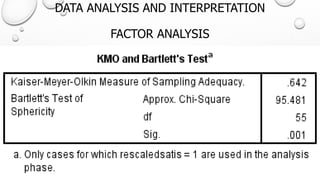

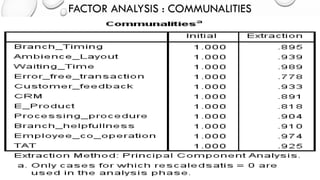

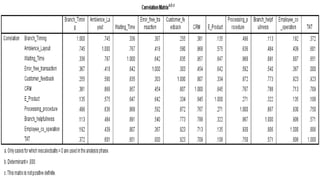

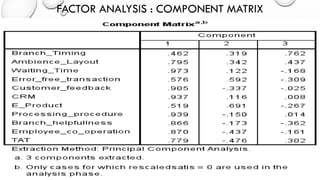

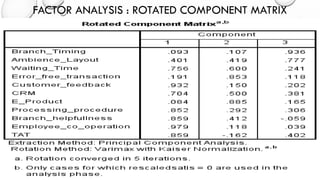

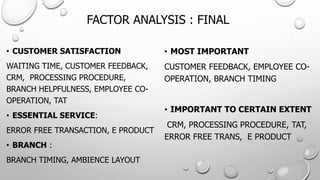

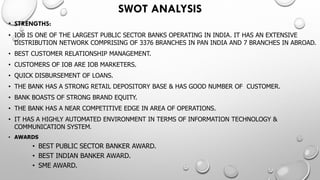

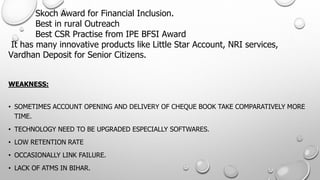

This document provides an overview of retail banking in India, with a focus on Indian Overseas Bank (IOB). It discusses the drivers of retail banking growth in India, the nationalization of banks, IOB's profile and branches, and research conducted on customer satisfaction with IOB's retail banking services. A survey of 50 IOB customers in Patna found high satisfaction with branch timing, ambience, and employee cooperation but less satisfaction with e-products and some issues with complaint resolution. Suggestions include improving technology offerings and expanding the ATM network to better serve customers.