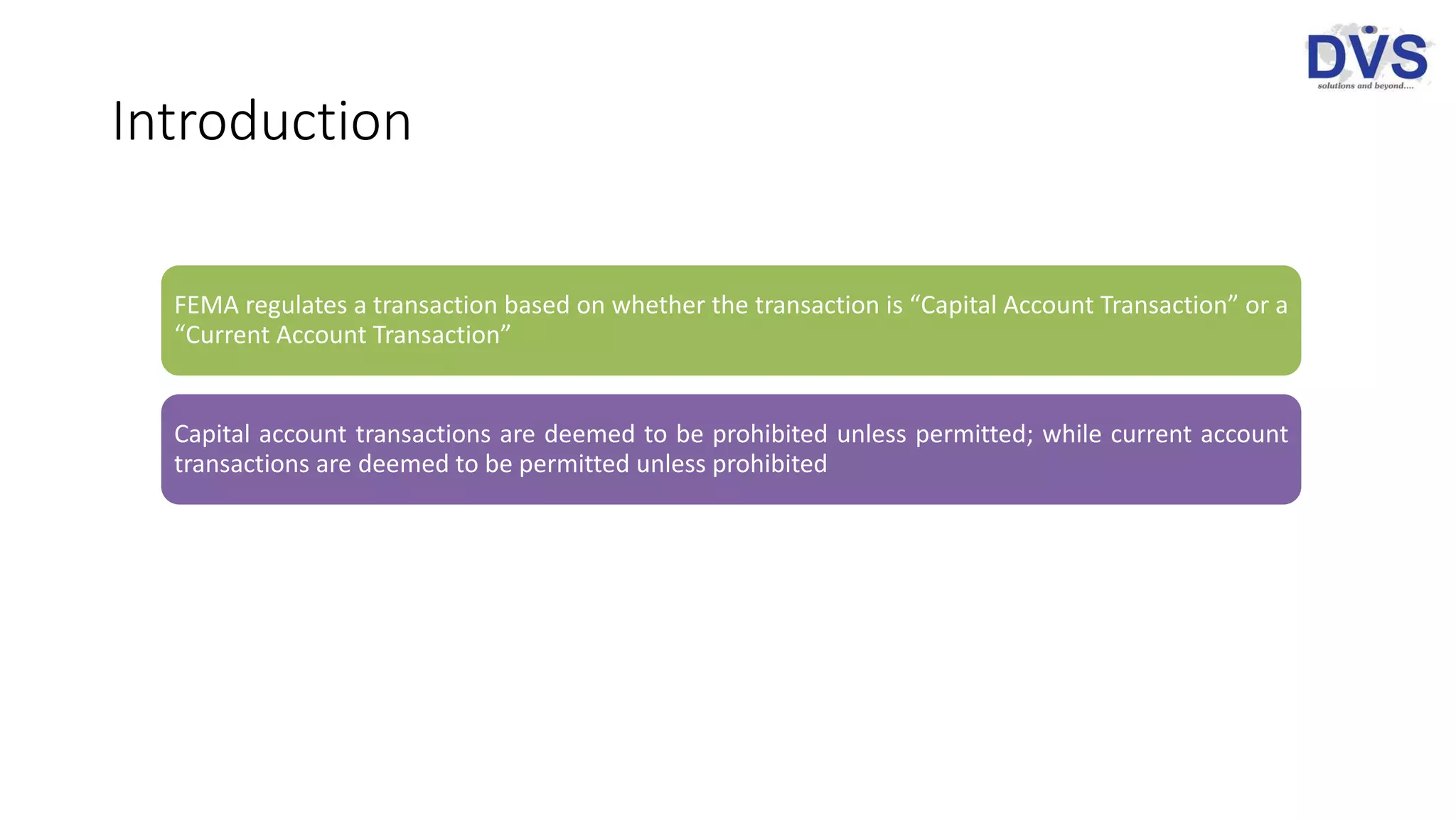

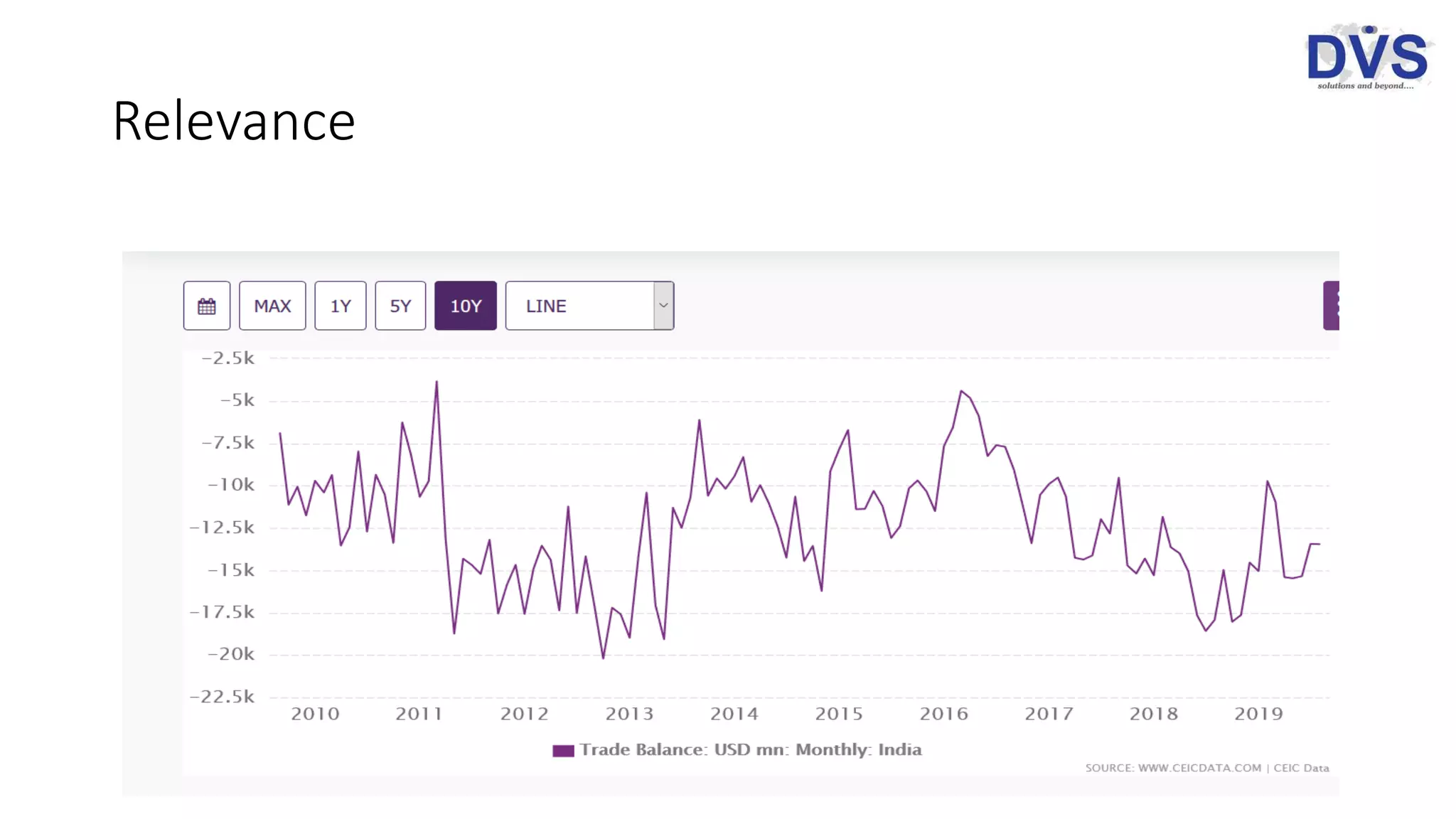

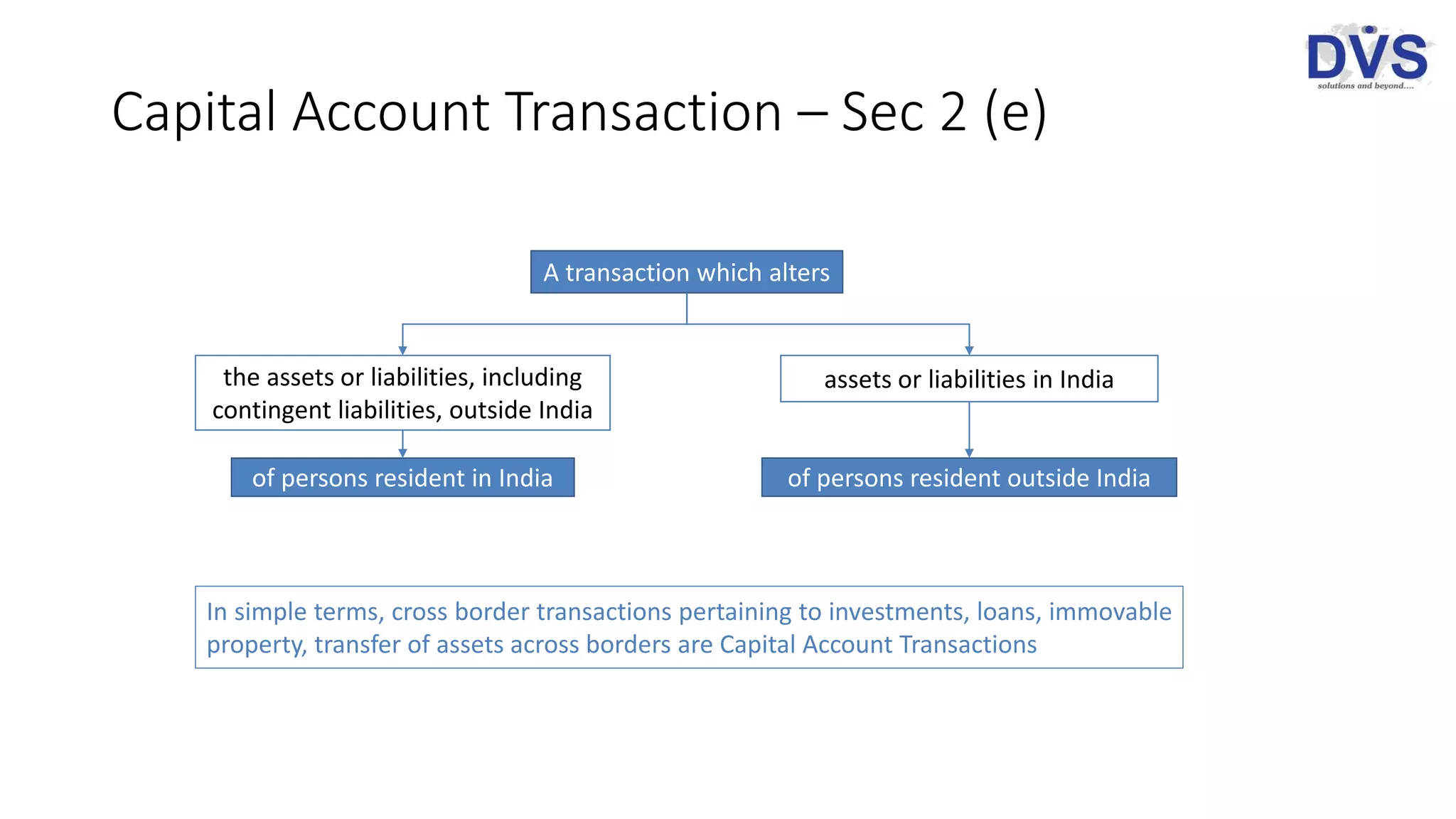

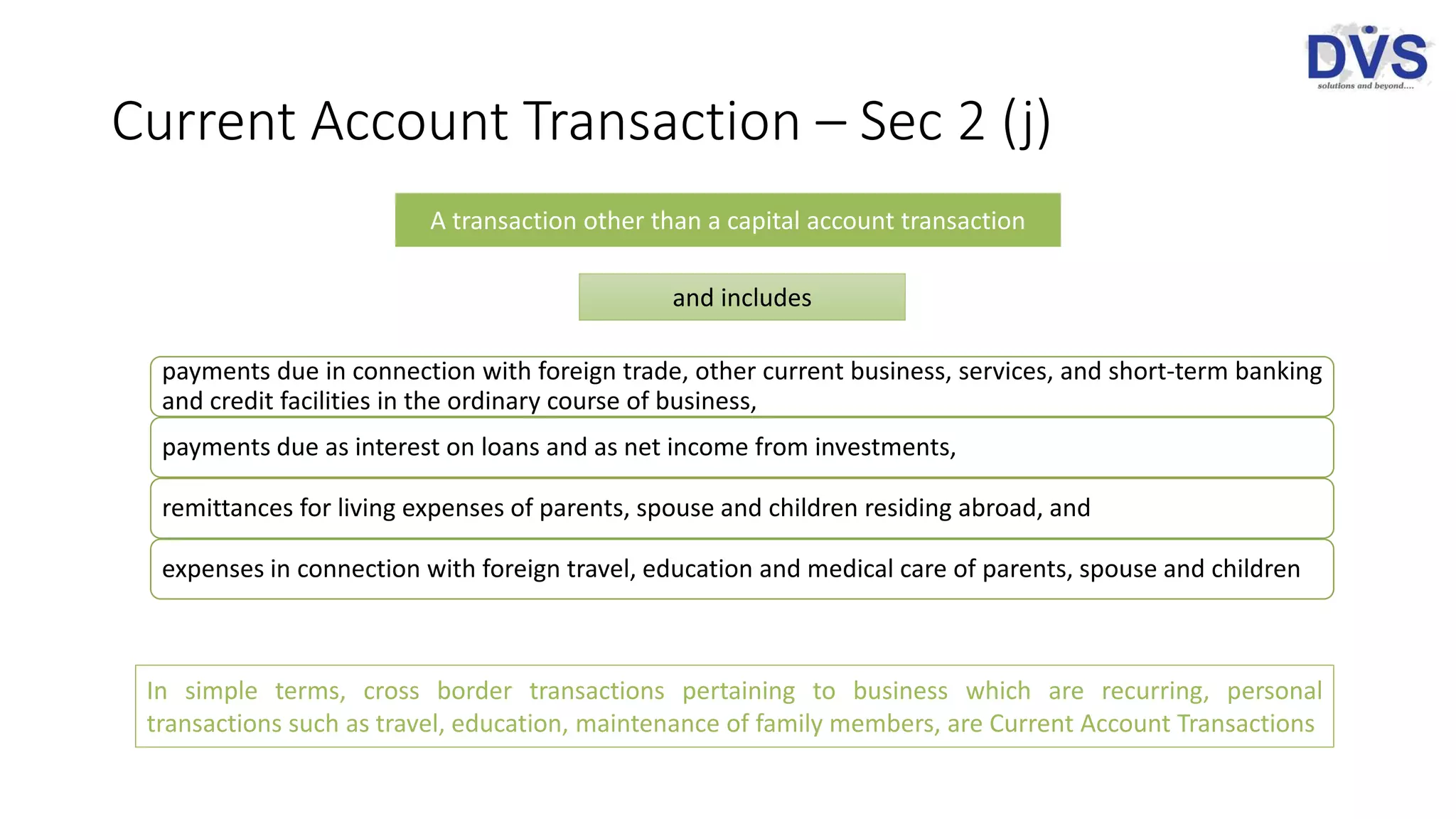

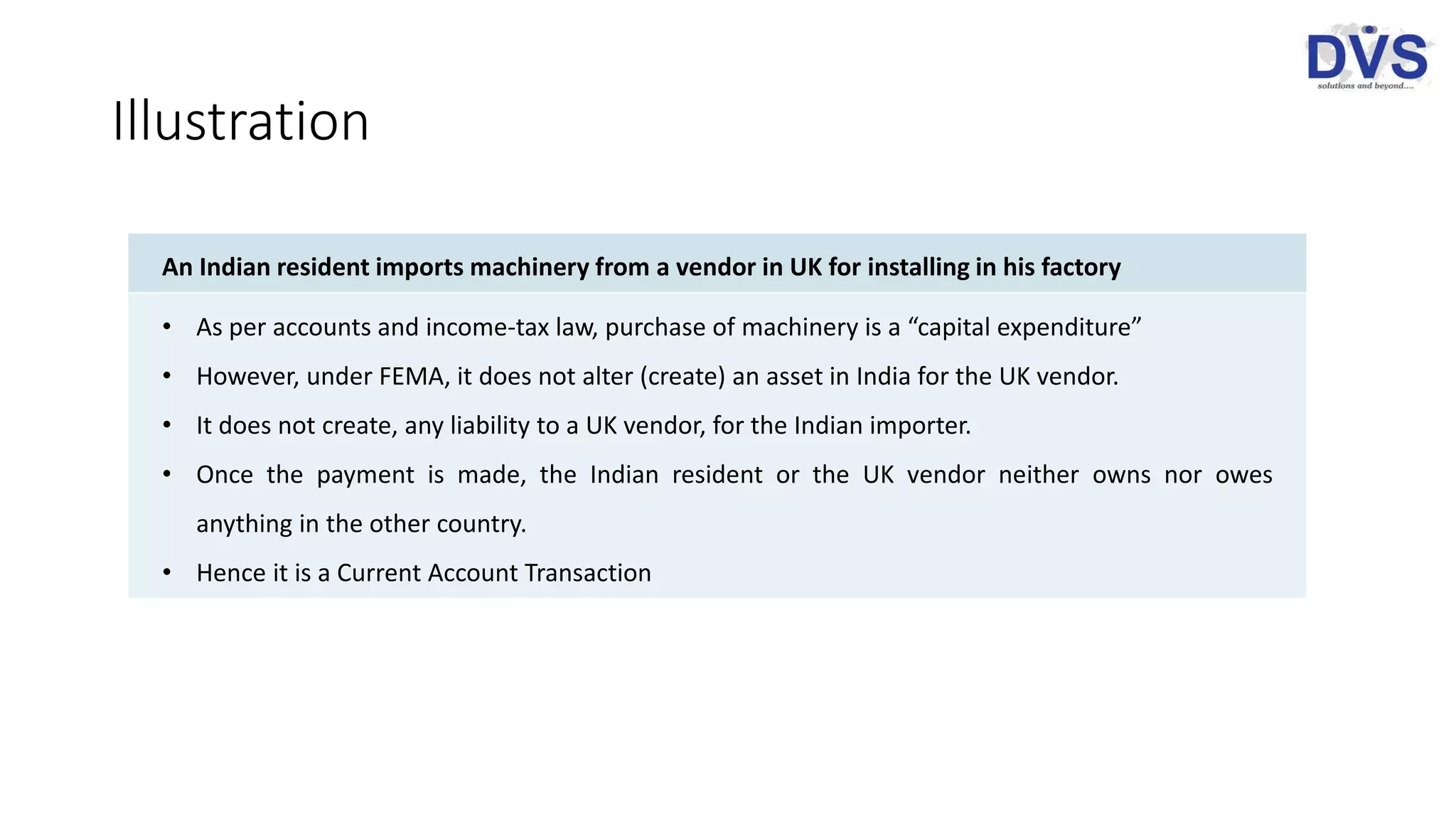

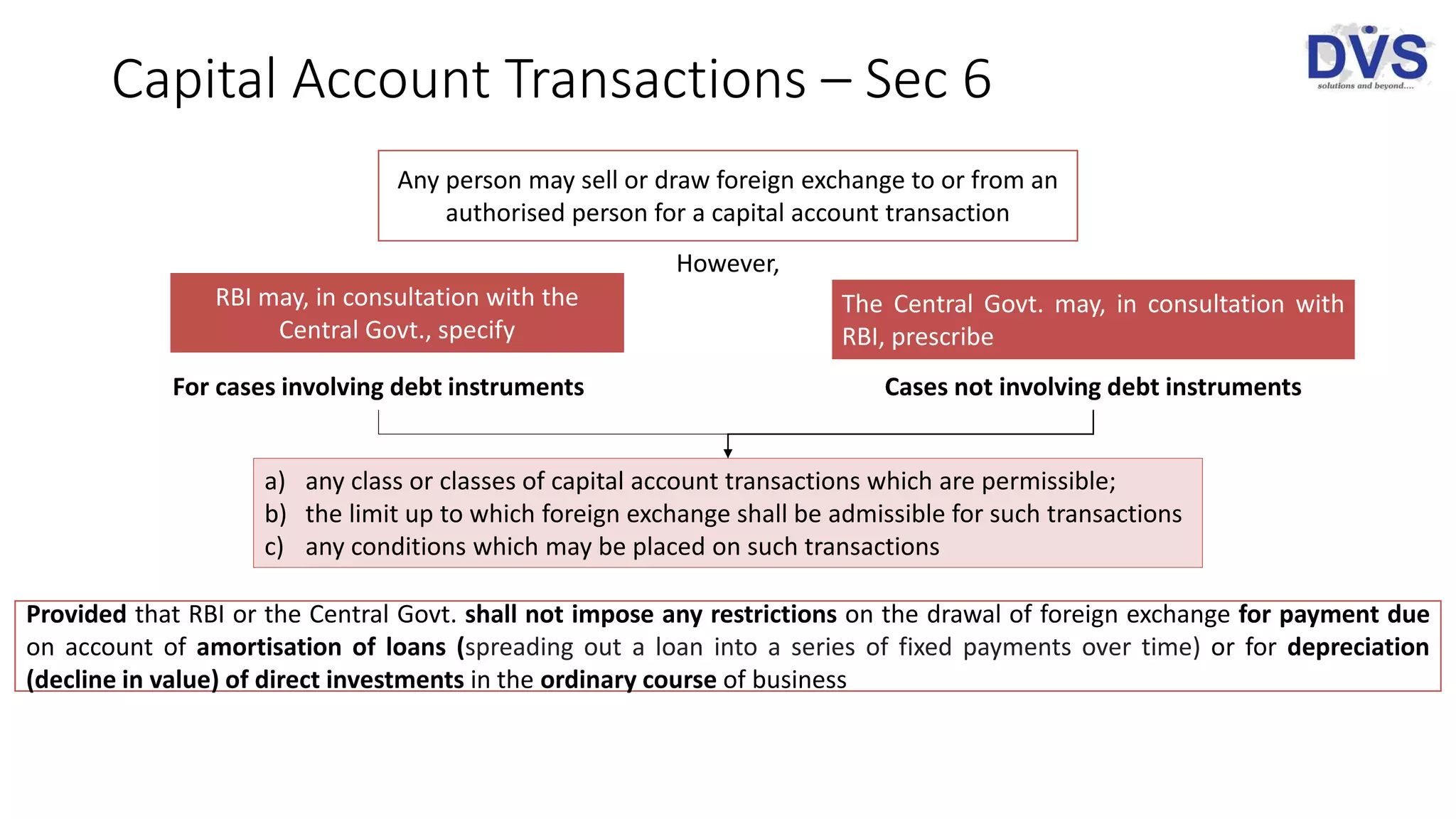

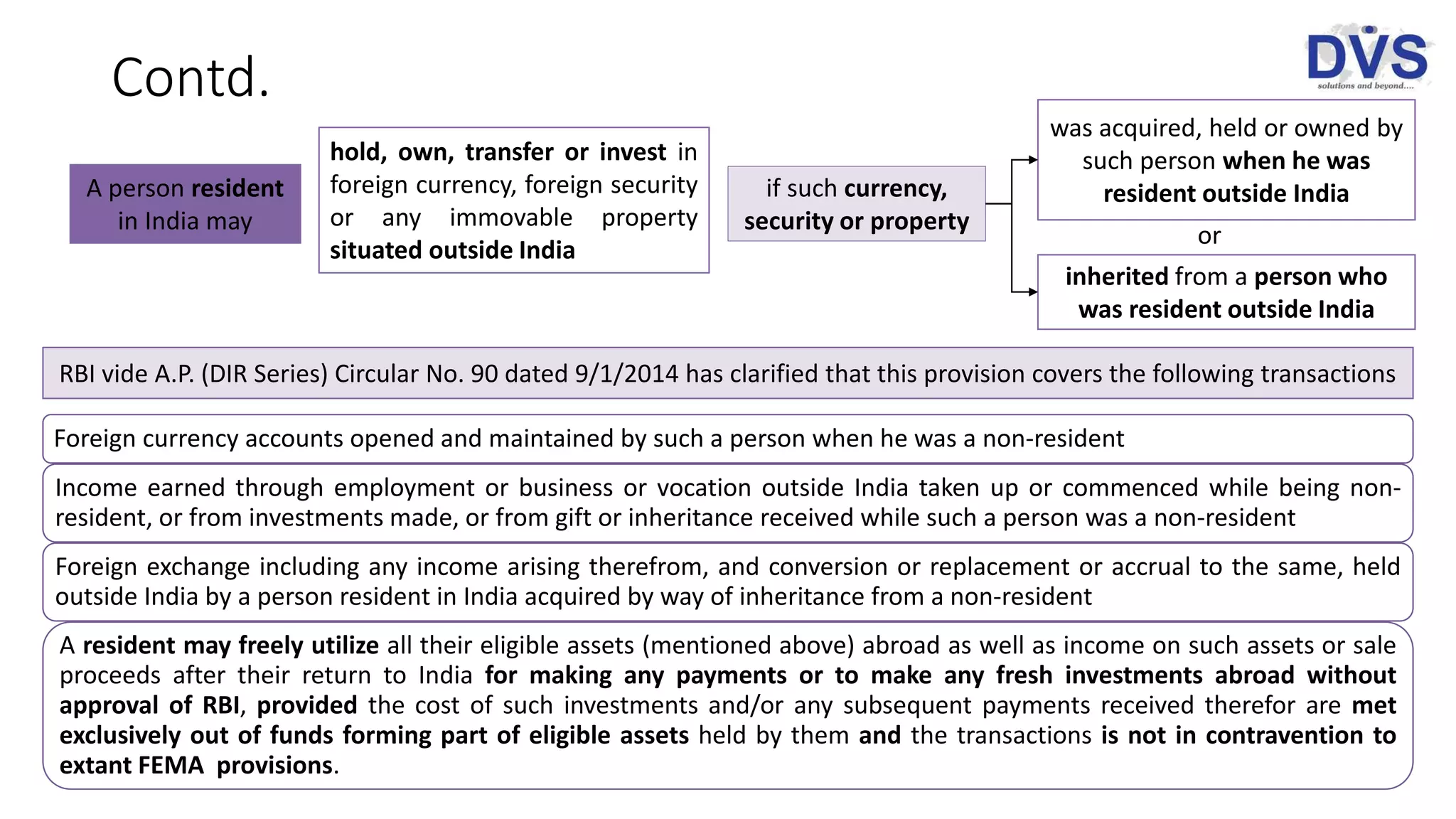

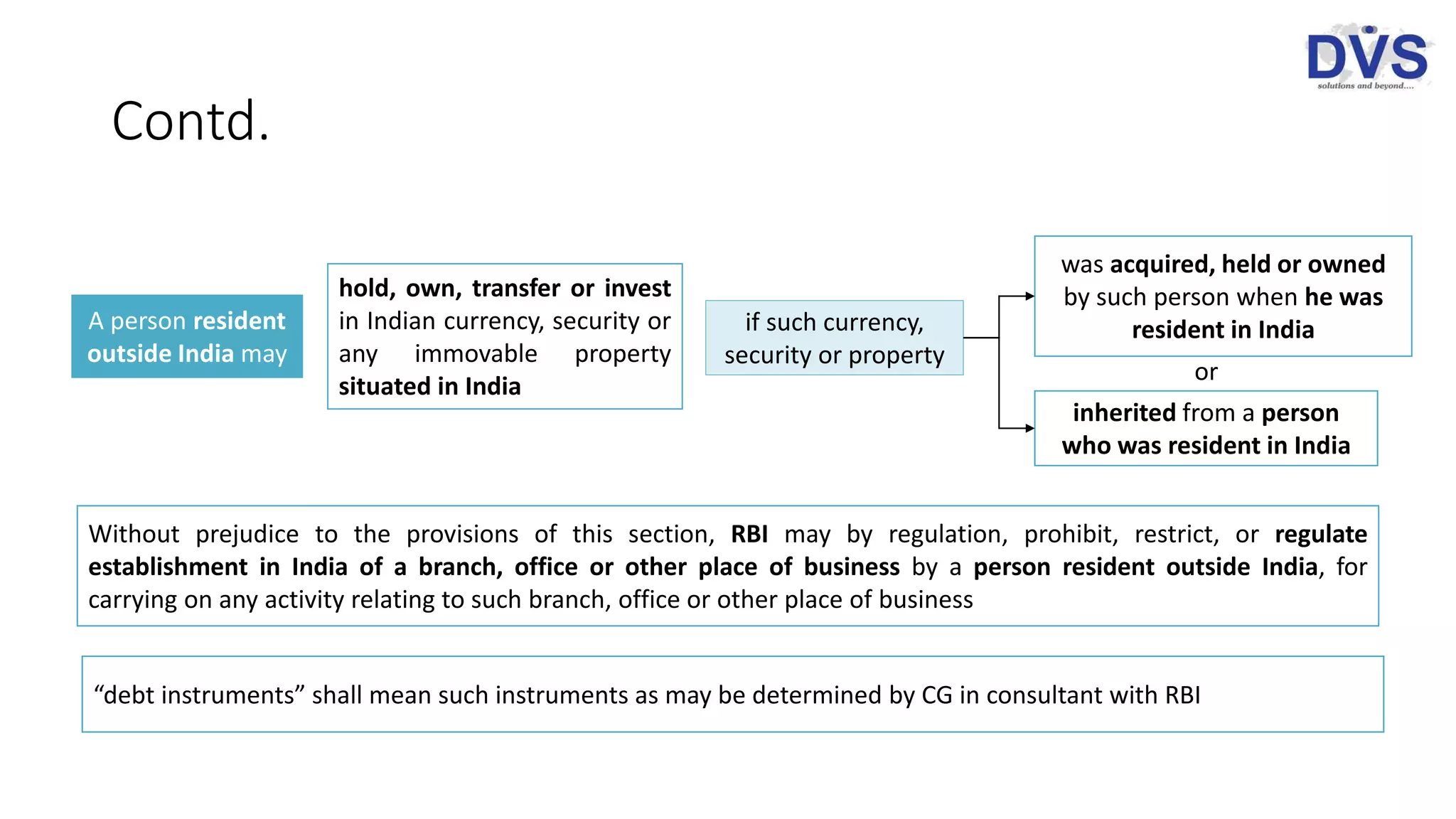

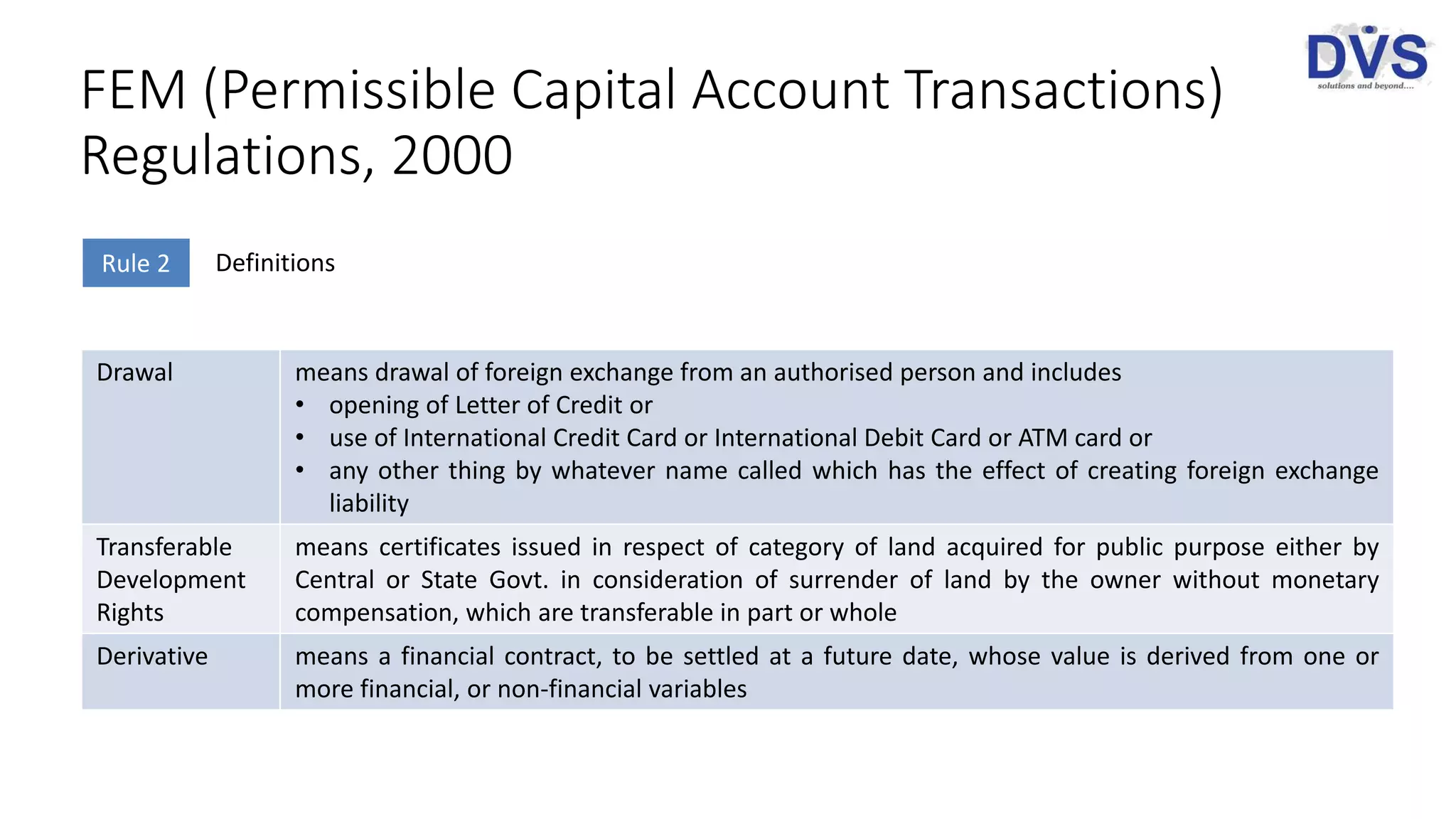

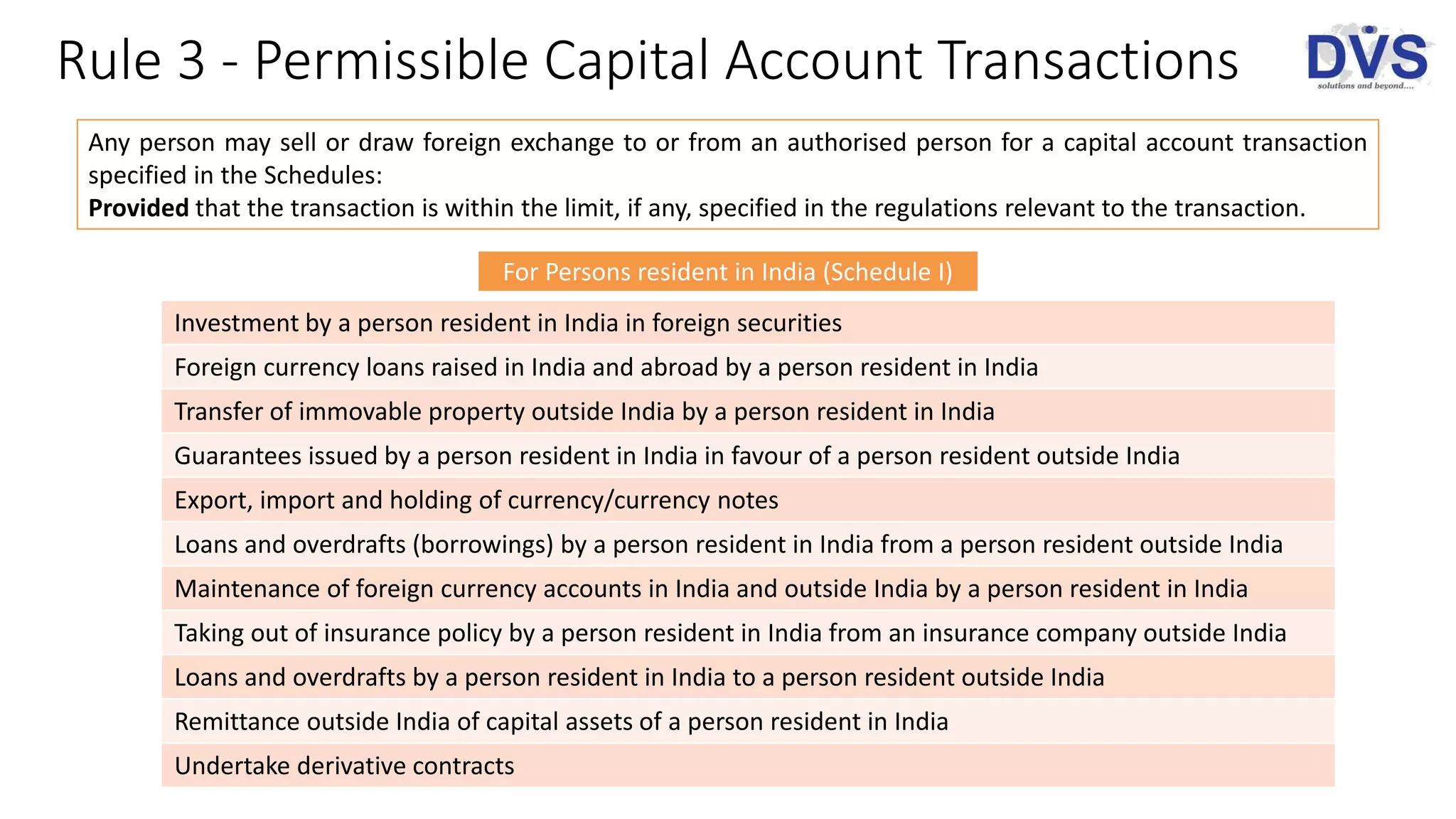

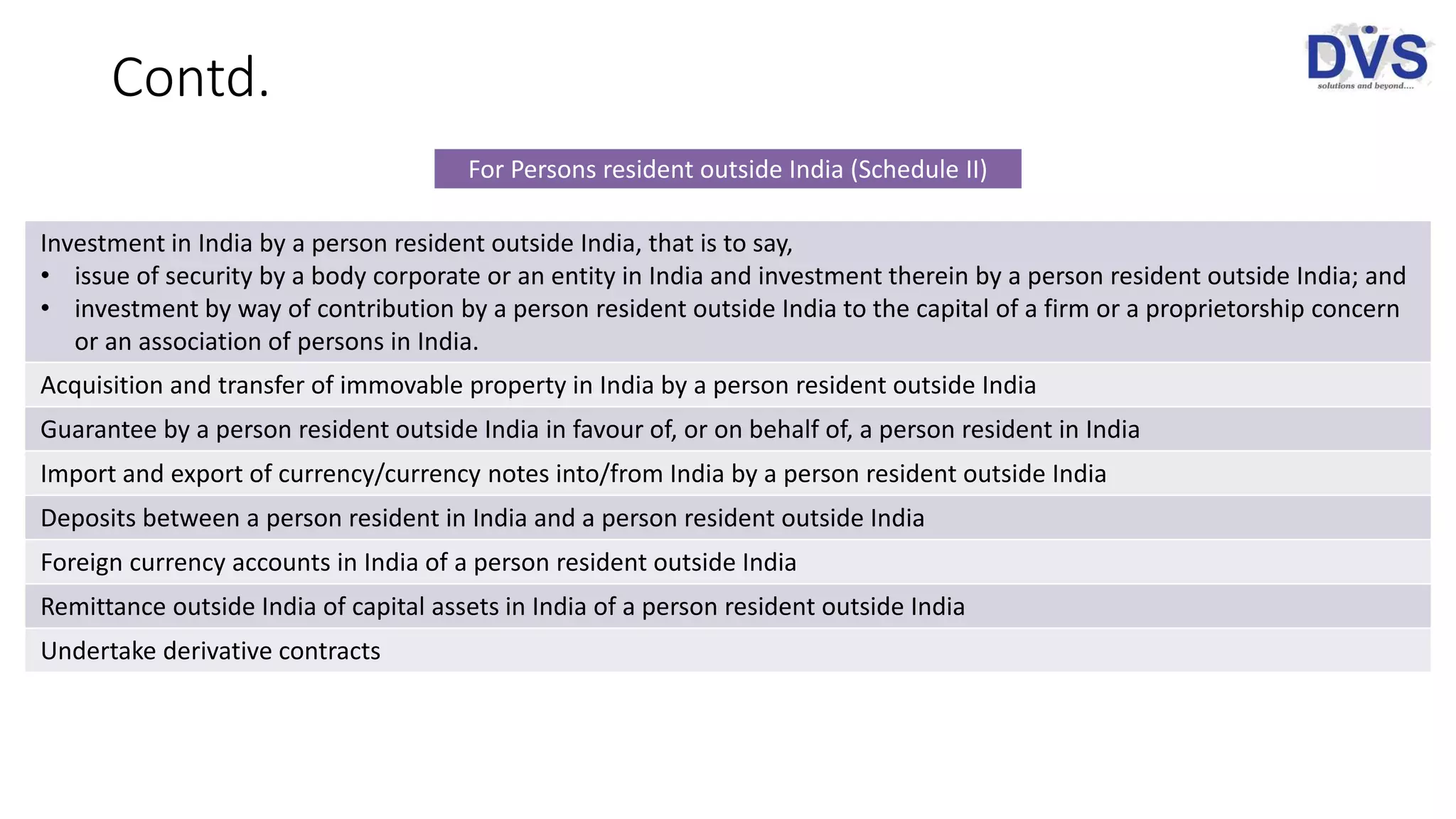

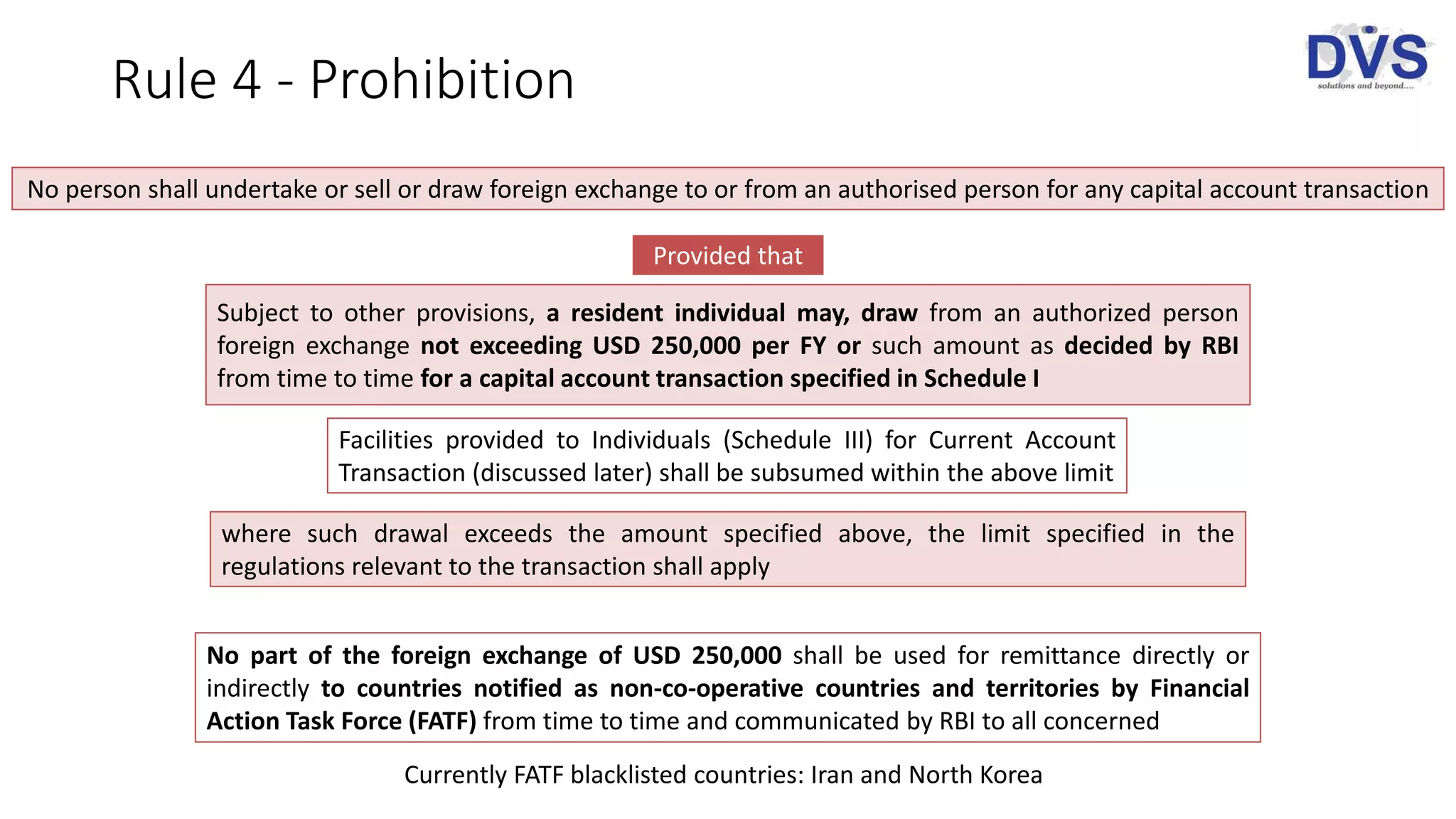

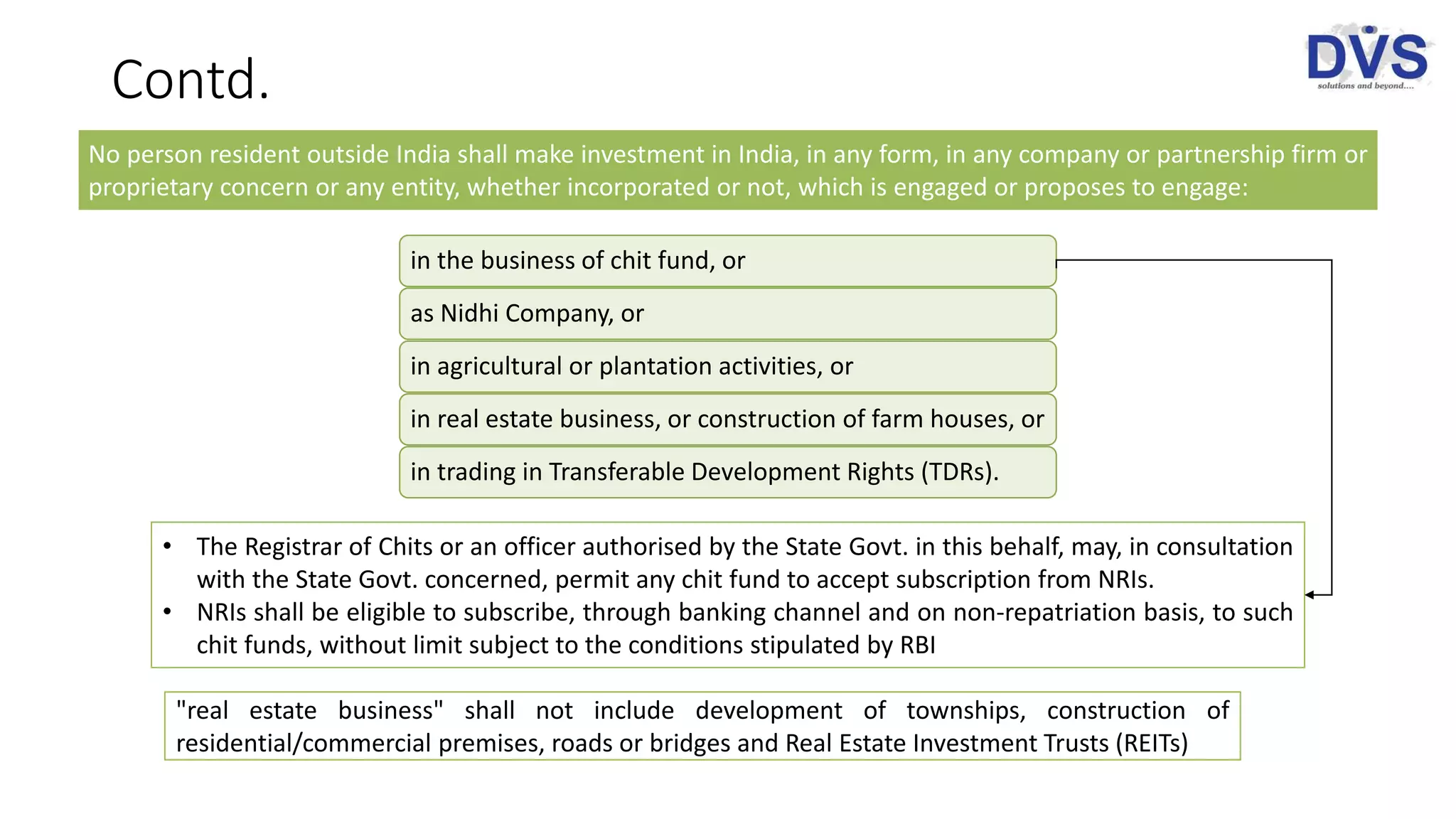

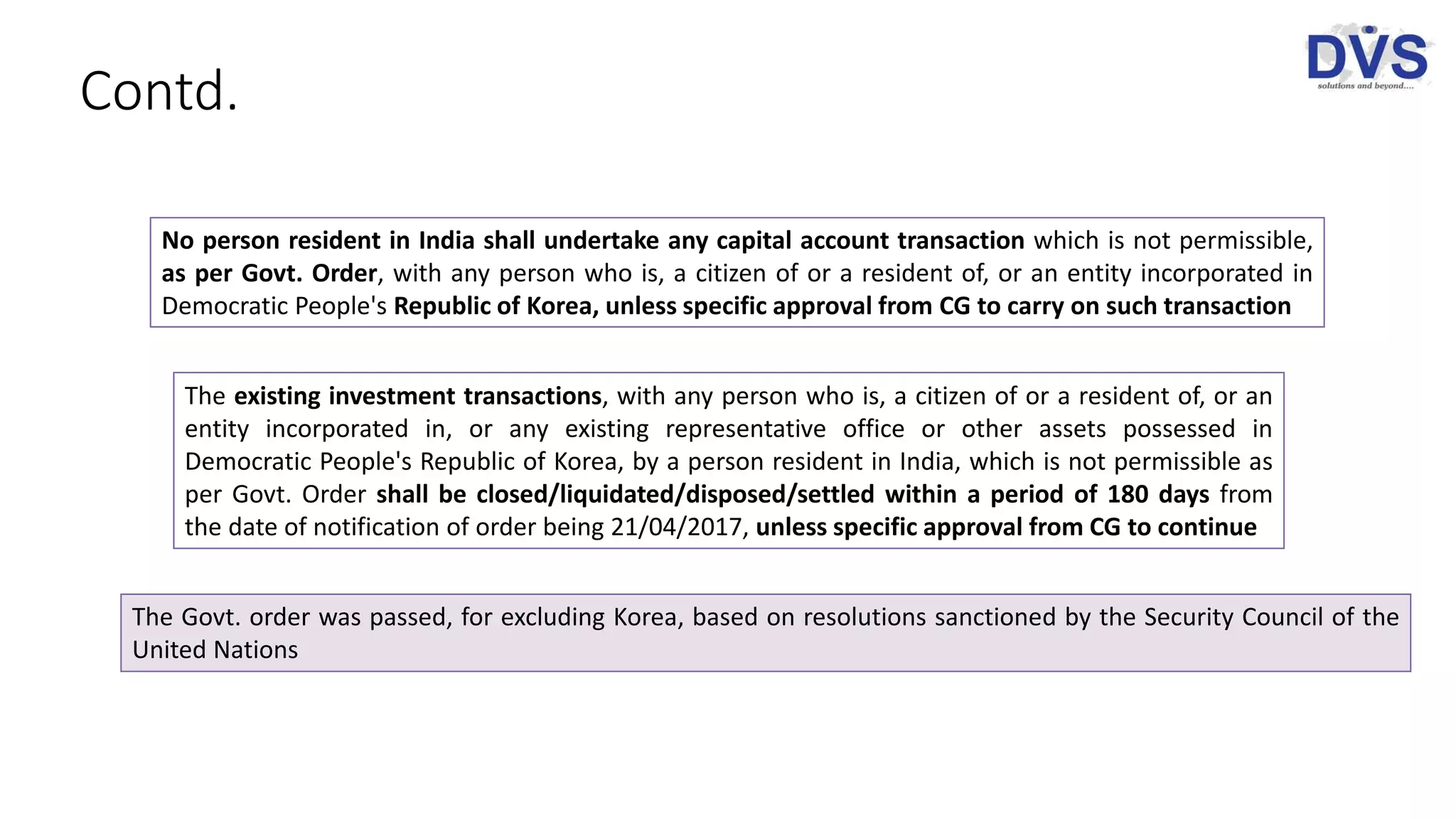

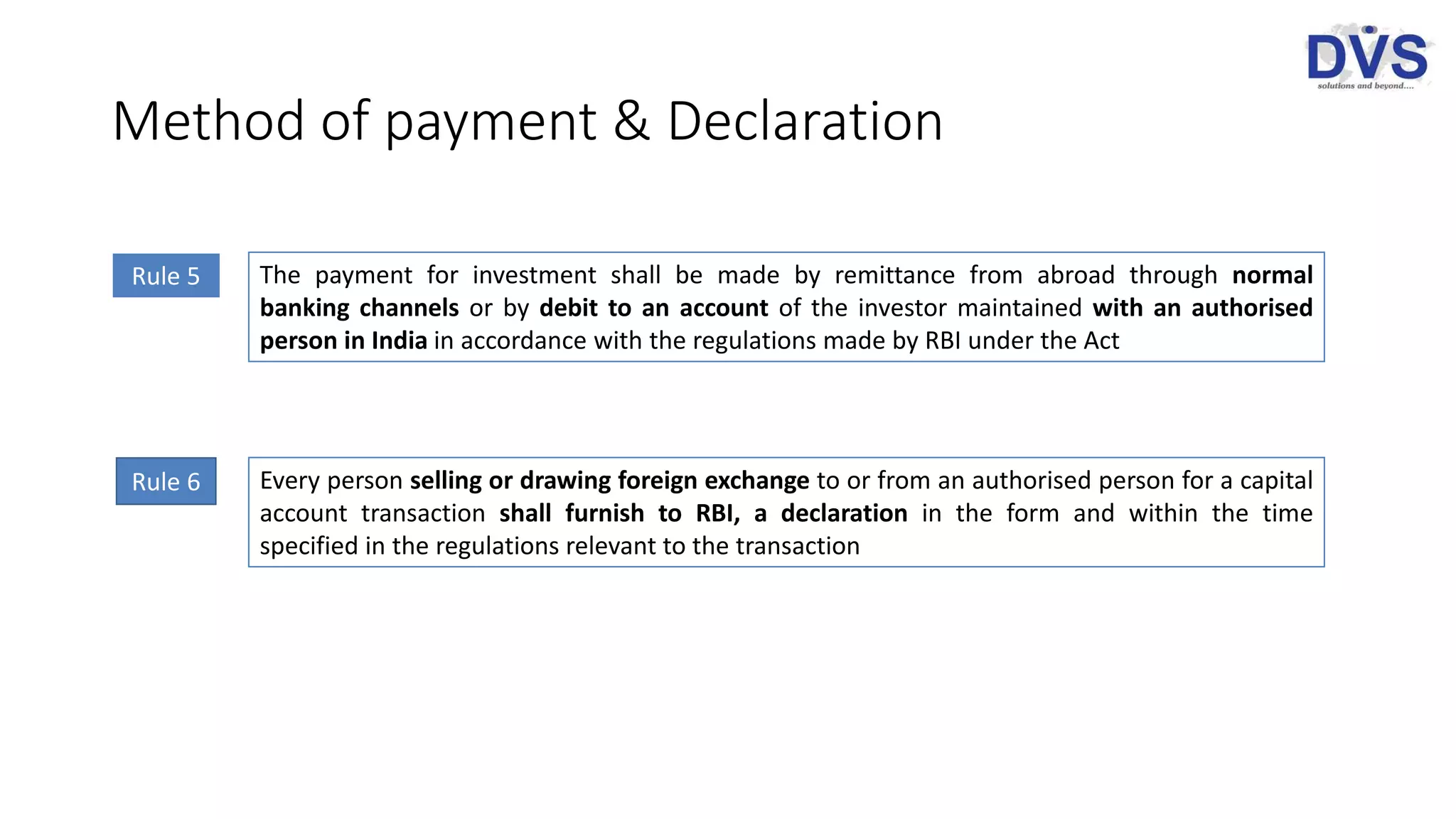

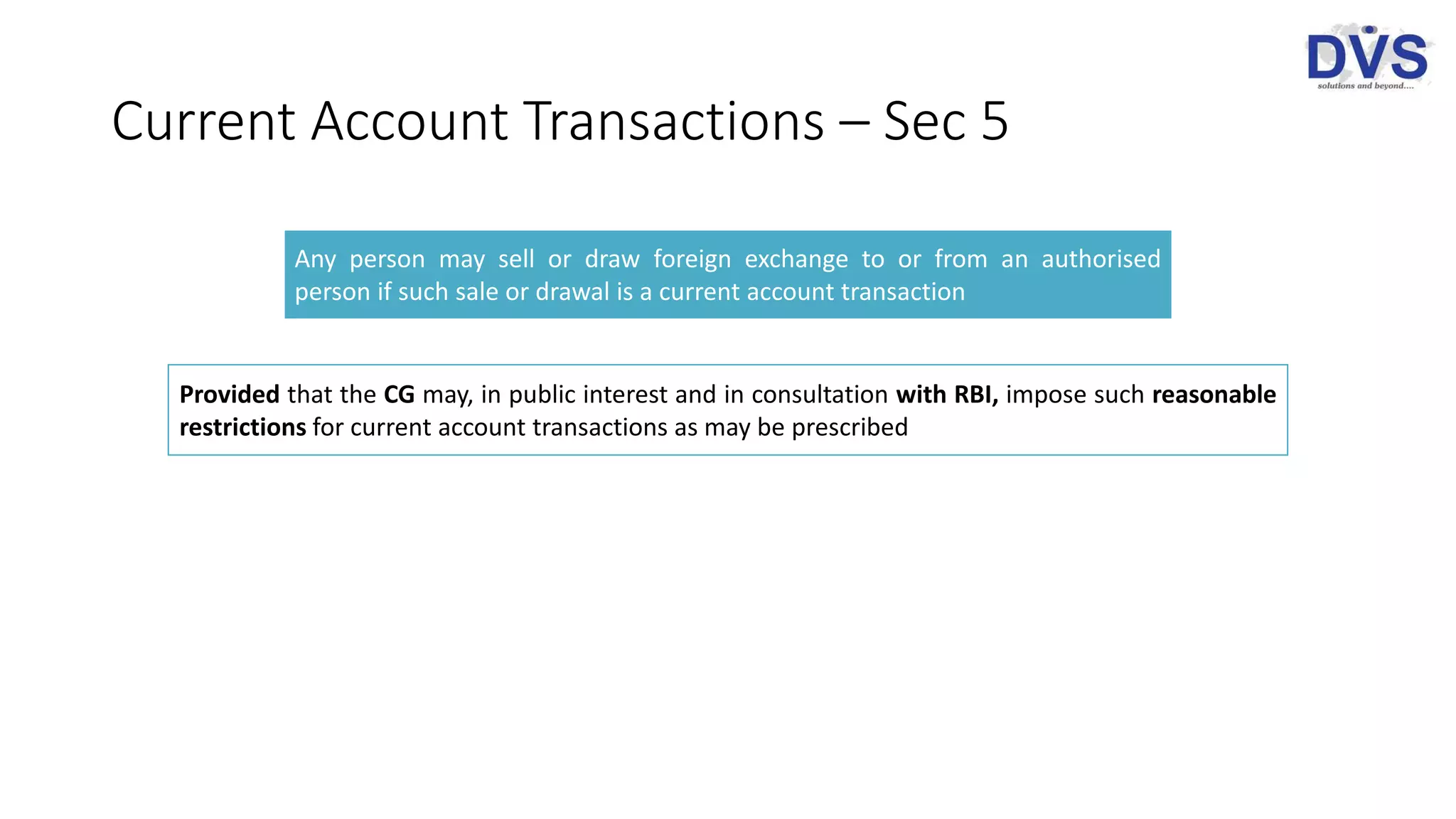

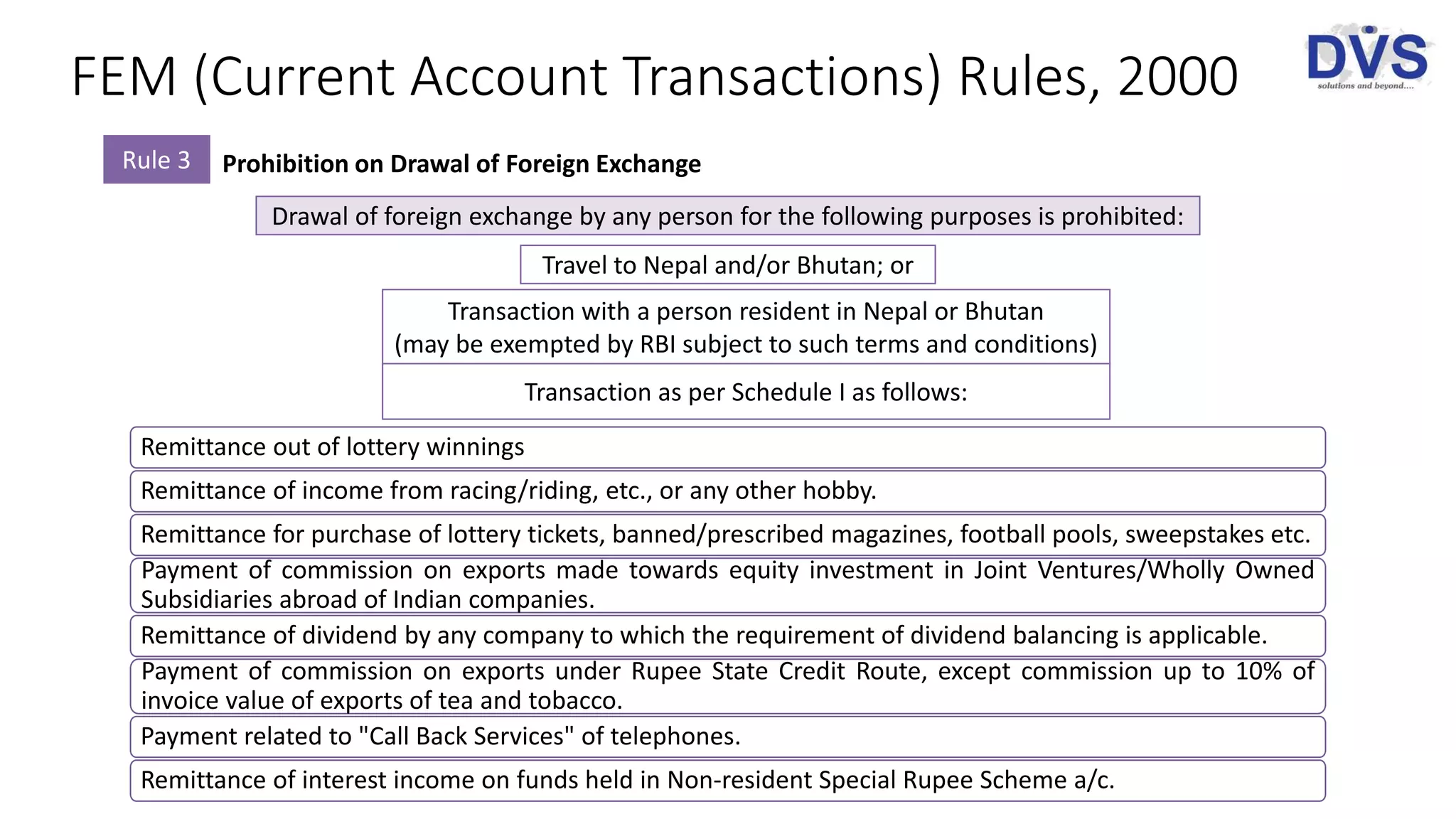

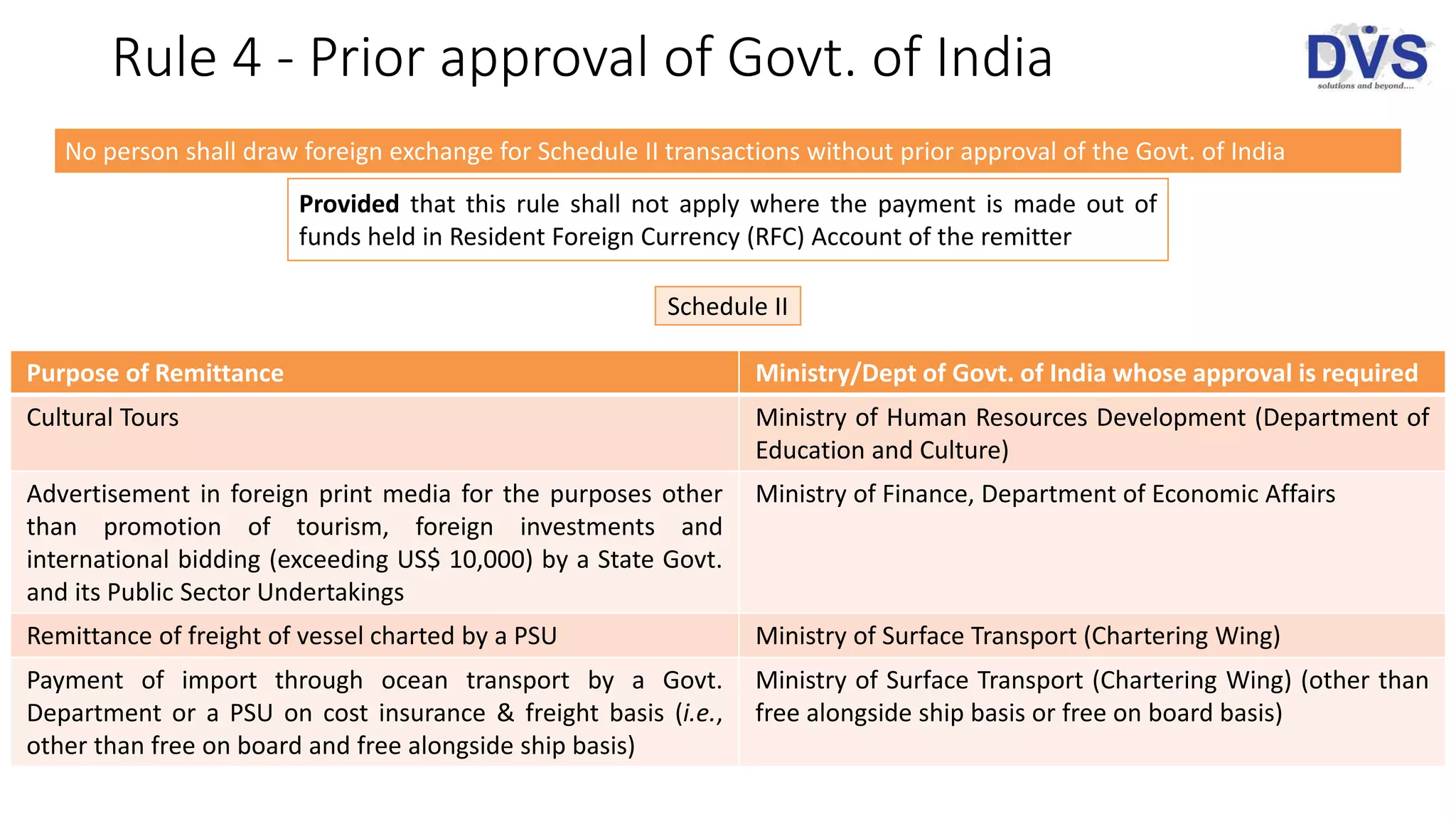

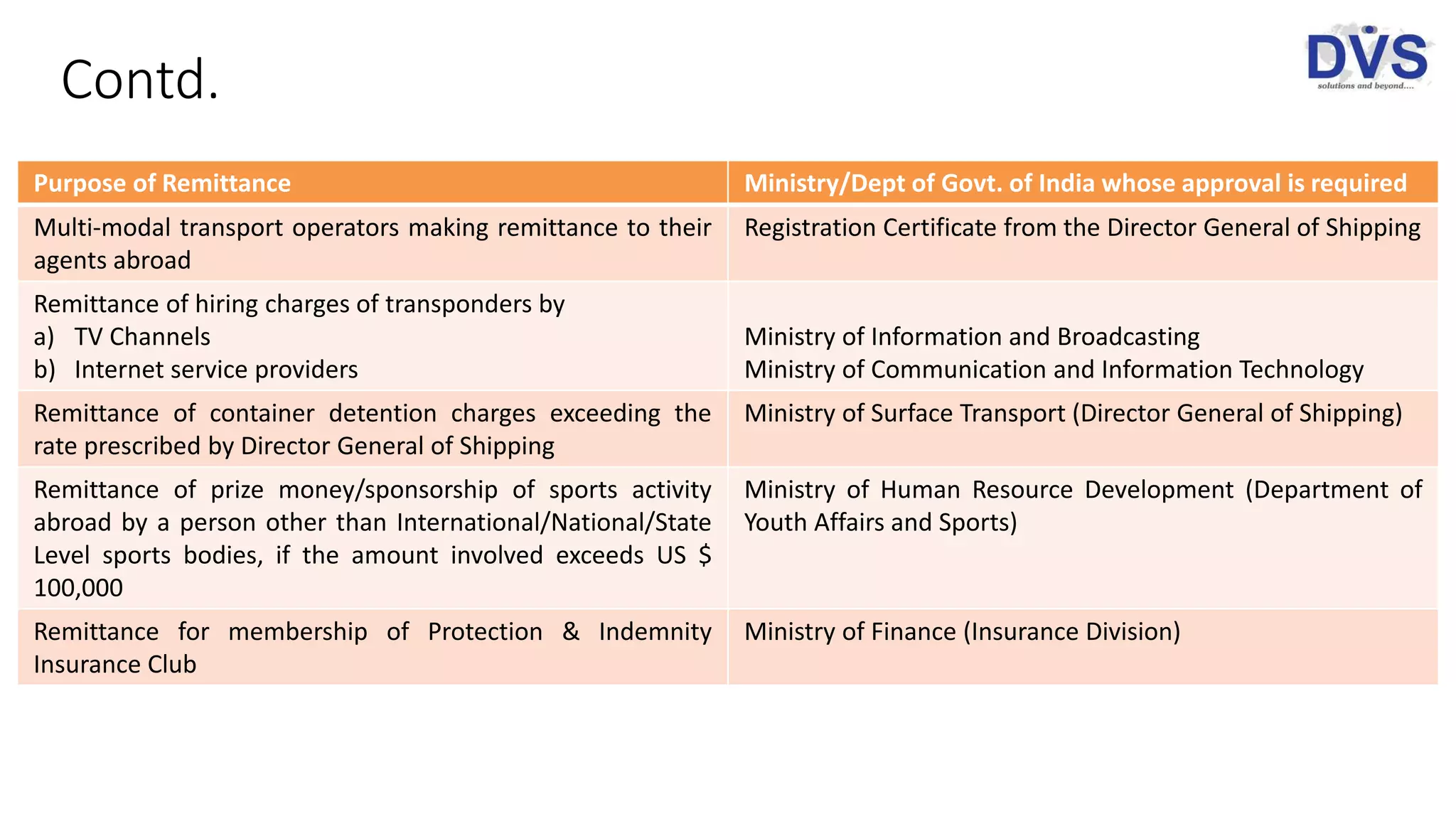

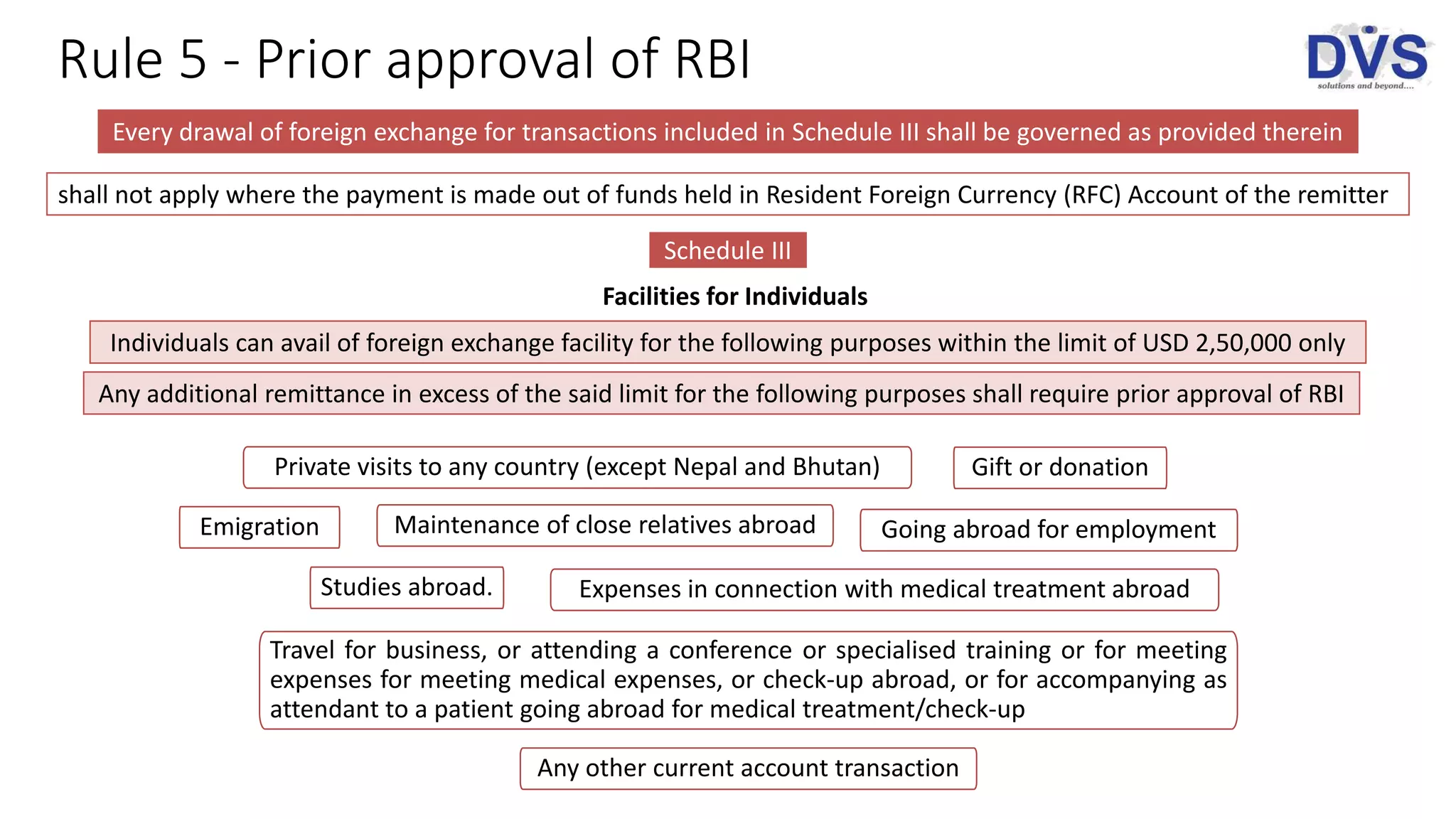

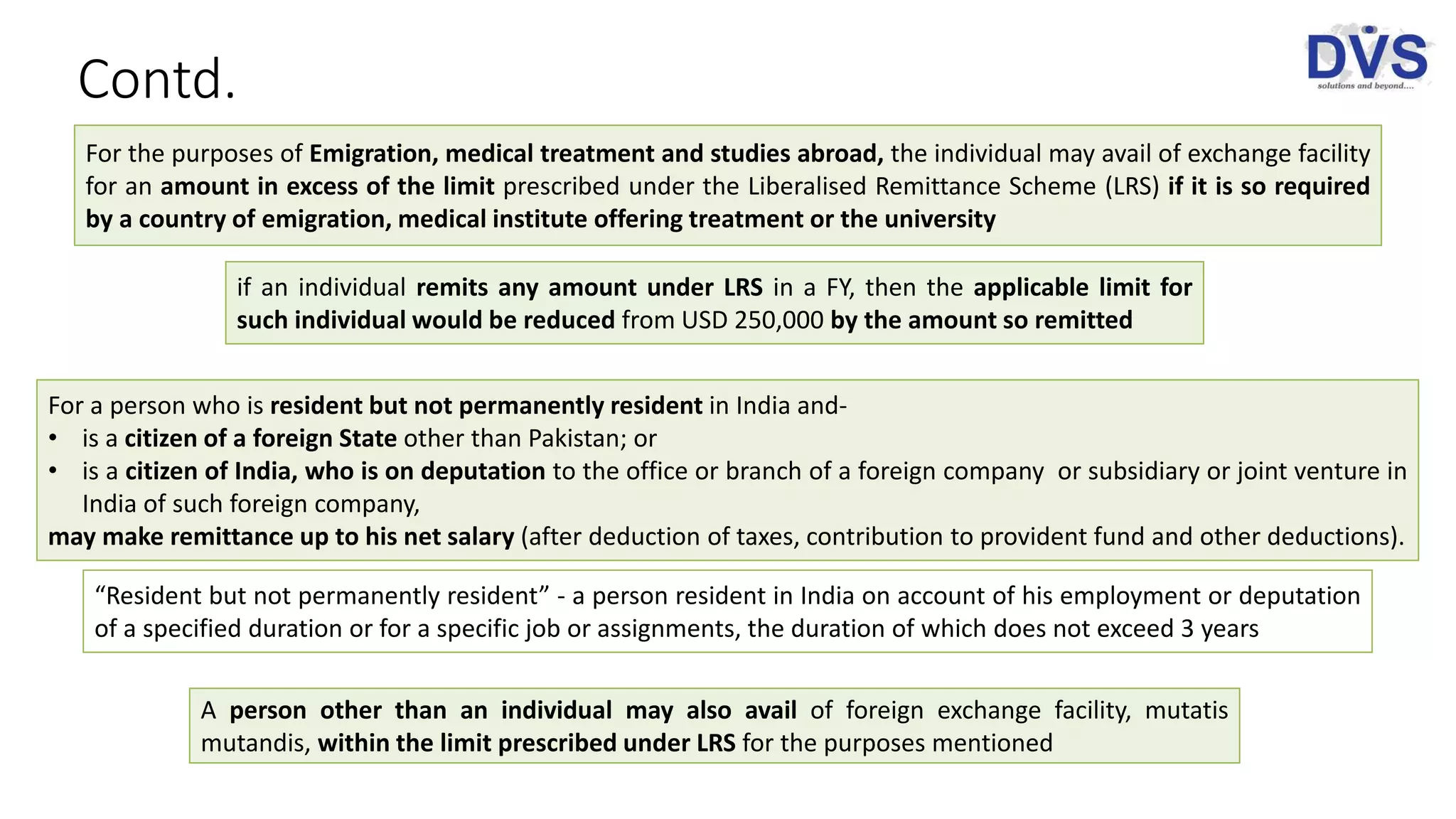

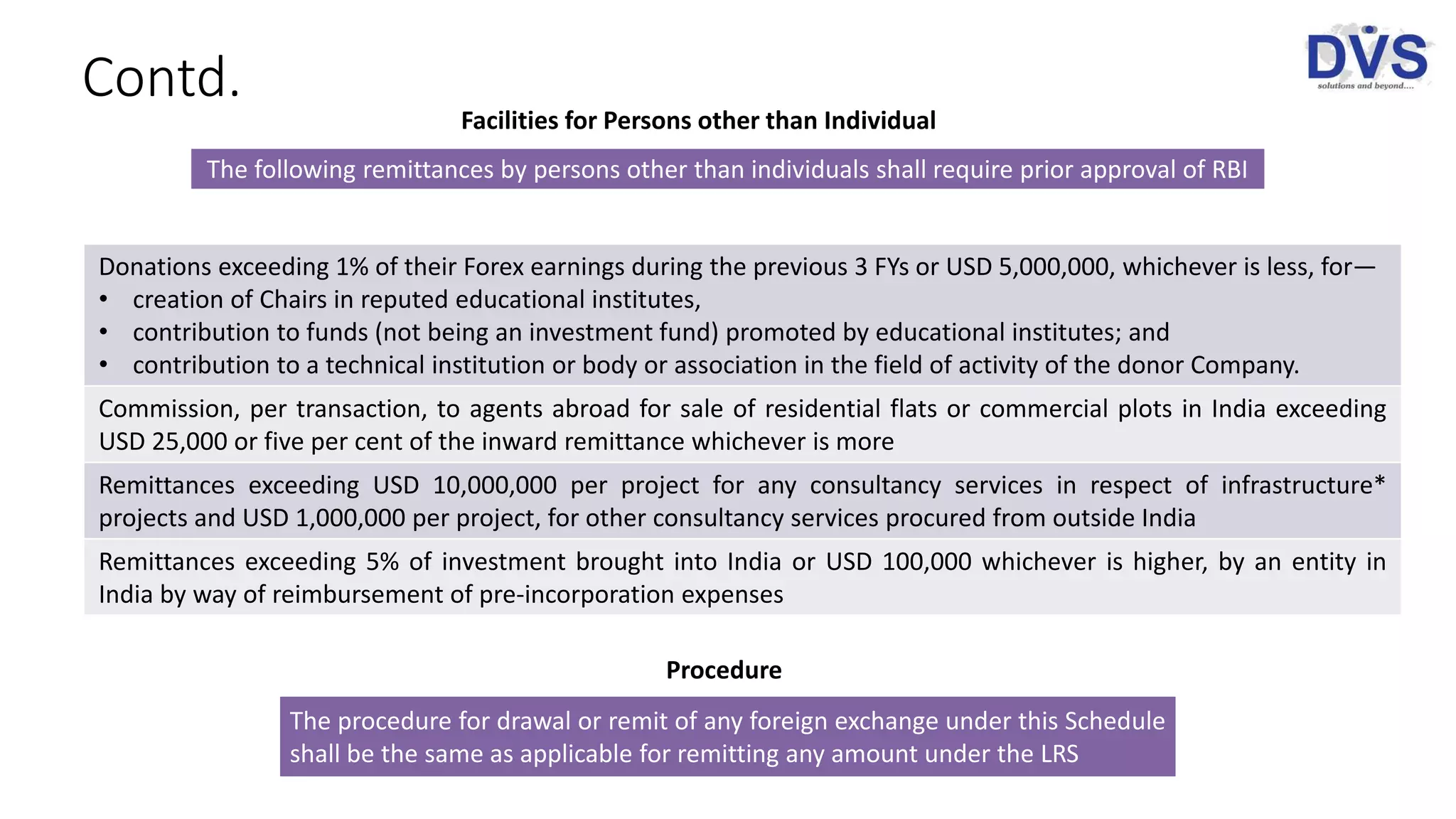

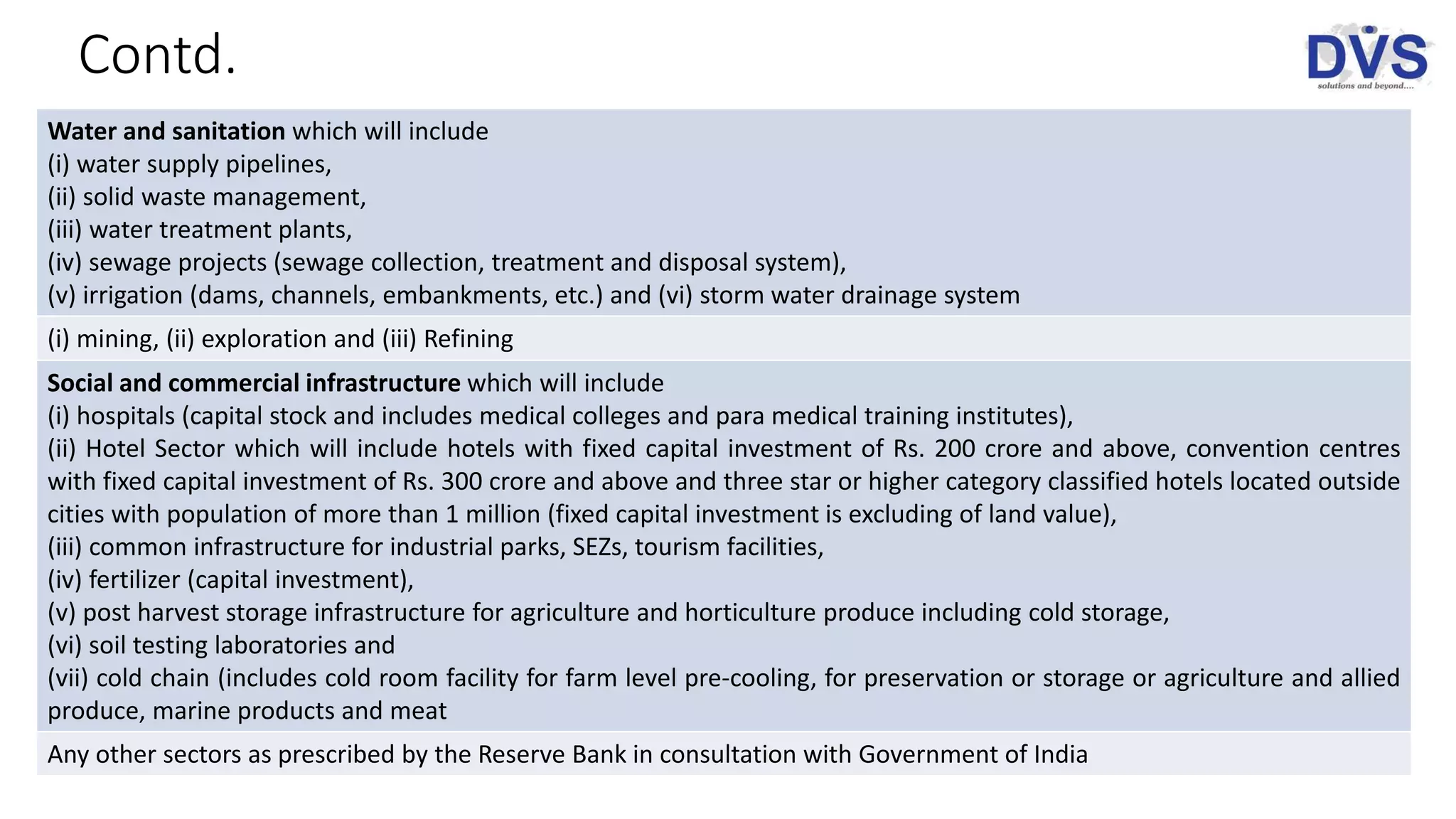

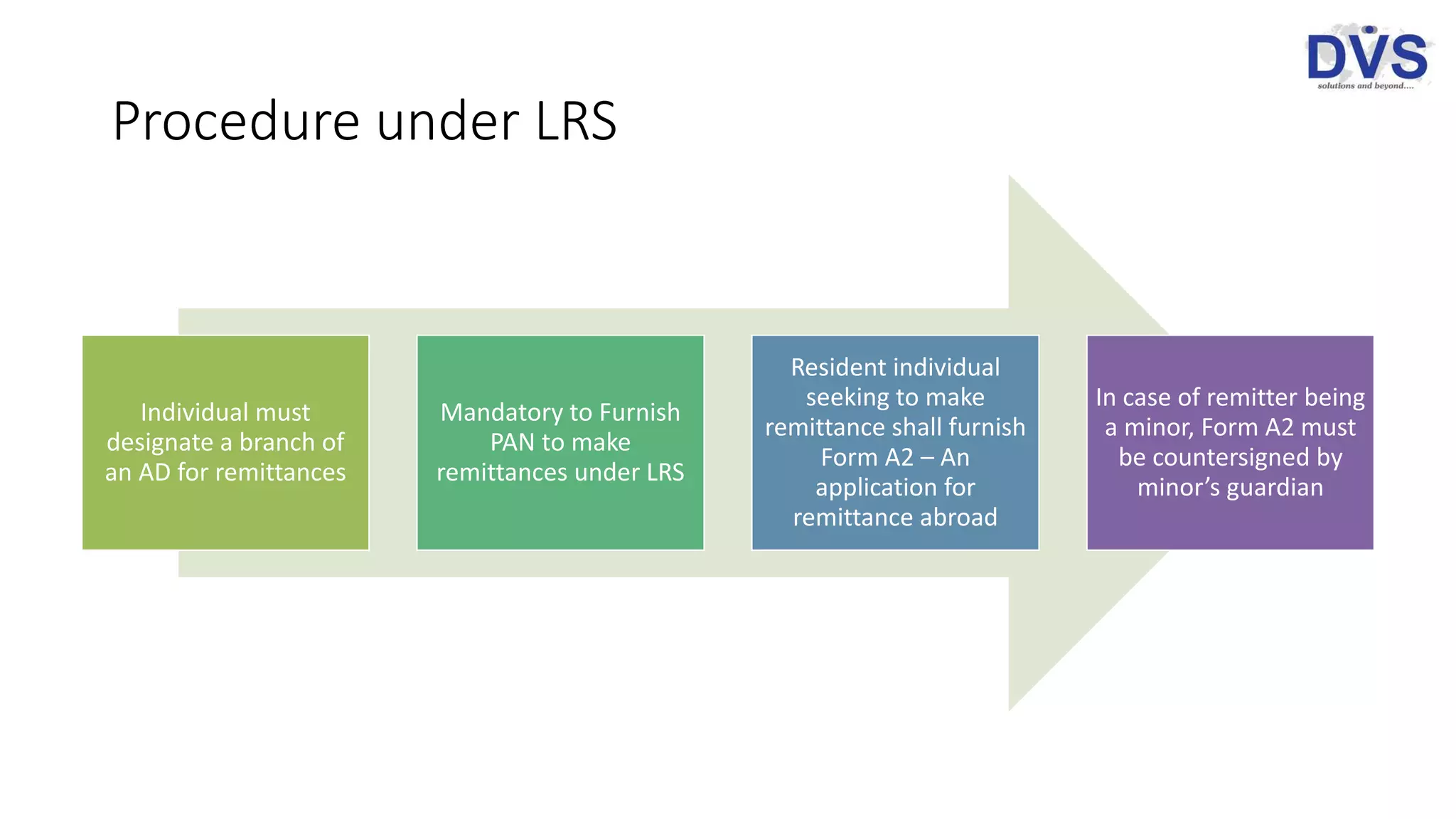

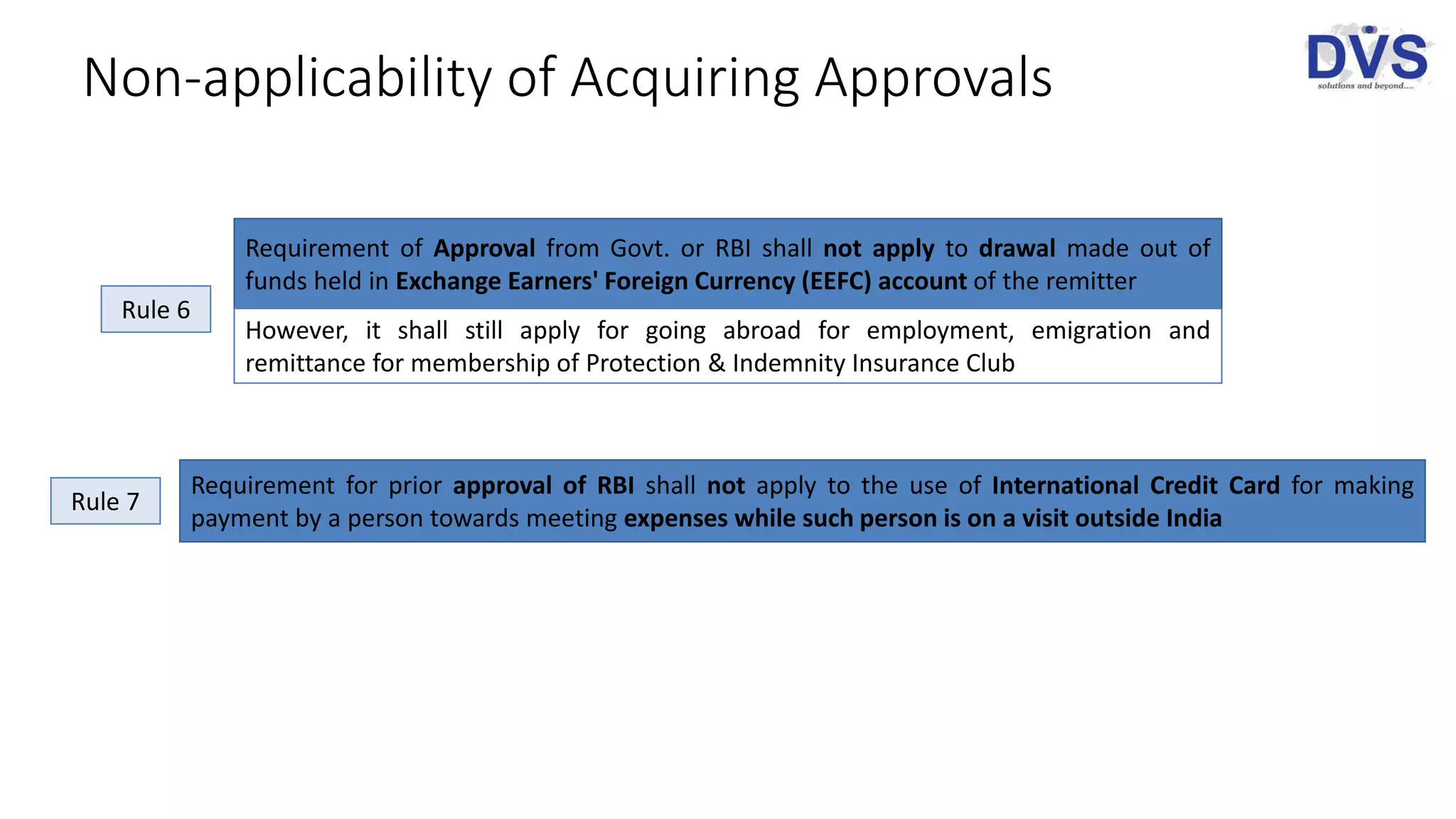

The document outlines the regulations under the Foreign Exchange Management Act (FEMA) related to capital and current account transactions, specifying their definitions, permissible transactions, and conditions. It differentiates between capital account transactions, which are generally prohibited unless specified, and current account transactions, which are usually permitted unless prohibited. Additionally, it details the approval processes for various external transactions and restrictions on foreign exchange drawals.