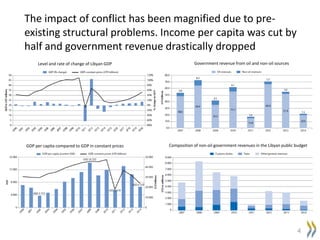

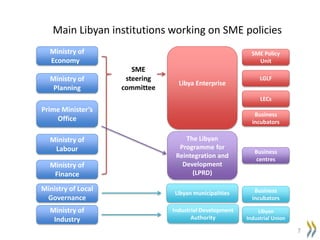

The document outlines Libya's SME development strategy and short-term action plan for post-conflict economic recovery, highlighting the country's over-dependence on hydrocarbons and significant challenges, including high youth unemployment. It emphasizes the need for economic diversification, the establishment of a credit guarantee agency, and regional investment funds to stimulate the private sector, while also detailing essential policies to support SMEs. The proposed short-term action plan includes improving the financing mechanism for SMEs, enhancing legal frameworks, and fostering collaboration among local and international stakeholders.