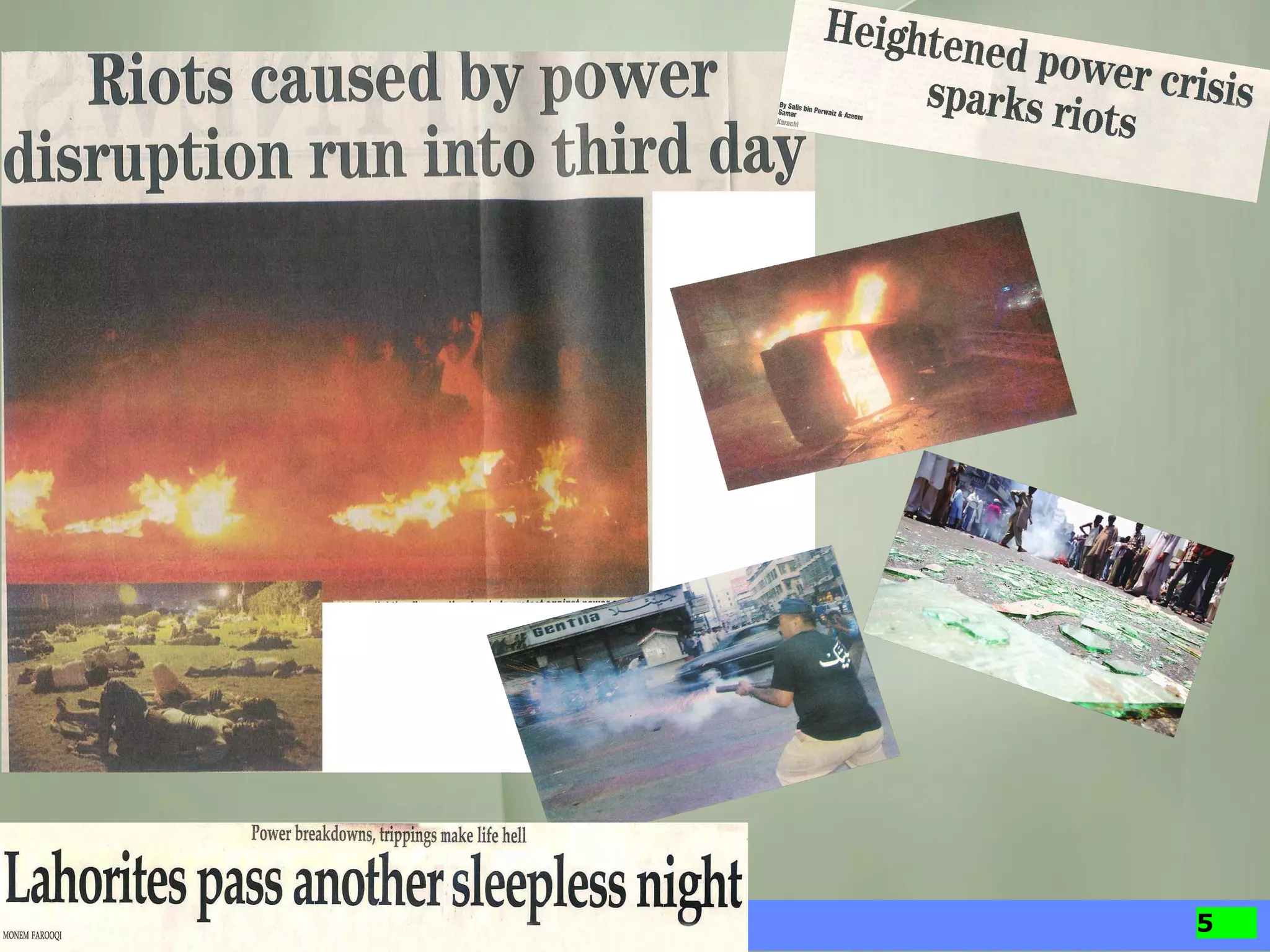

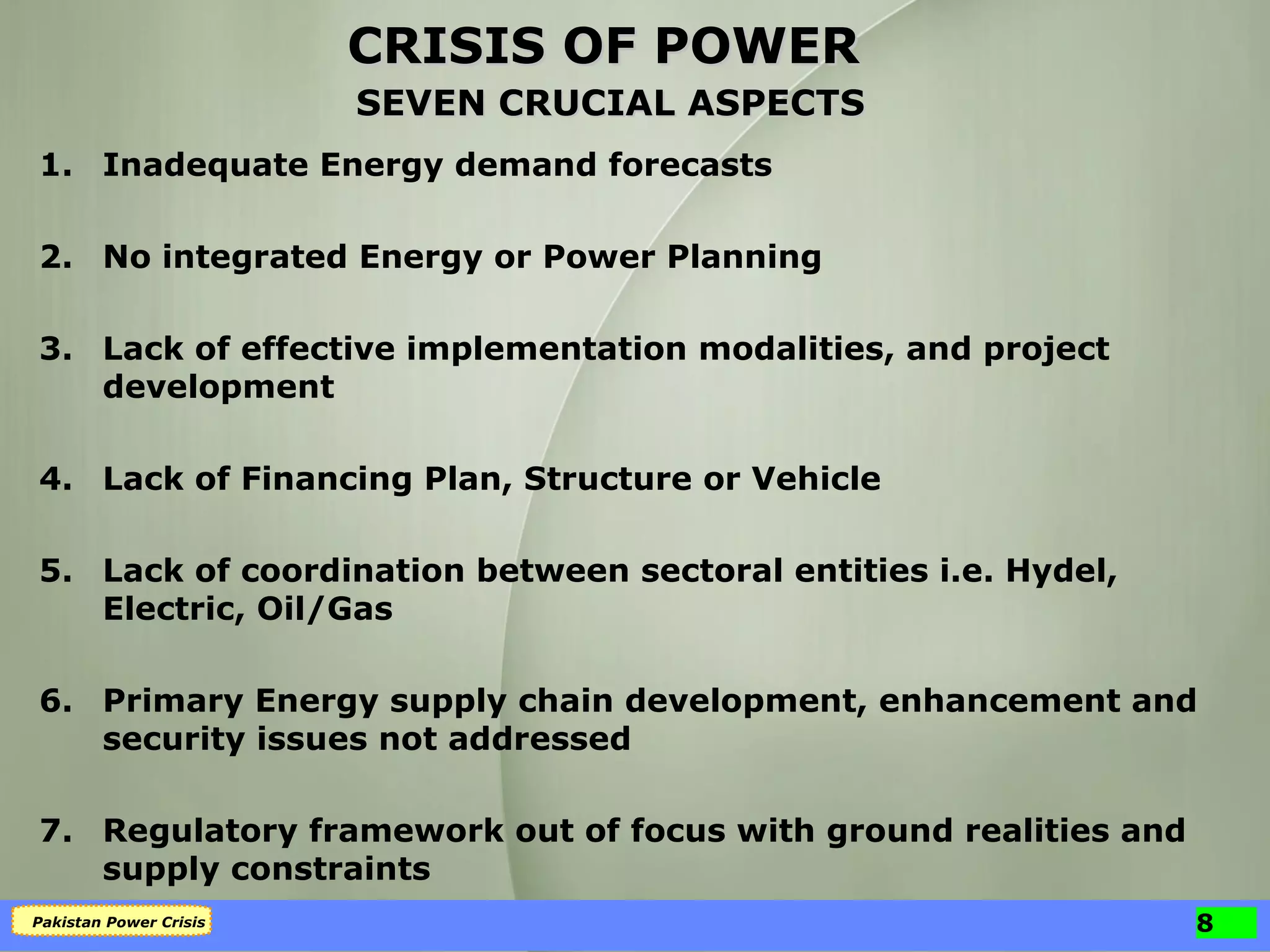

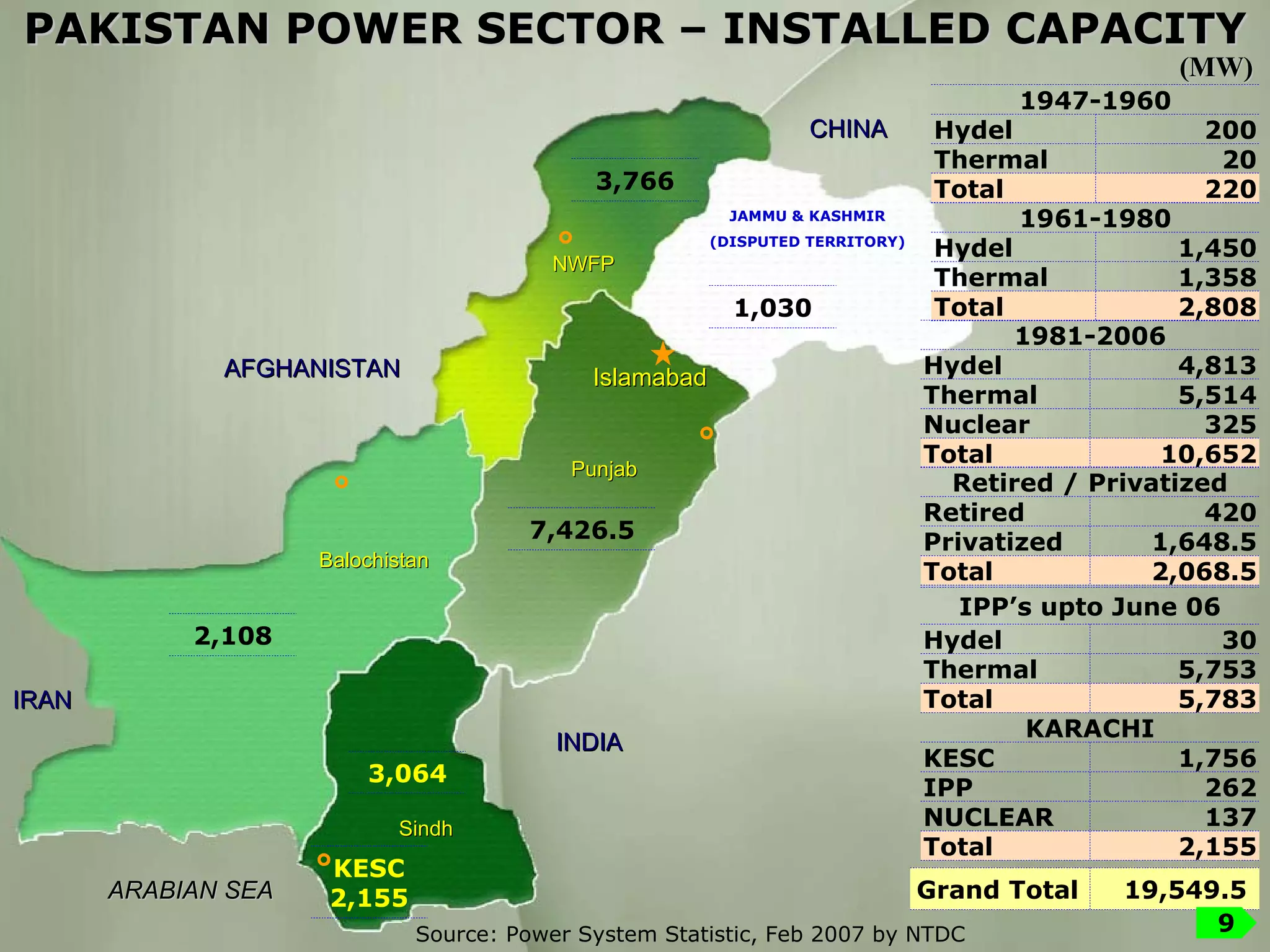

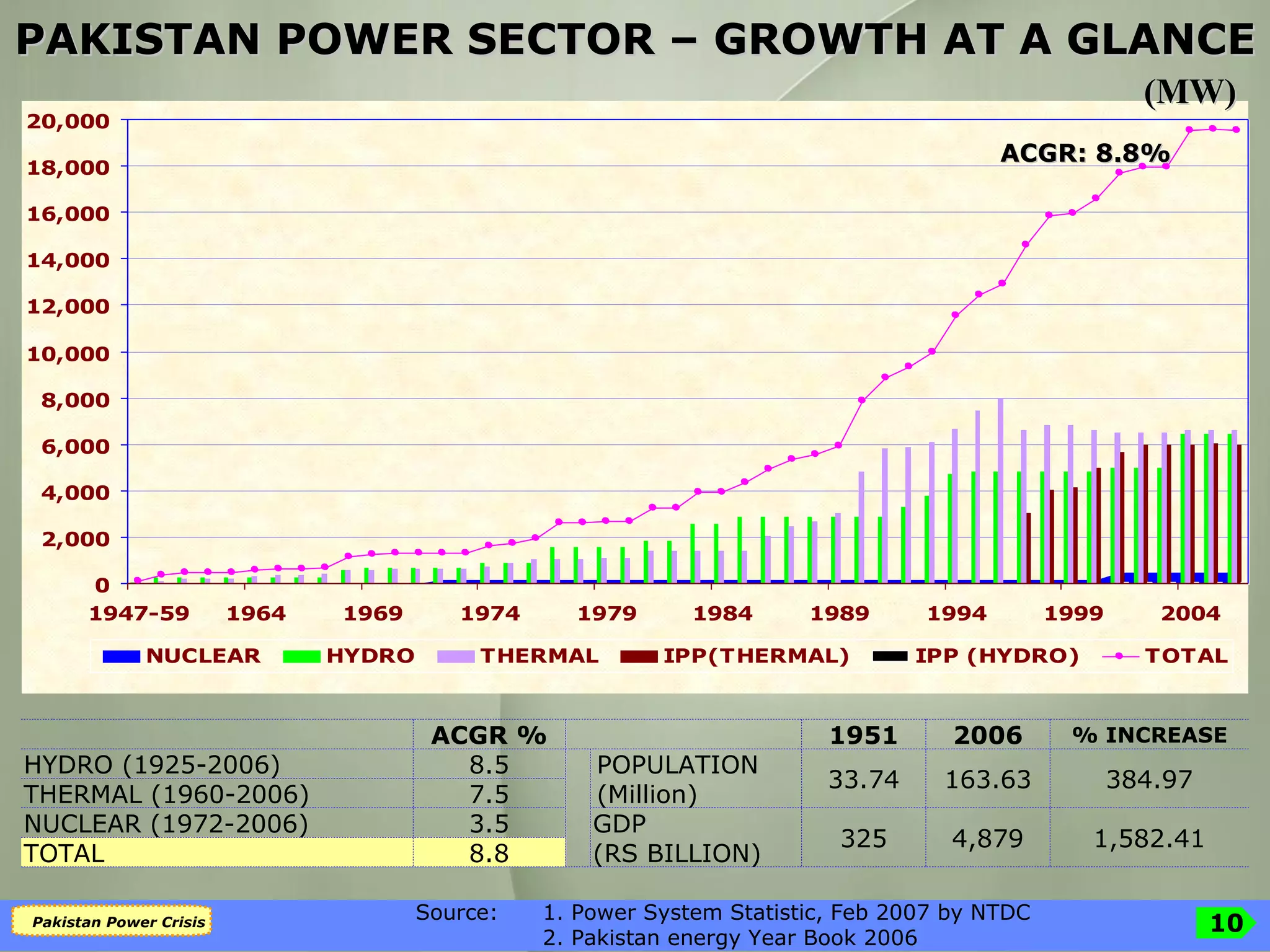

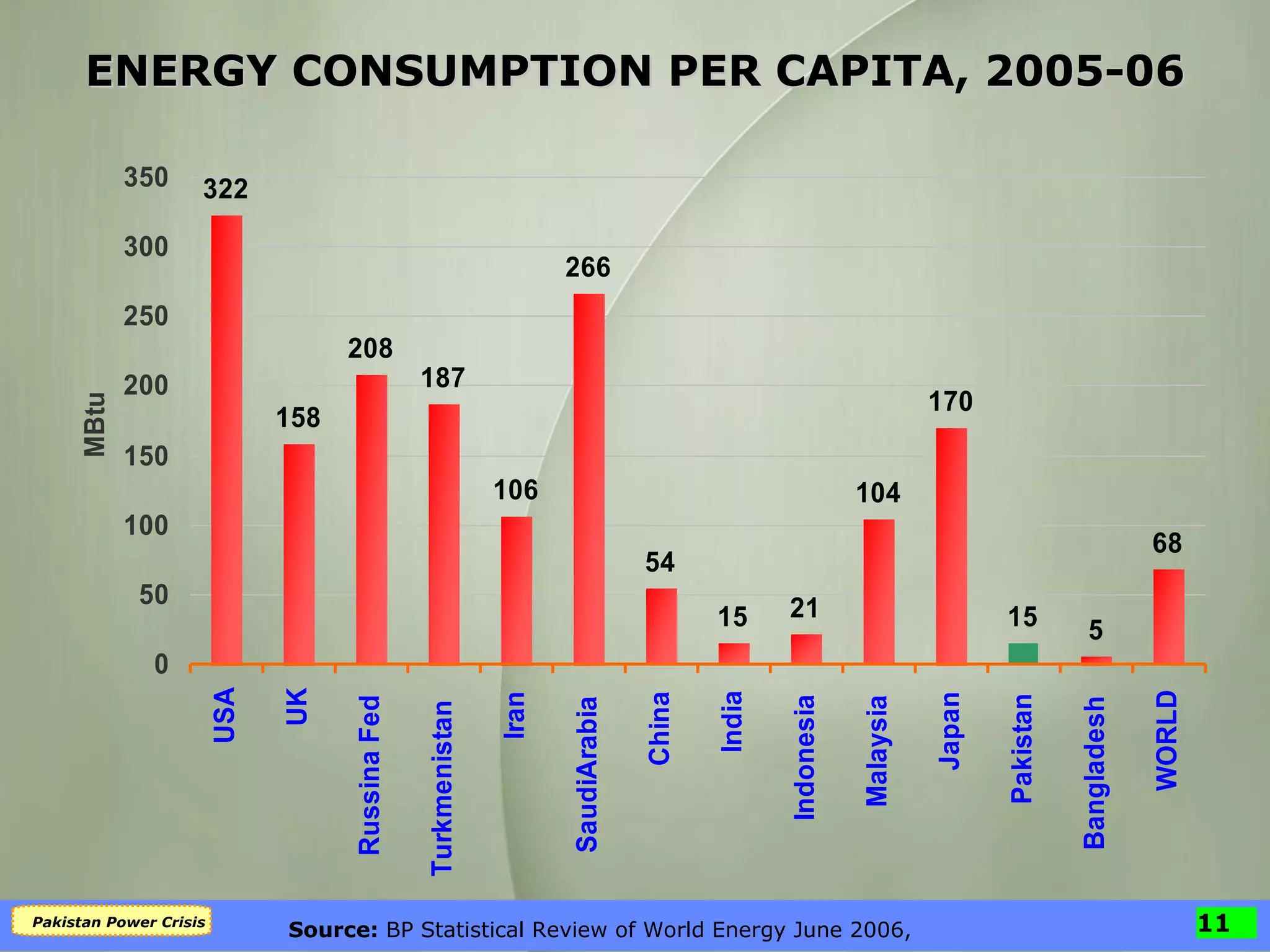

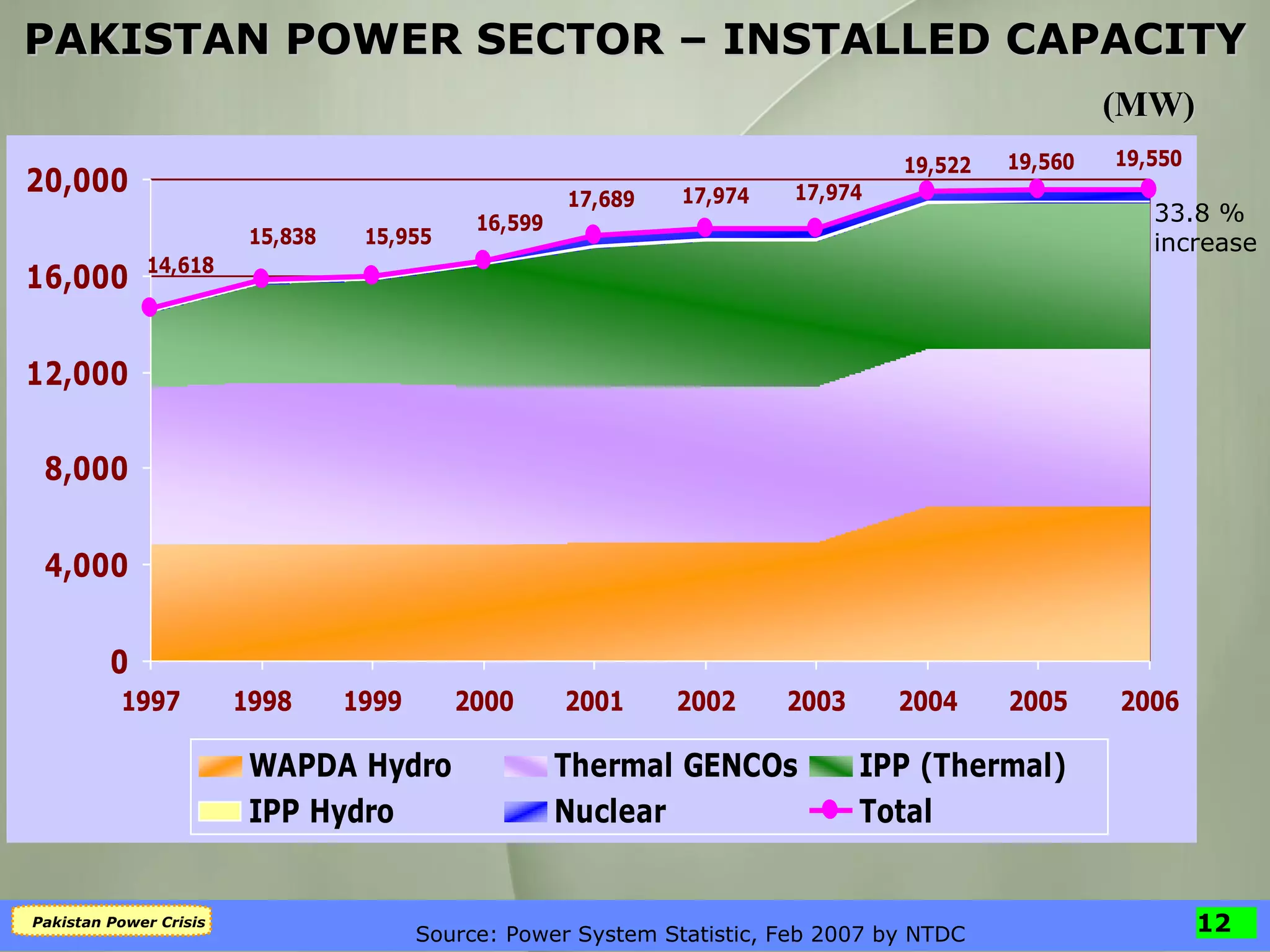

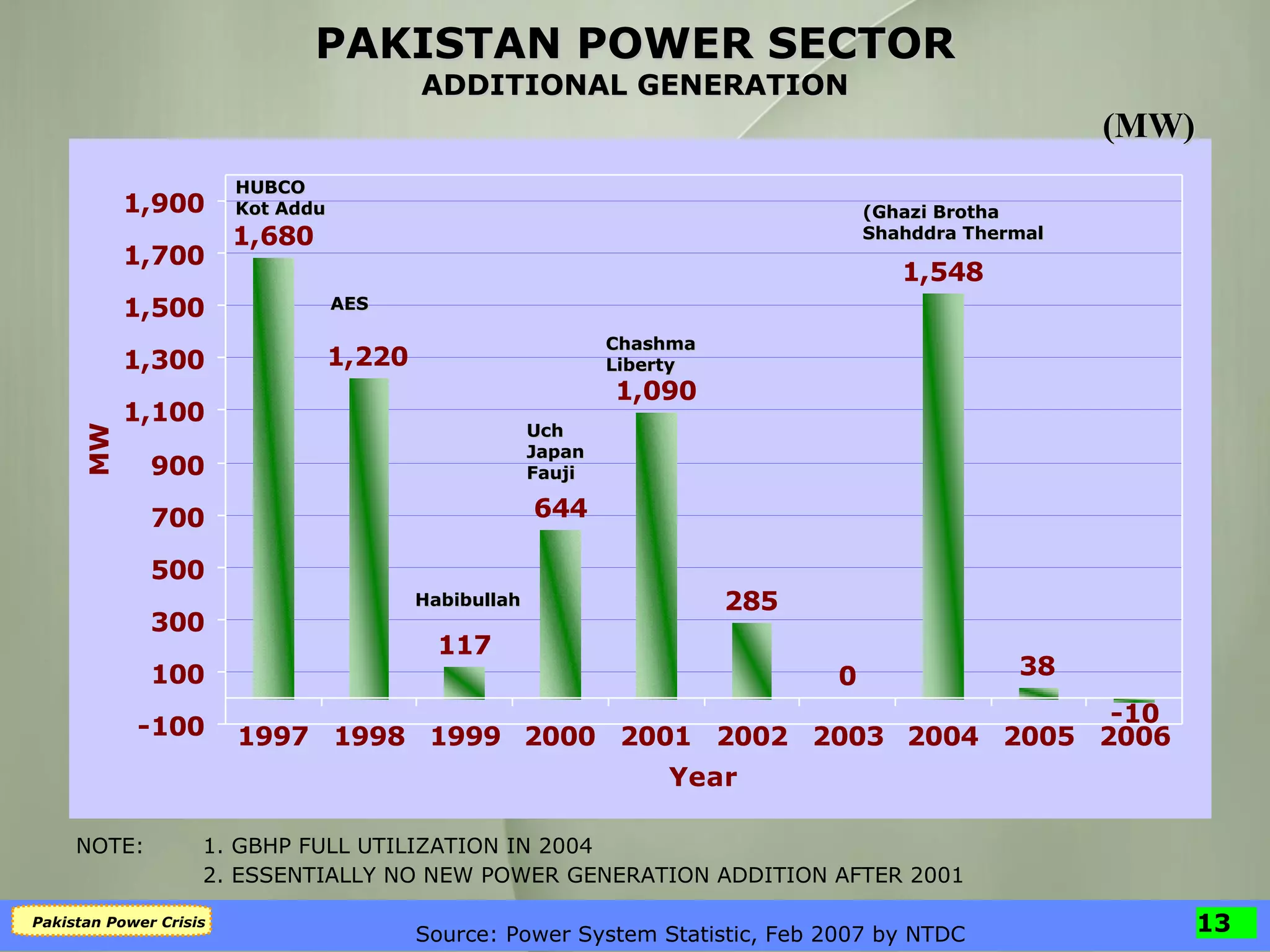

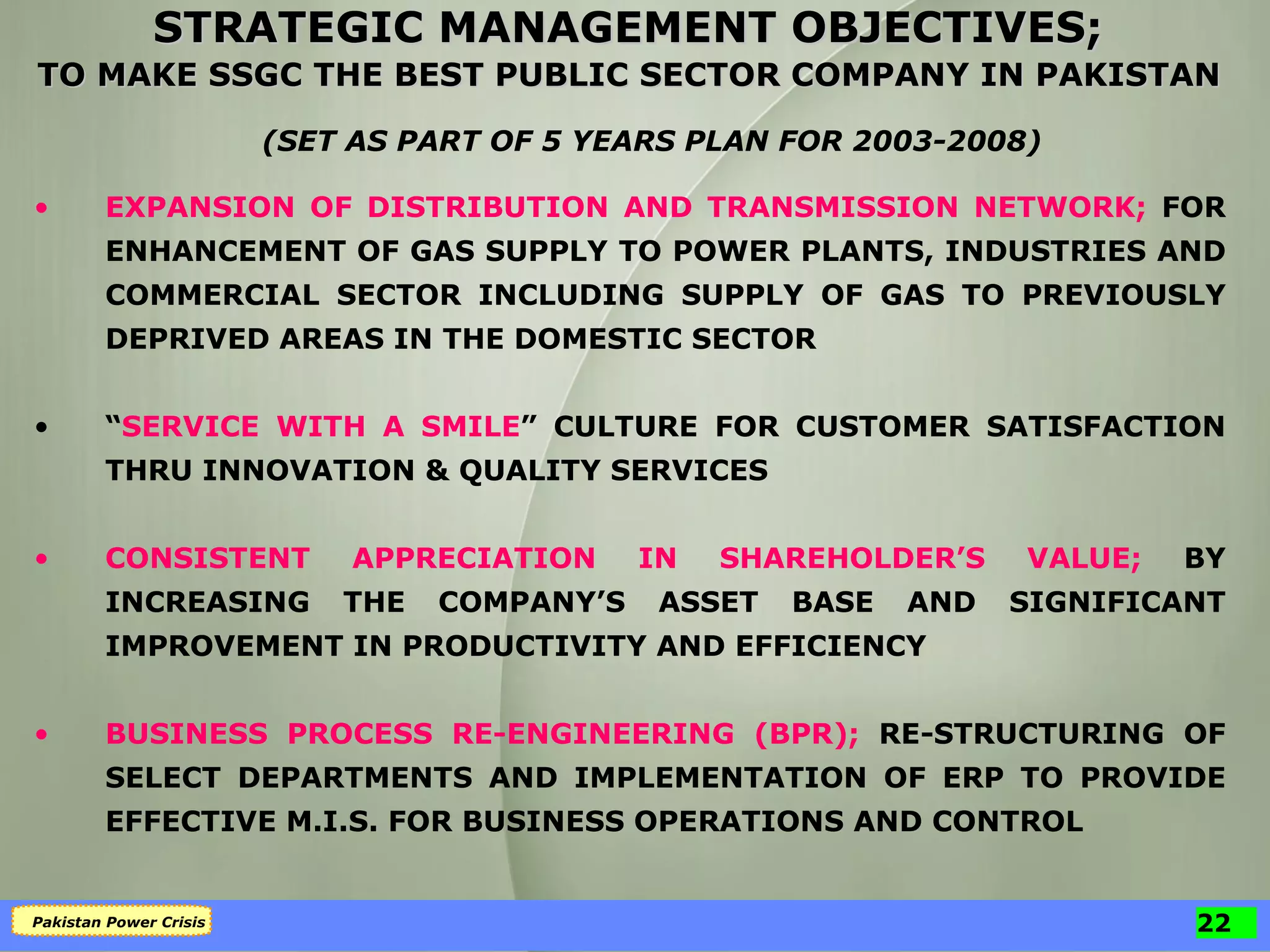

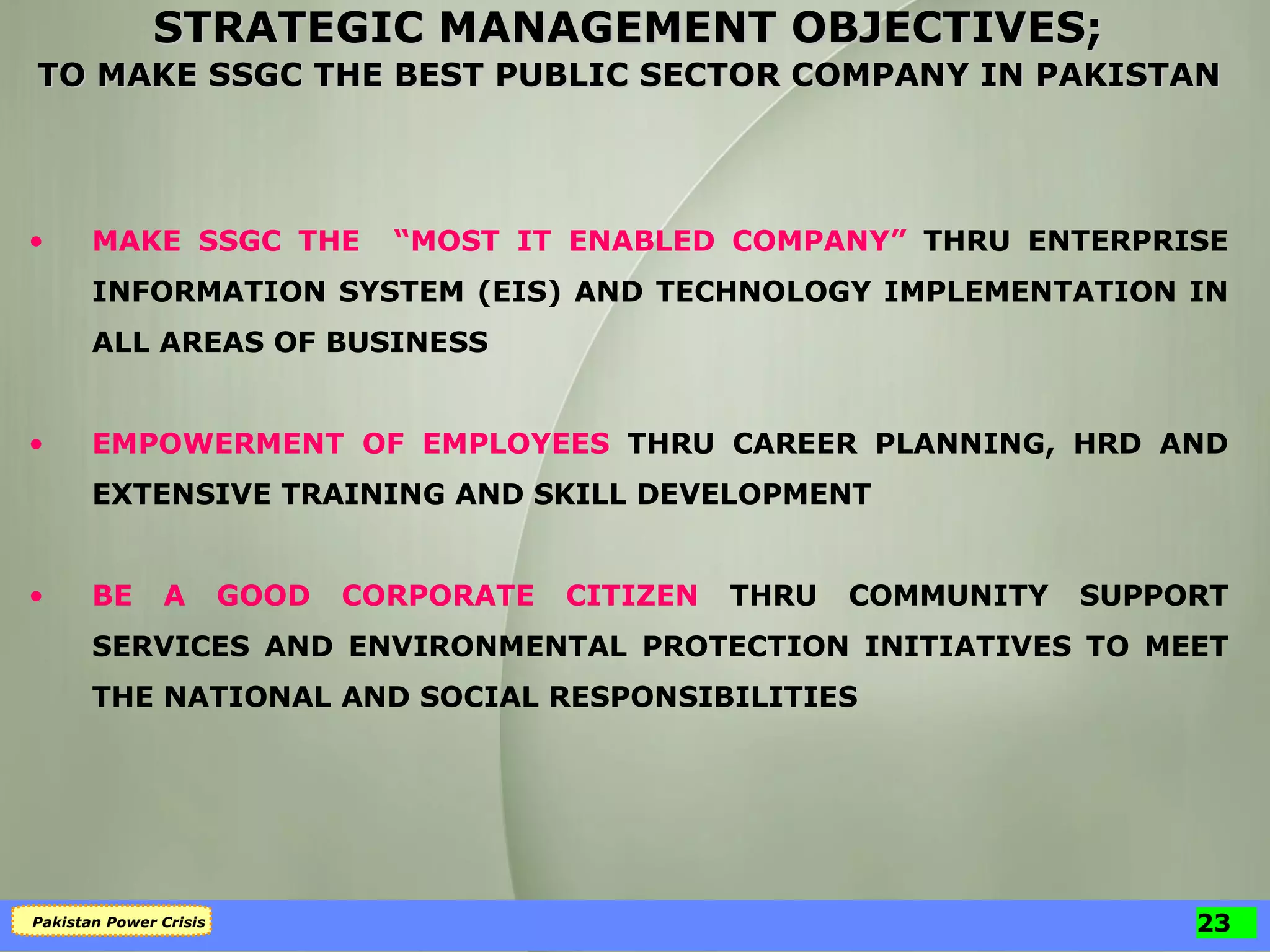

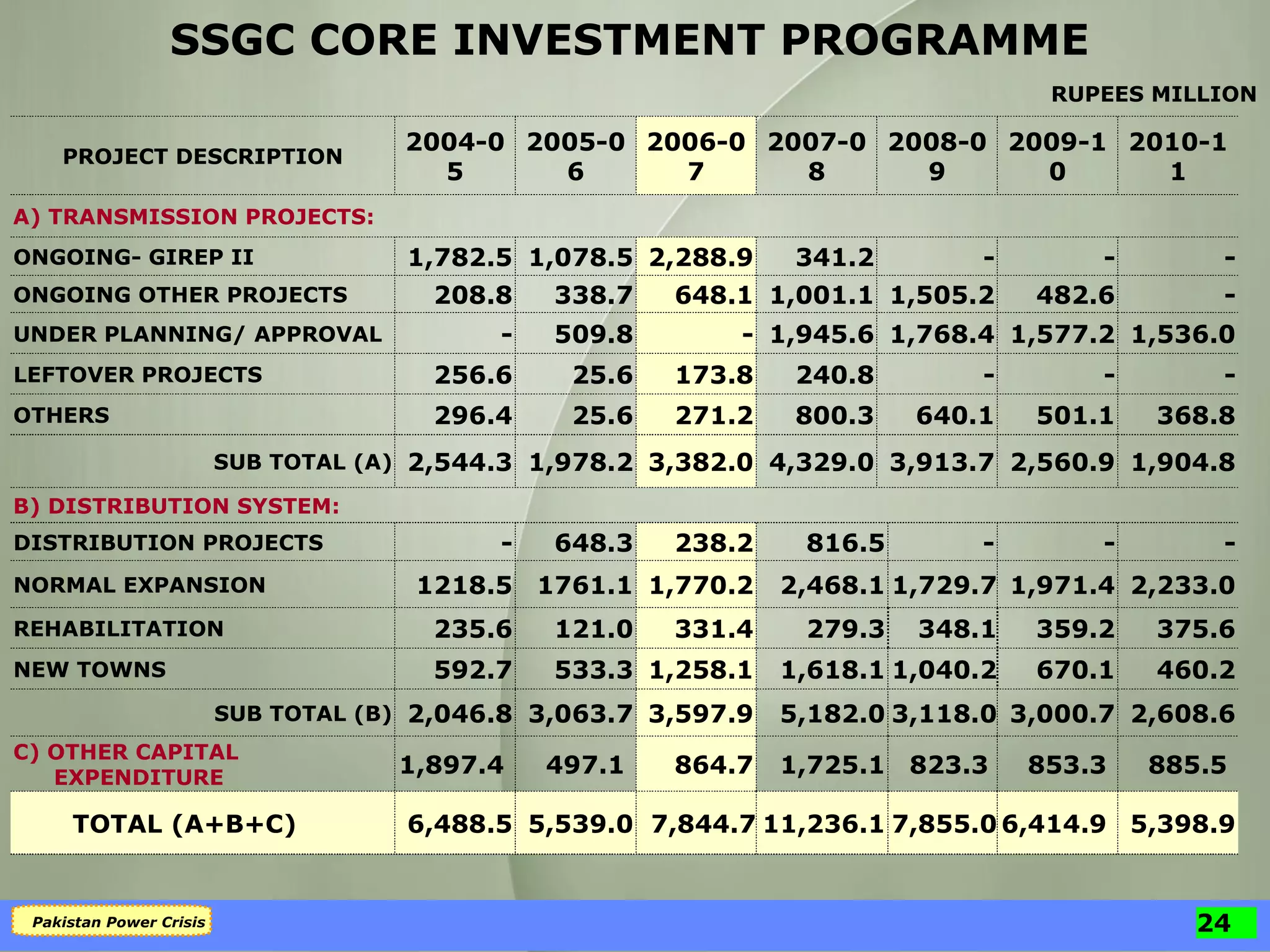

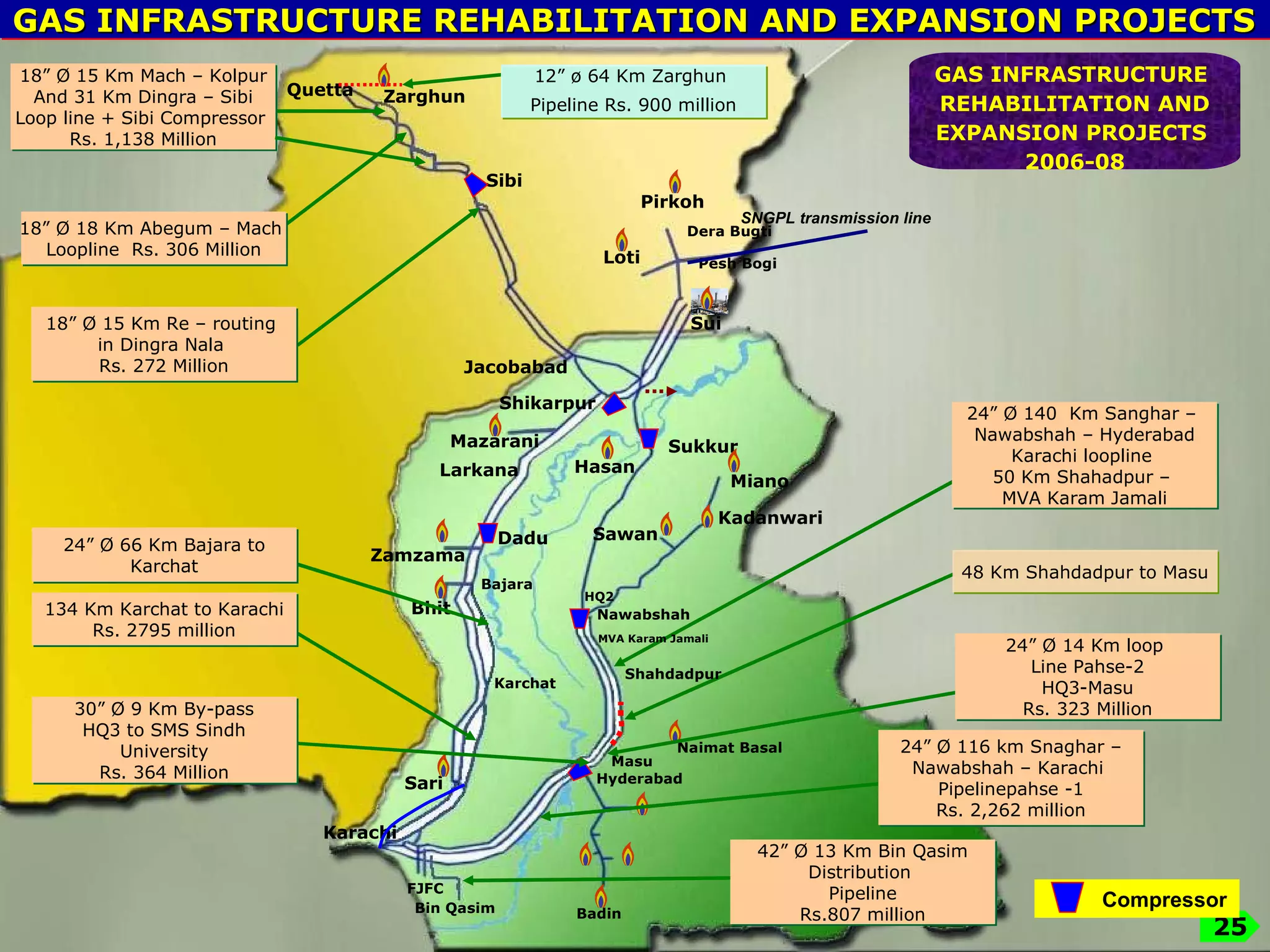

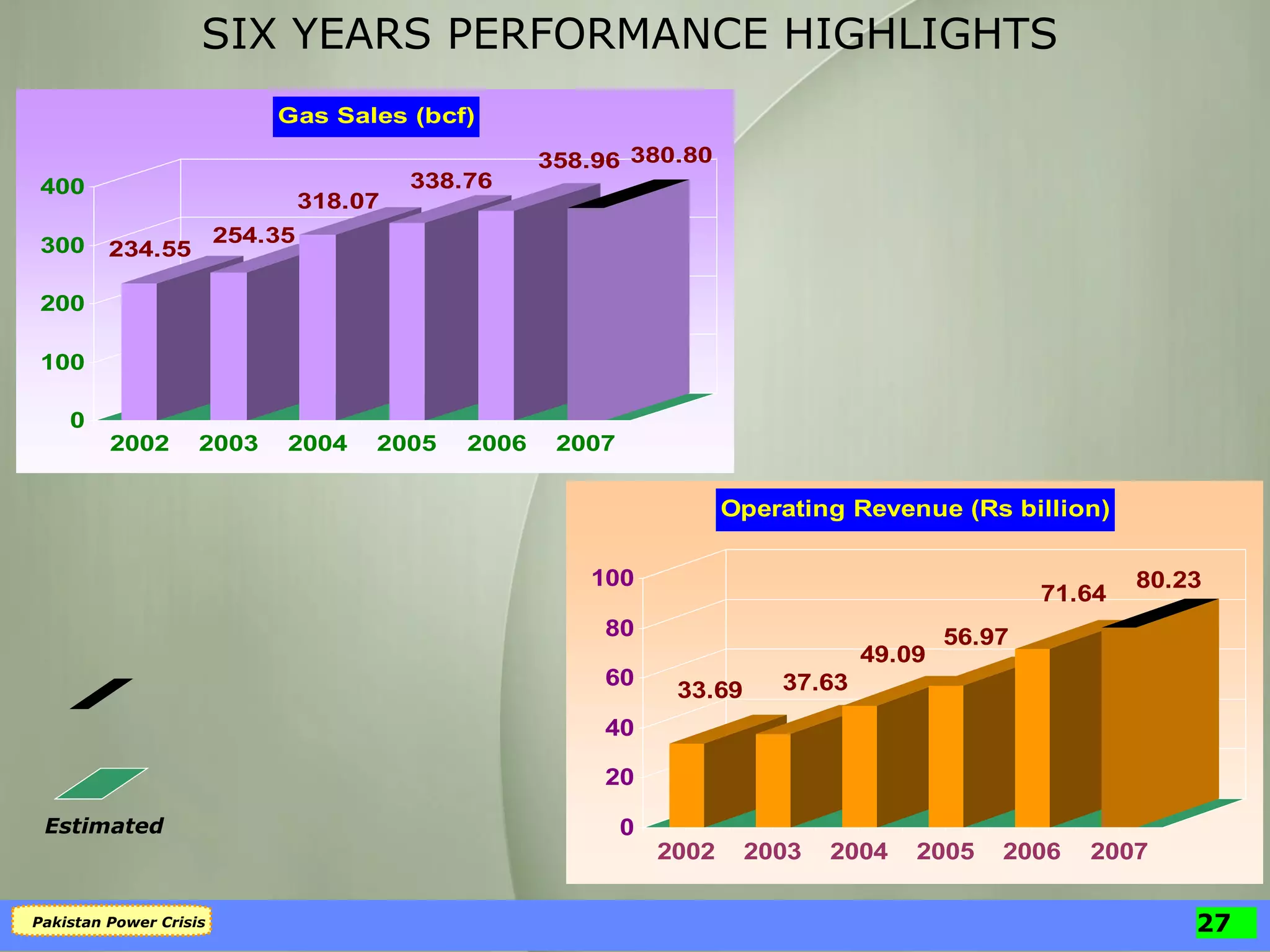

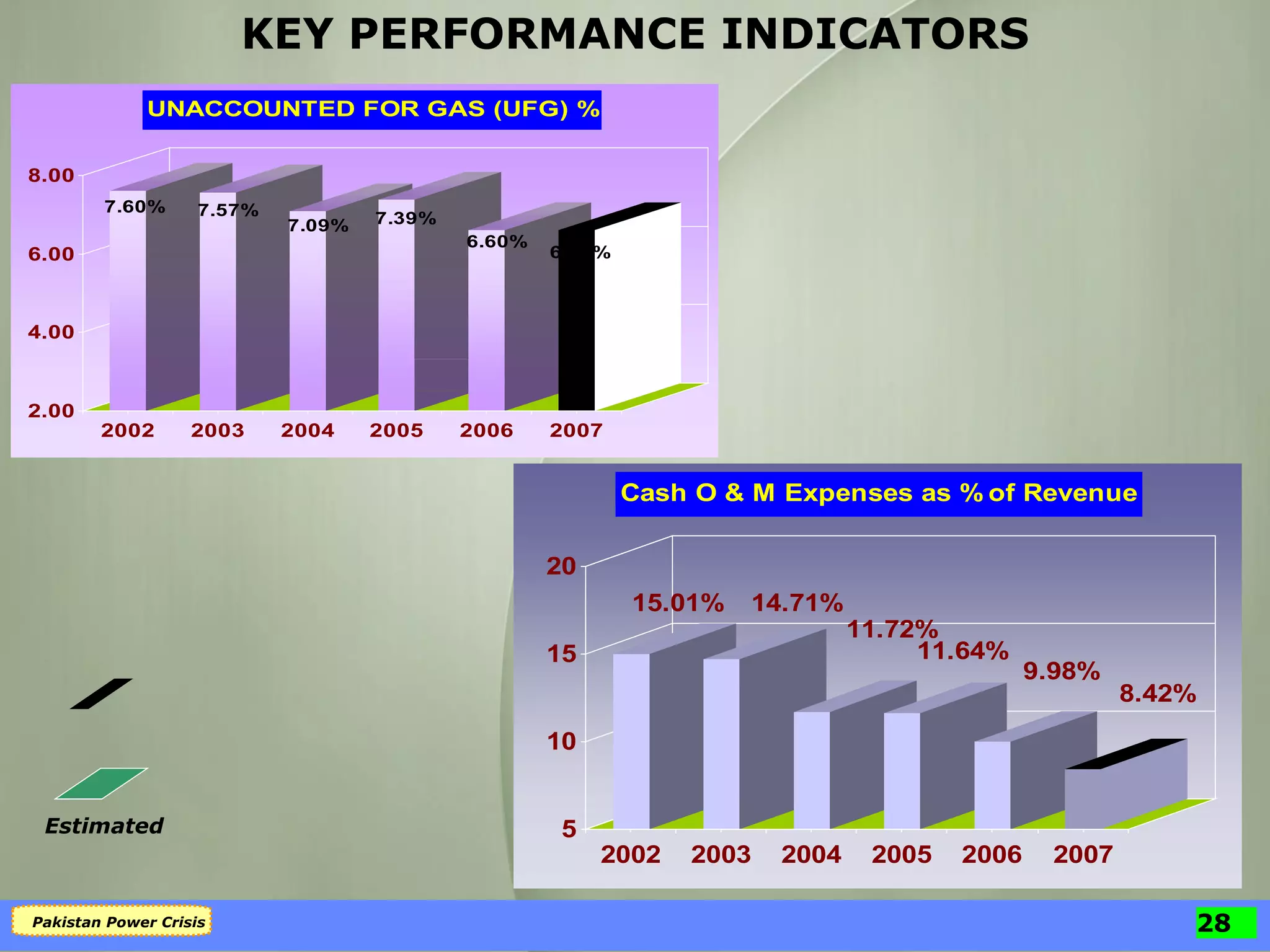

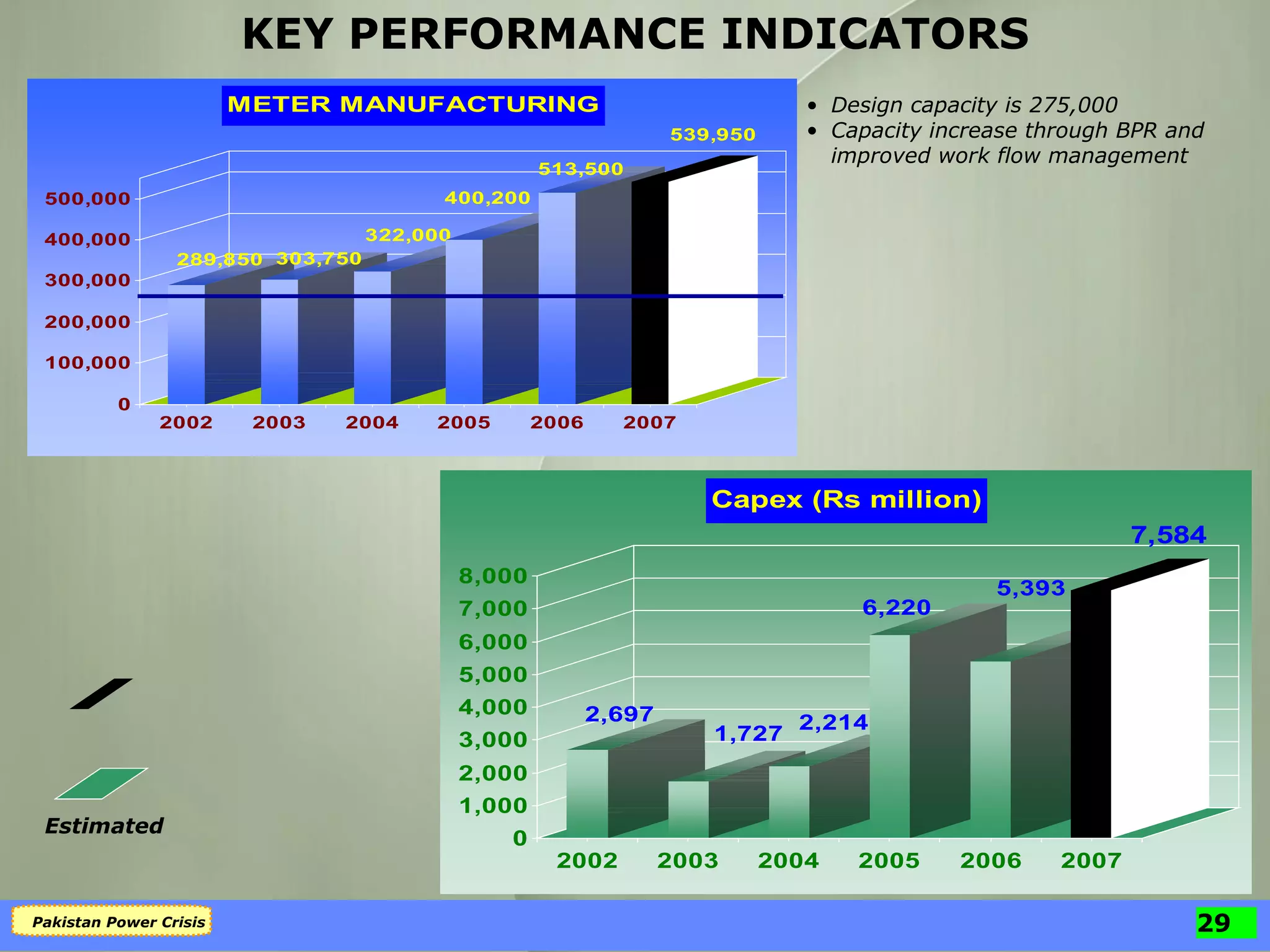

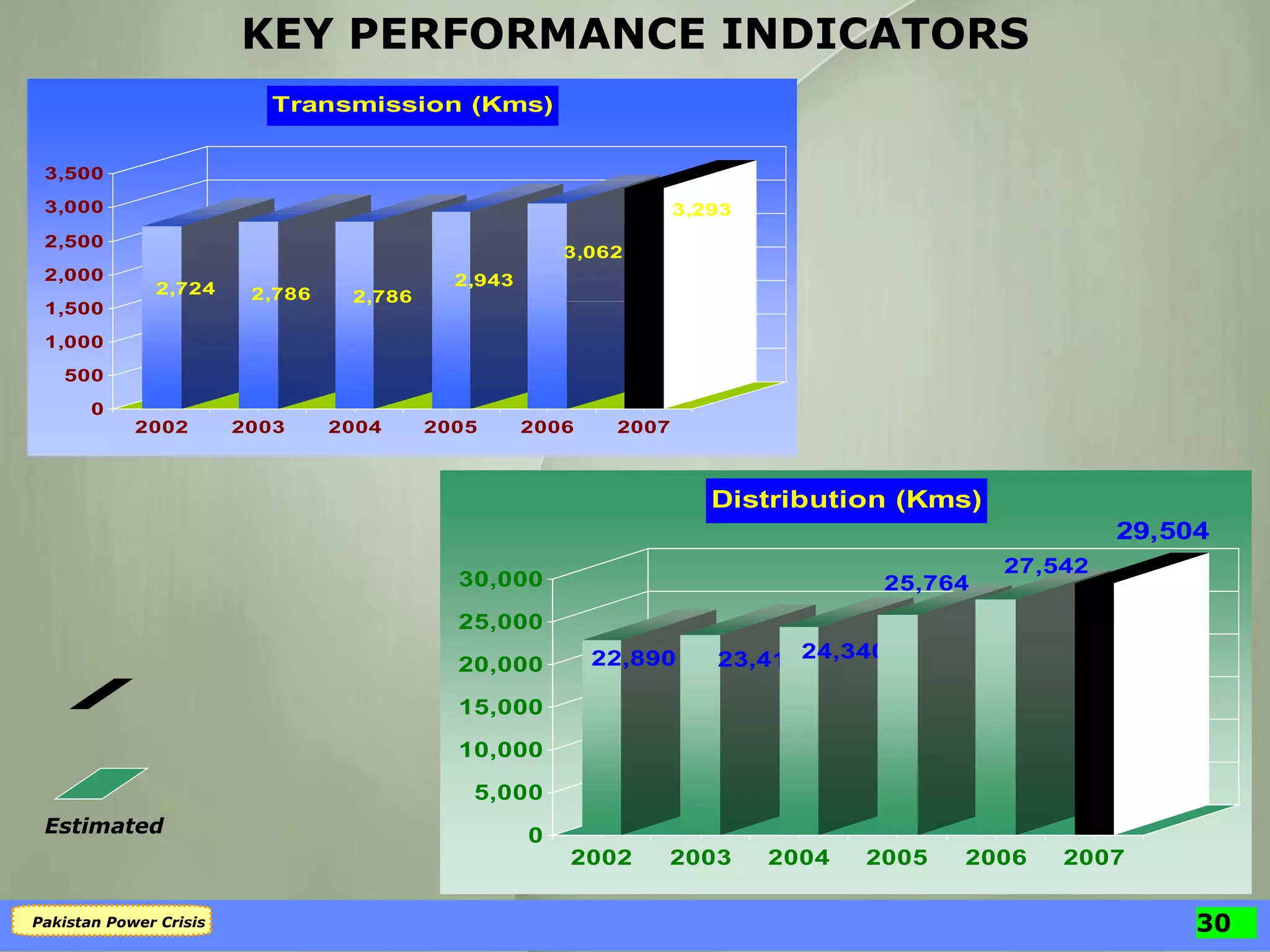

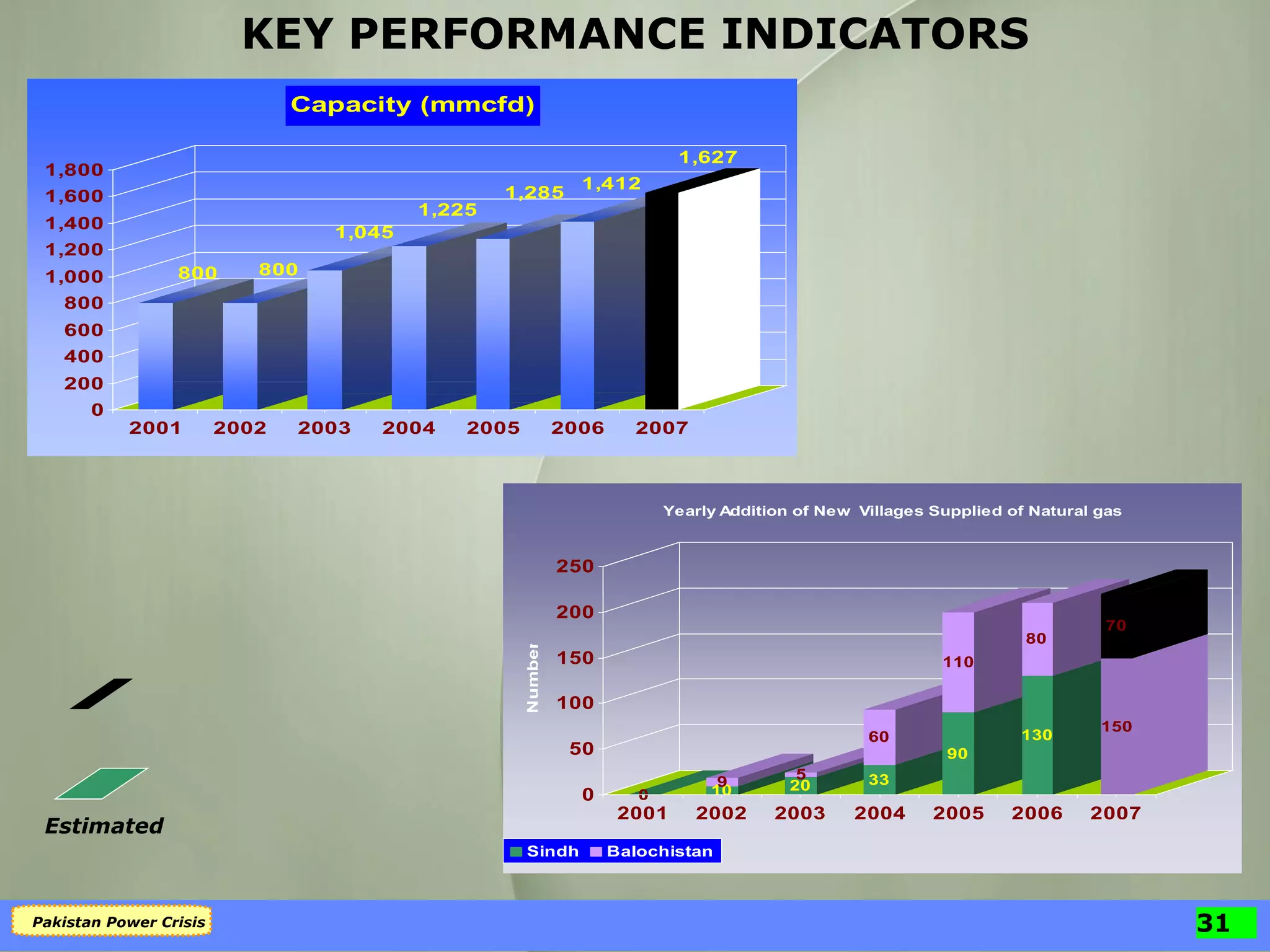

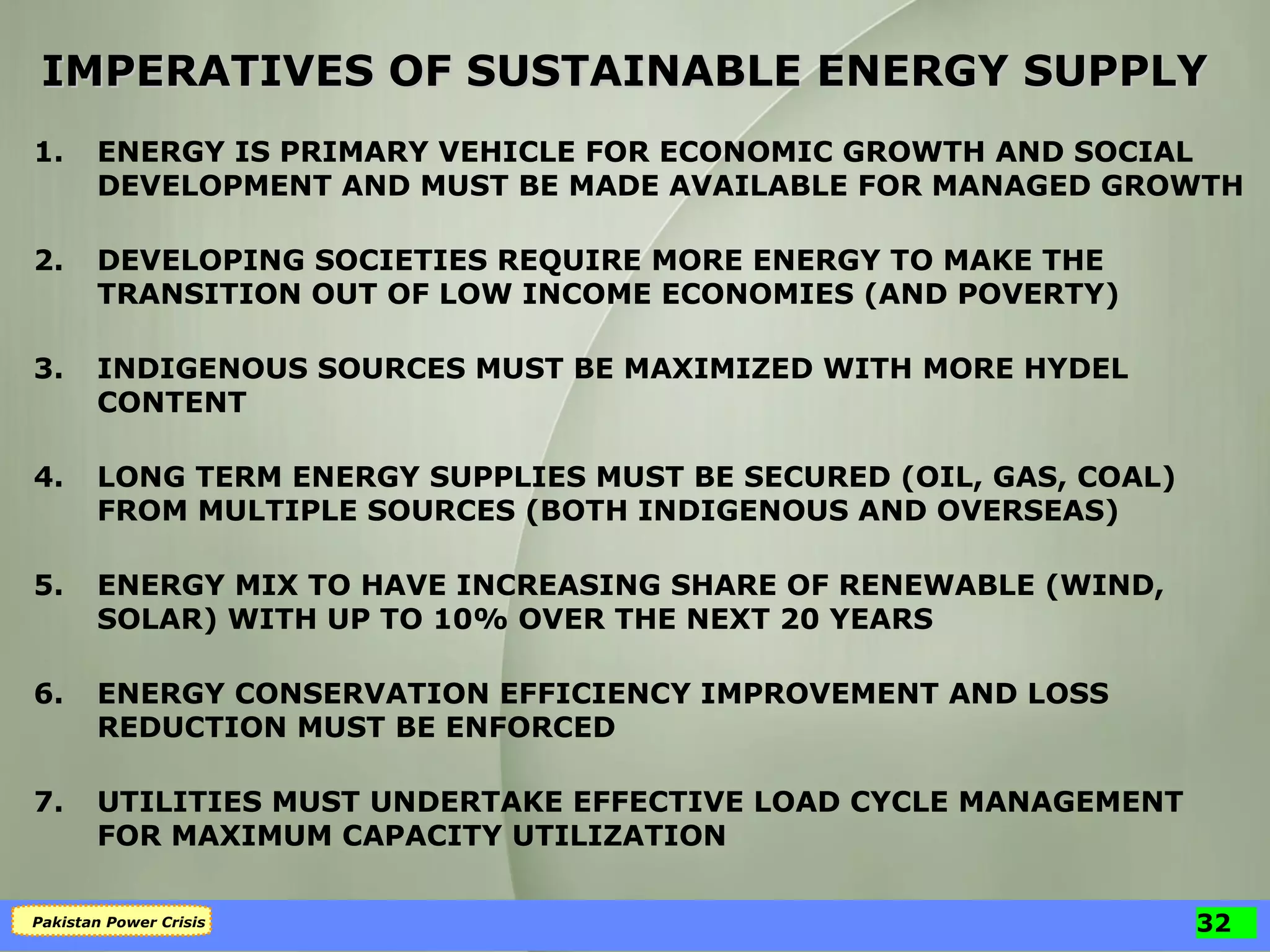

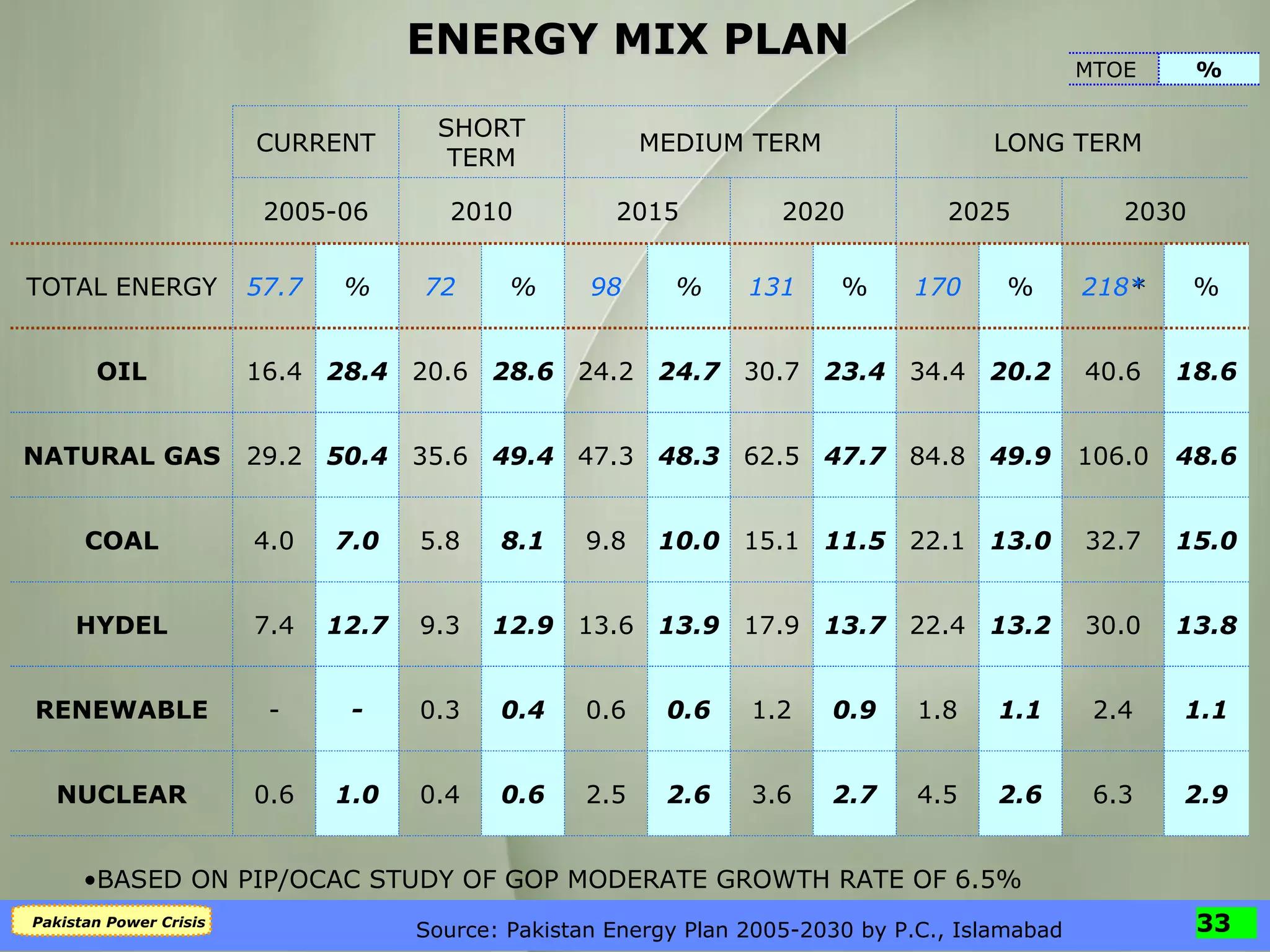

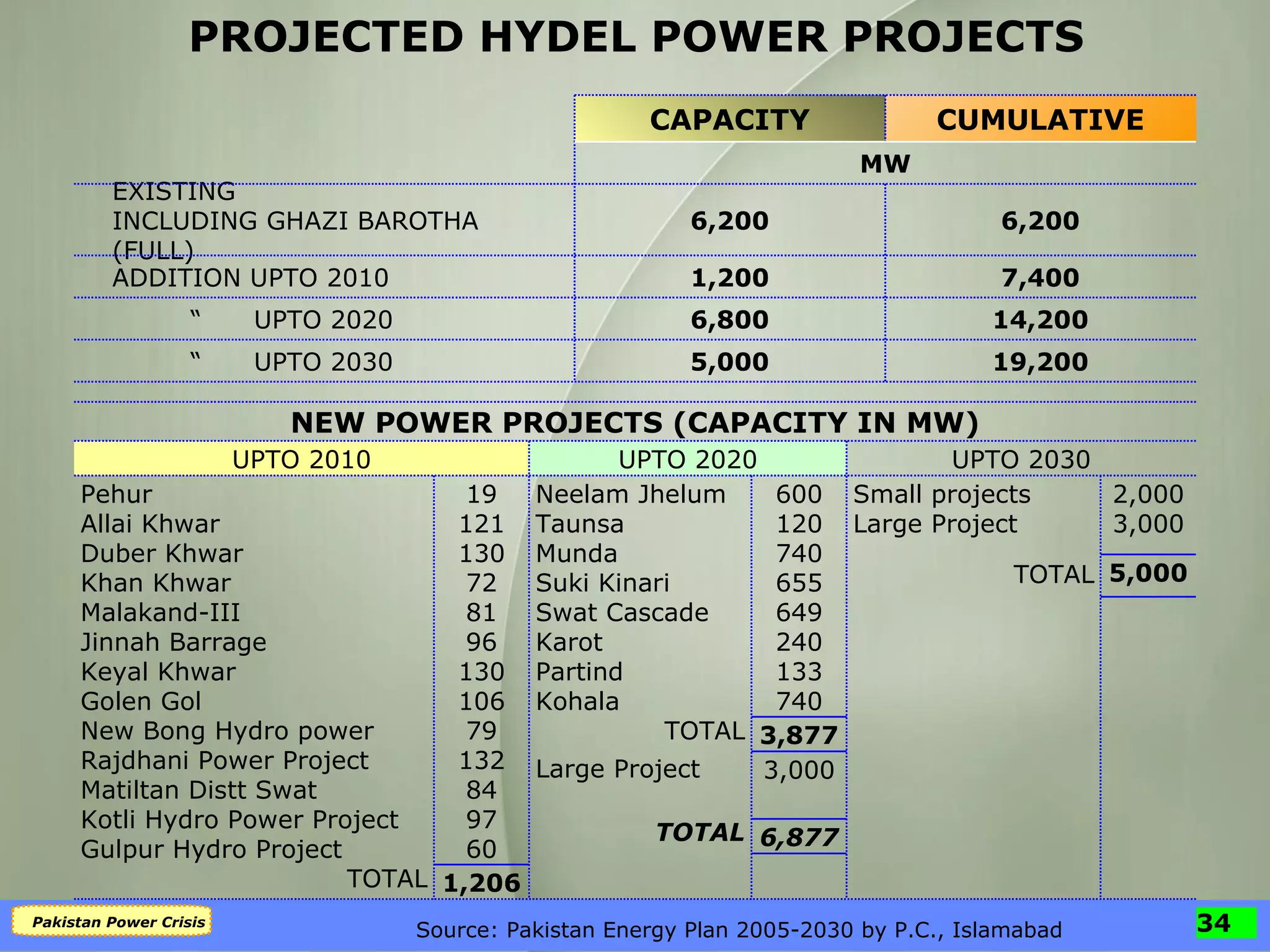

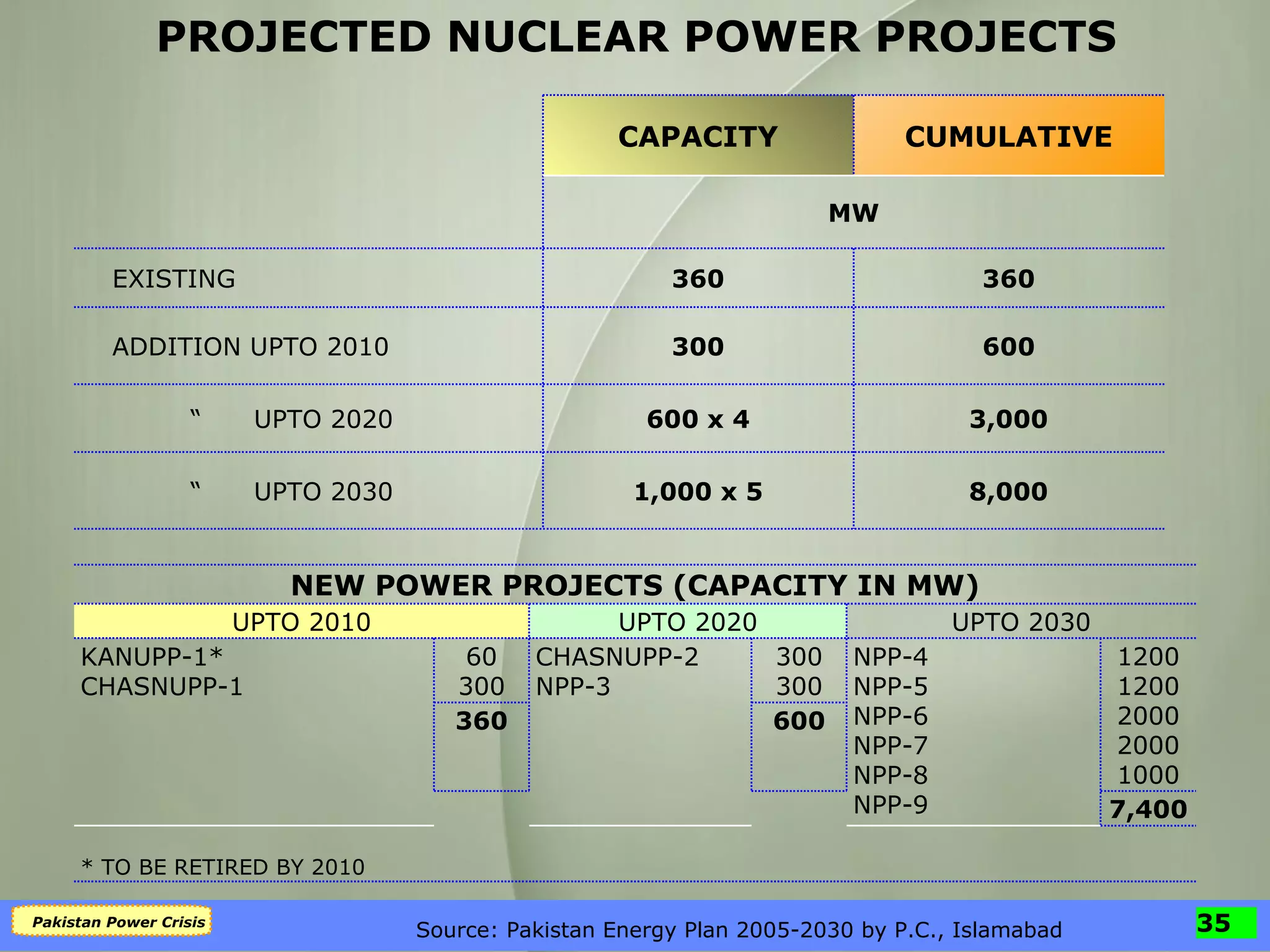

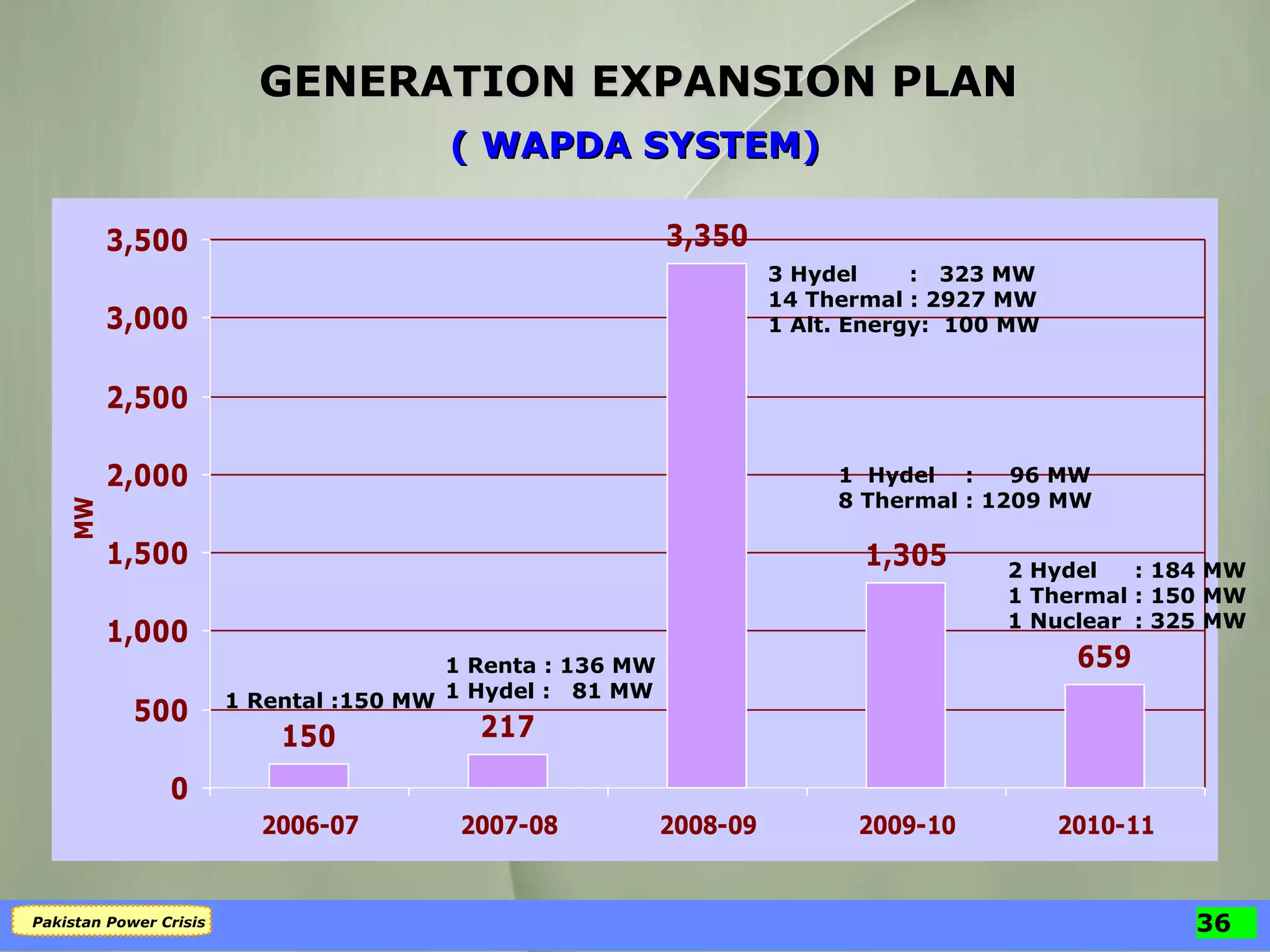

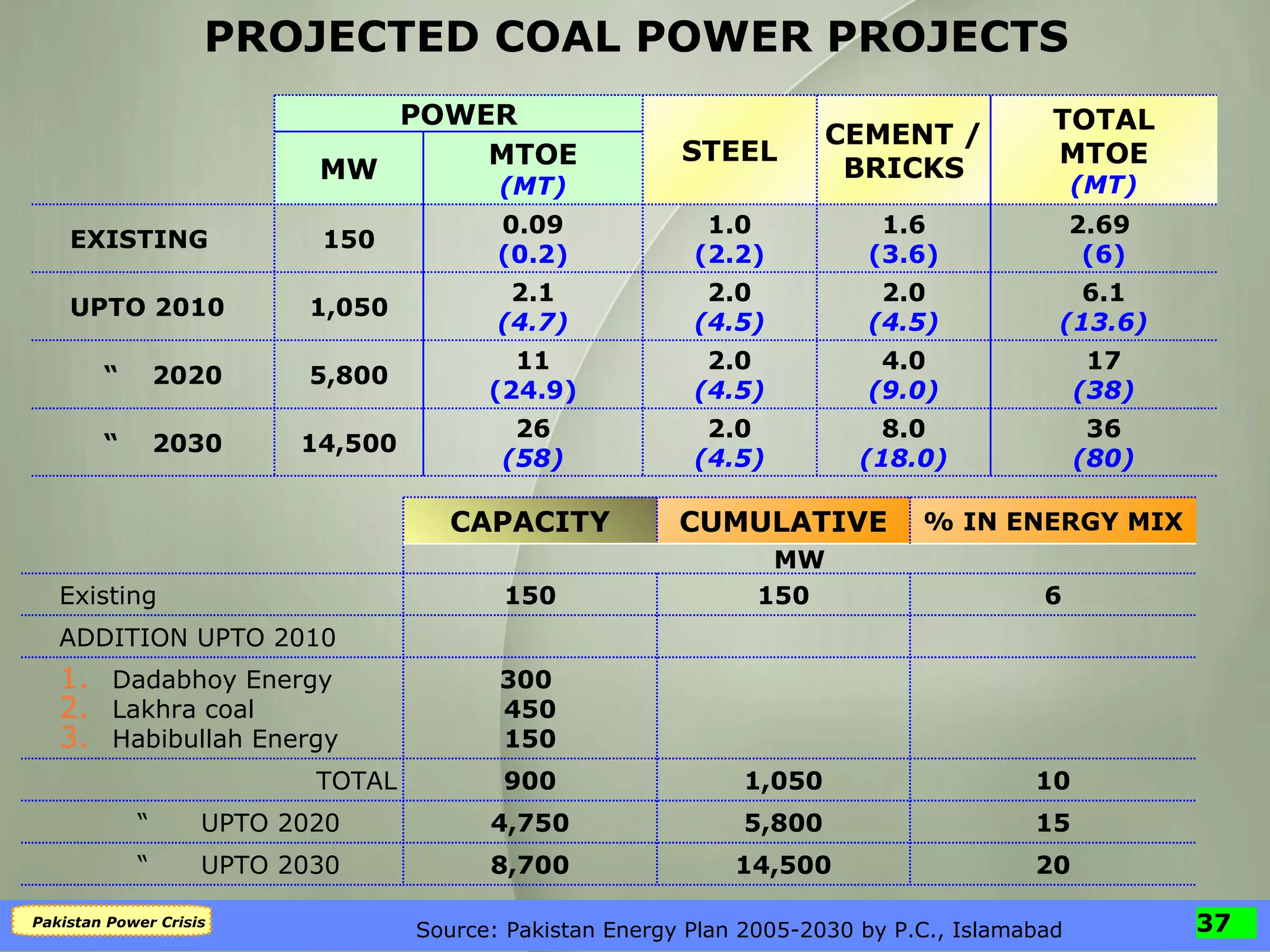

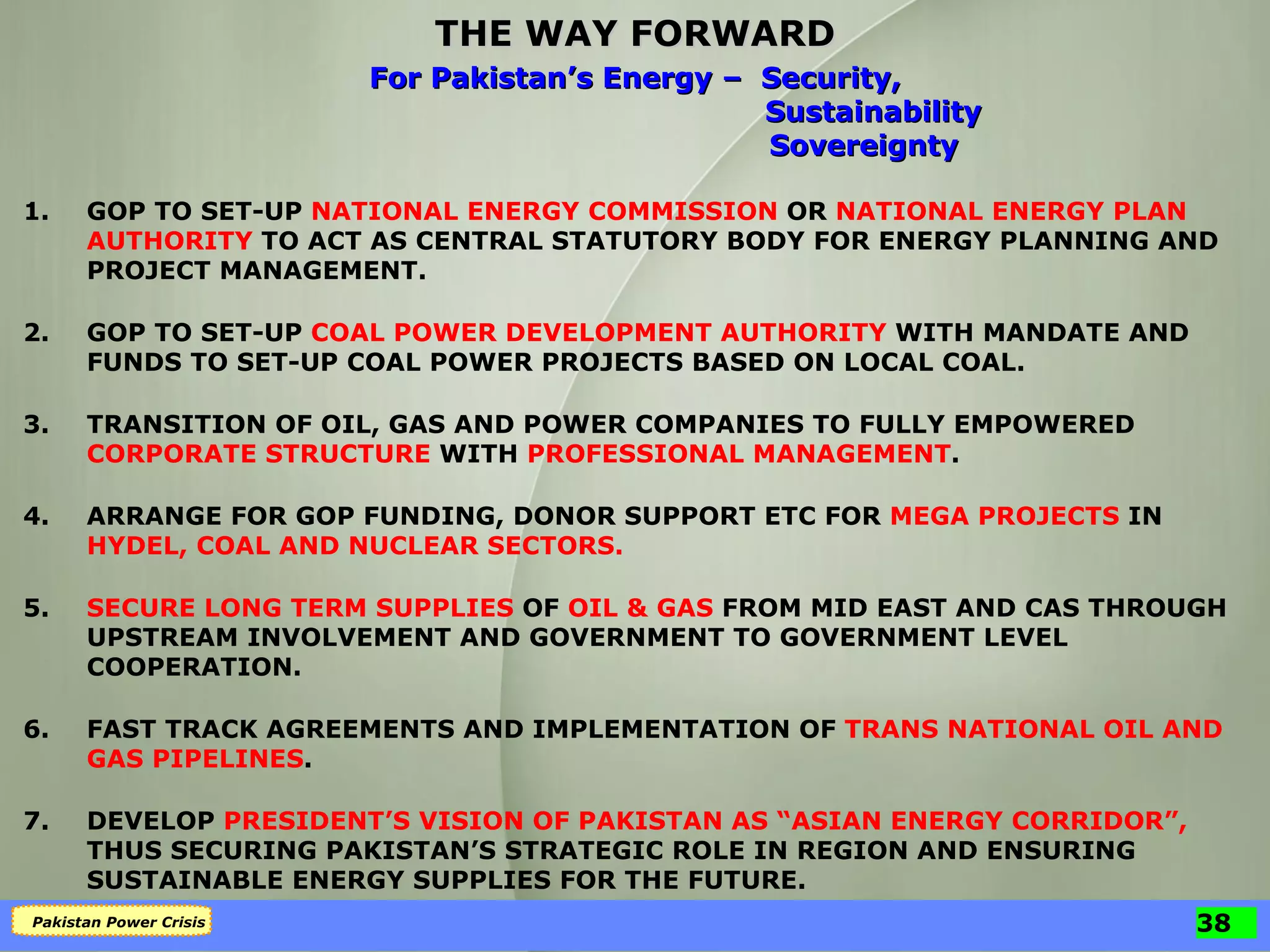

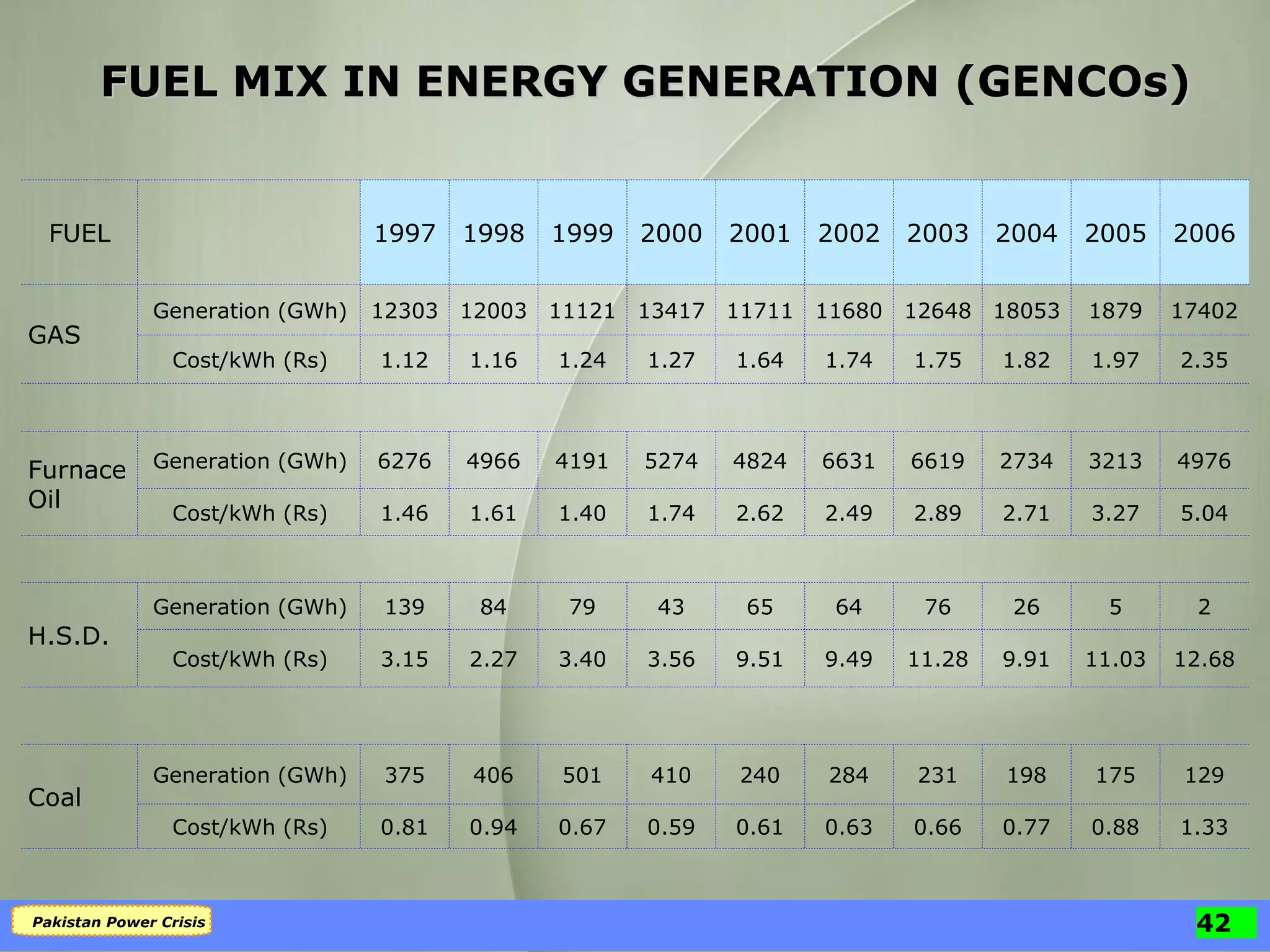

The document discusses Pakistan's power crisis and issues in the power sector. It outlines seven key aspects that have contributed to the crisis, including inadequate energy planning and lack of effective implementation. It then provides examples of SSGC's strategic planning process and investment programs that have led to improved performance. Finally, it discusses Pakistan's proposed energy mix and hydel power projects to help ensure future energy security and sustainability.