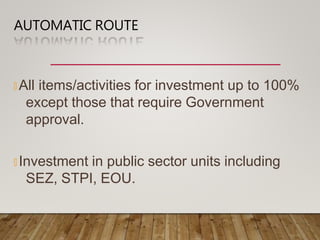

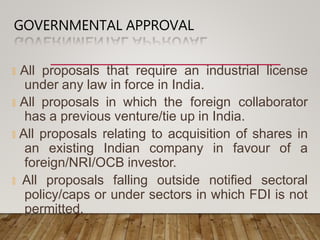

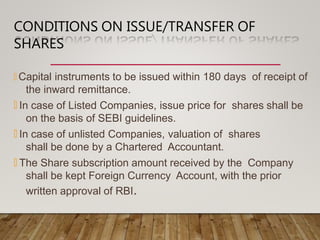

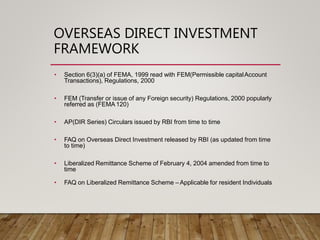

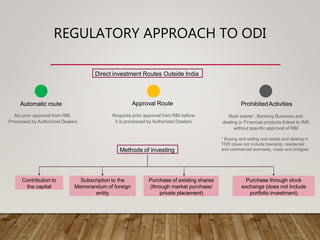

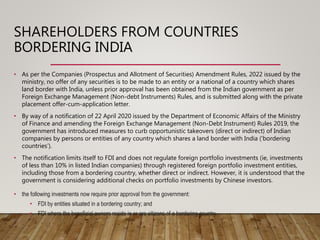

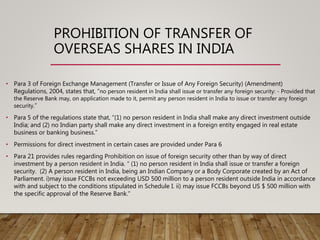

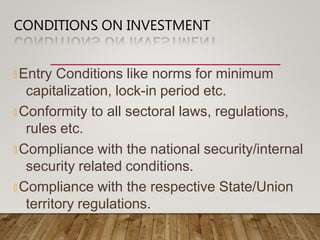

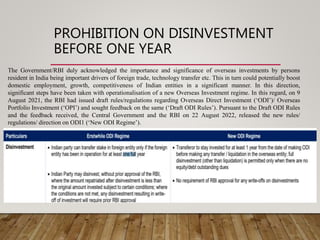

The document summarizes India's foreign direct investment policy. It outlines that FDI is regulated by the Foreign Exchange Management Act and RBI. There are two routes for FDI - automatic and government. Most sectors allow up to 100% FDI through the automatic route. Some sectors require government approval. There are also conditions on issue/transfer of shares and limits on disinvestment within one year. FDI is prohibited in certain sectors like retail, gambling, real estate development and printing of Indian currency.