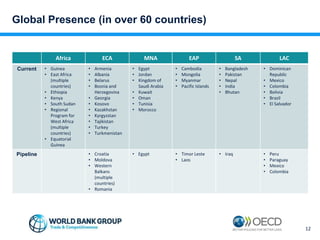

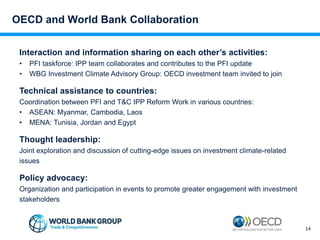

The document discusses the collaboration between the OECD and the World Bank Group (WBG) to improve investment climates through policy frameworks, investment reviews, and regional cooperation. It emphasizes the importance of connecting domestic and foreign investments, tailoring policies to different investment types, and leveraging international agreements for implementation. The ultimate goal is to catalyze reforms that enhance business competitiveness and job creation across various regions.