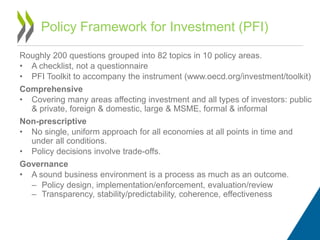

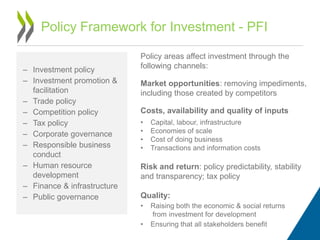

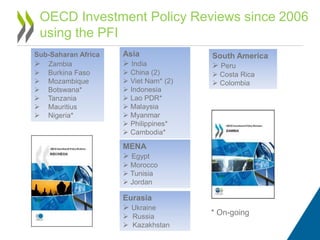

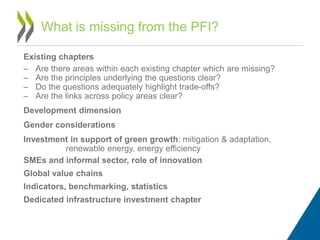

The document outlines the Policy Framework for Investment (PFI) developed by OECD and non-OECD participants to enhance the investment climate by promoting good governance, transparency, and protection of property rights. It emphasizes adaptability to various economies and includes a comprehensive toolkit addressing diverse investment areas, such as trade and corporate governance. The PFI is set to be updated by incorporating new dimensions based on user feedback and evolving global investment landscapes.